UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x☒

Filed by a Party other than the Registrant ¨☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

DigitalBridge Group, Inc.

(Name(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| NOTICE OF ANNUAL MEETING OF STOCKHOLDERS Items of Business Record Date Virtual Meeting Date and Time via Live Audio Webcast |

| Annual Report Our |

TABLE OF

CONTENTS

|

|

| PROXY SUMMARY This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. This Proxy Statement and the enclosed form of proxy are |

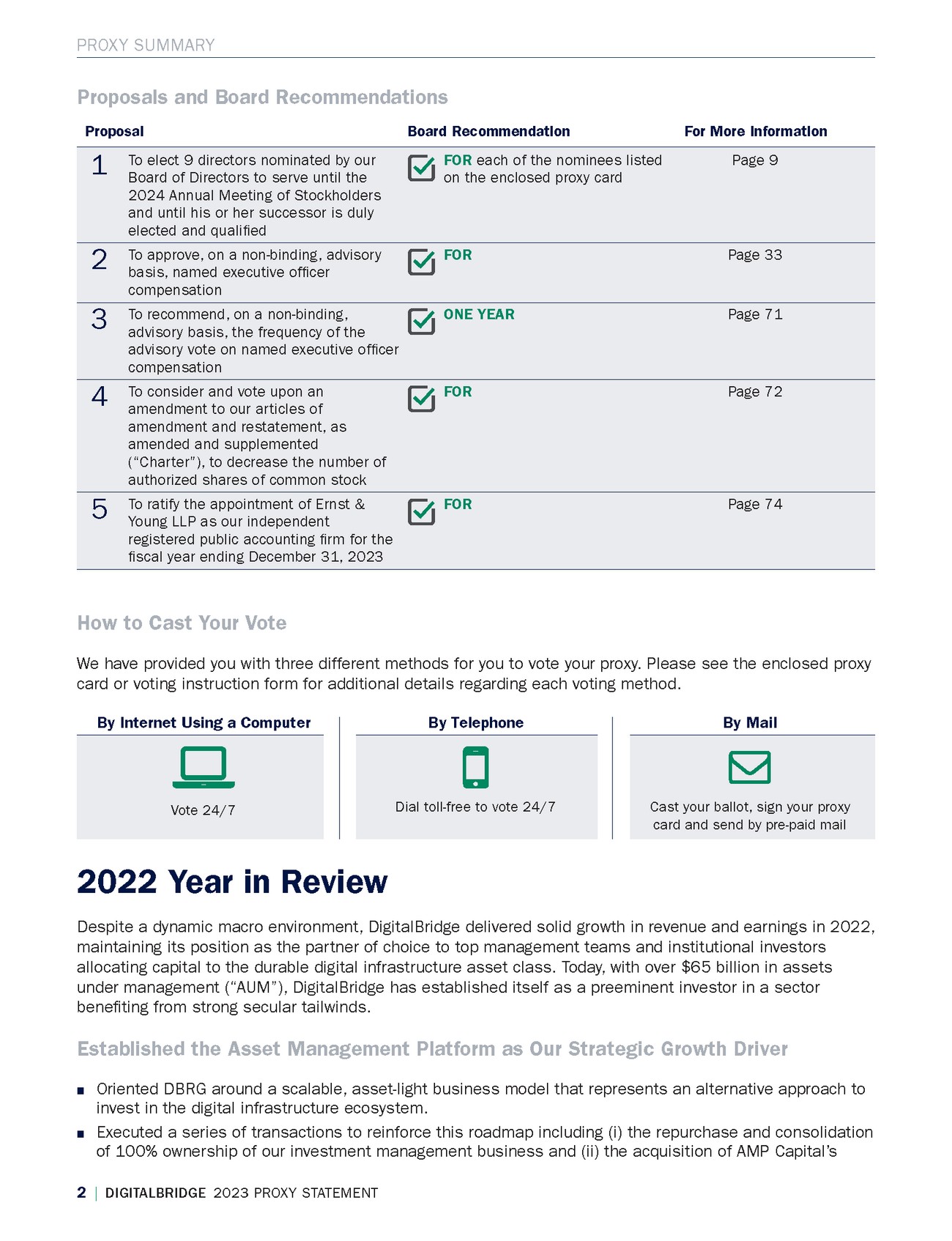

| PROXY SUMMARY 2 | DIGITALBRIDGE 2023 PROXY STATEMENT Proposals and Board Recommendations How to Cast Your Vote We have provided you with three different methods for you to vote your proxy. Please see the enclosed proxy card or voting instruction form for additional details regarding each voting method. |

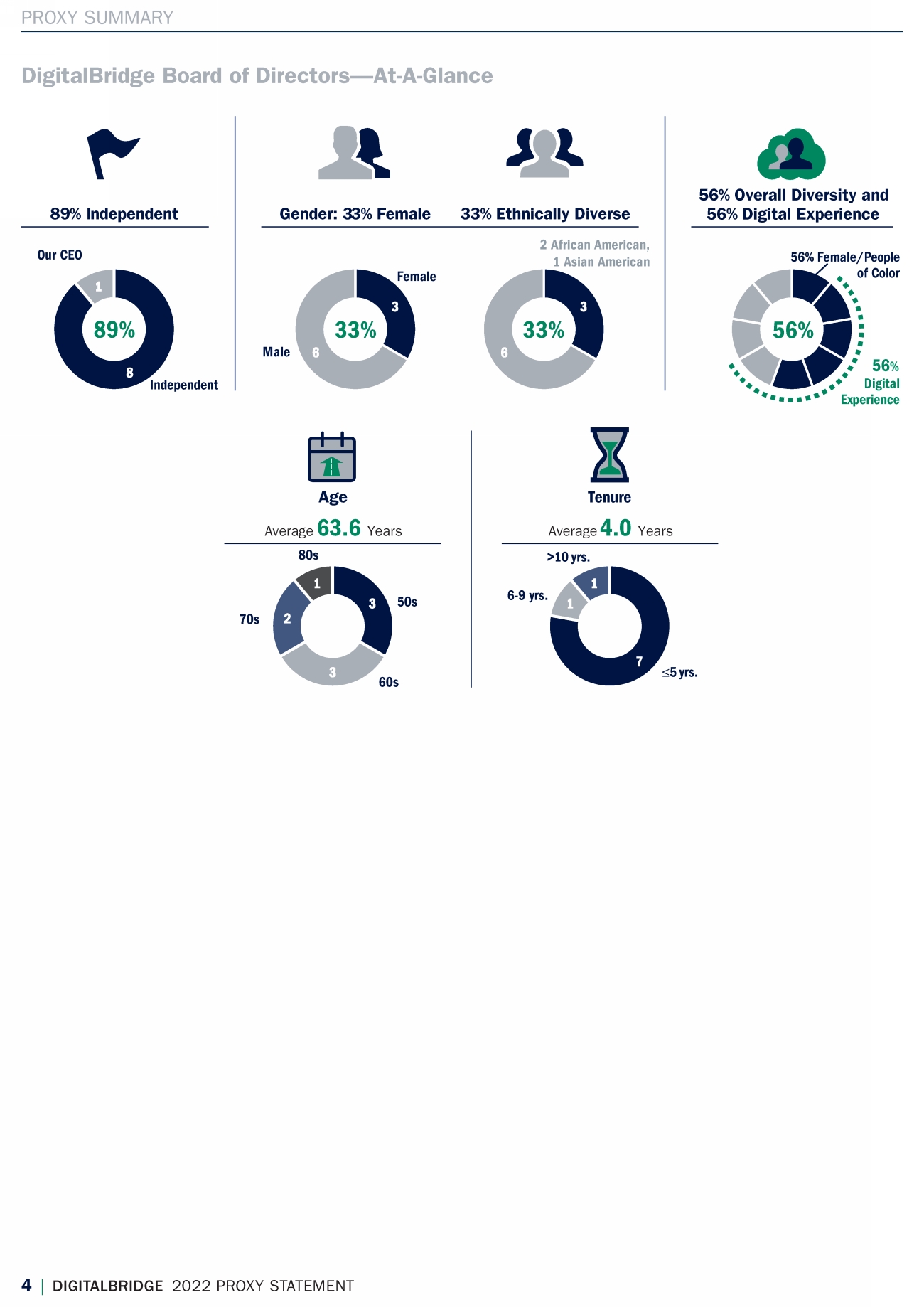

| PROXY SUMMARY |

|

|

|

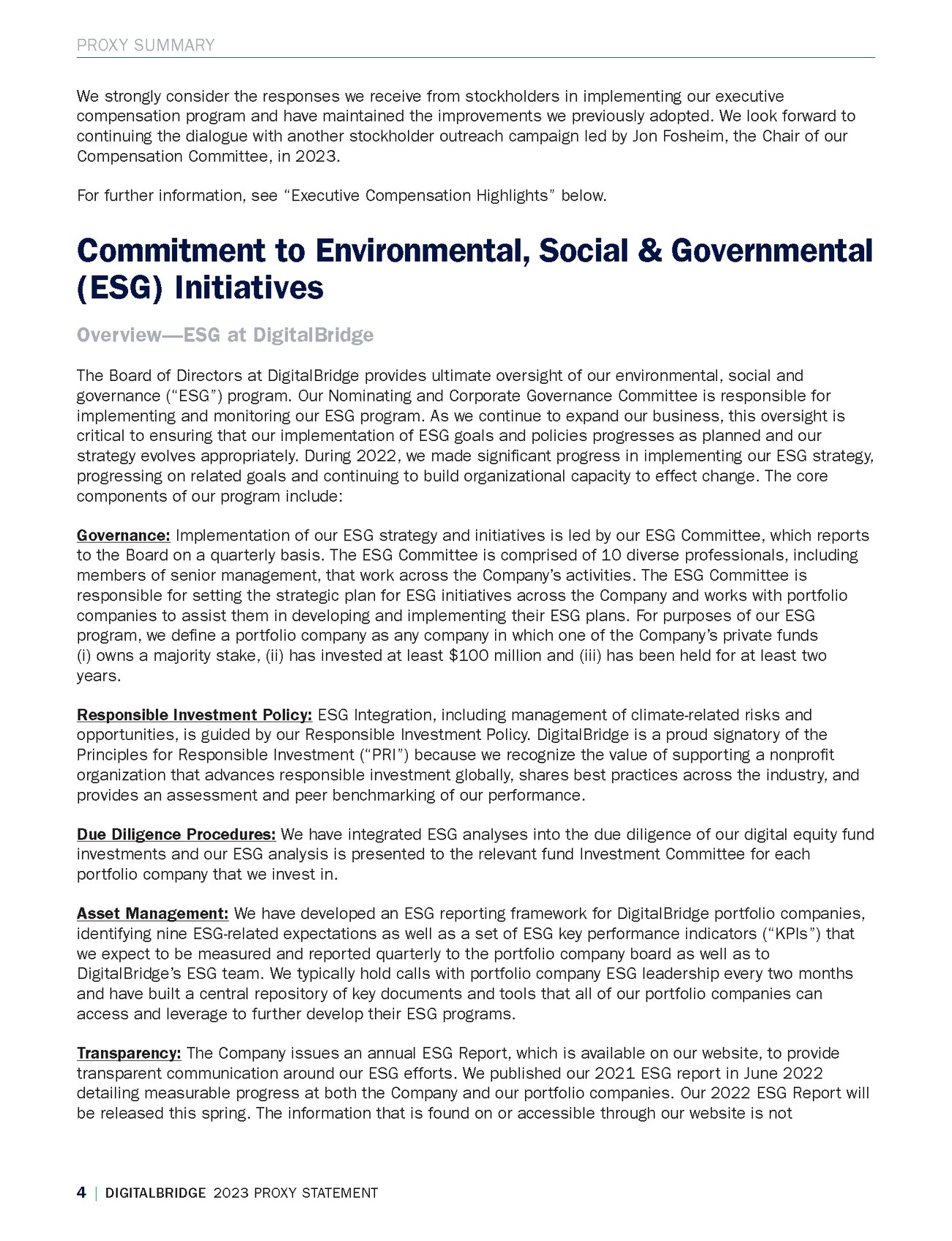

| PROXY SUMMARY 4 | DIGITALBRIDGE 2023 PROXY STATEMENT We strongly |

|

|

| PROXY SUMMARY incorporated into, and |

|

| PROXY SUMMARY 6 | DIGITALBRIDGE 2023 PROXY STATEMENT ■ Training: Each portfolio company |

|

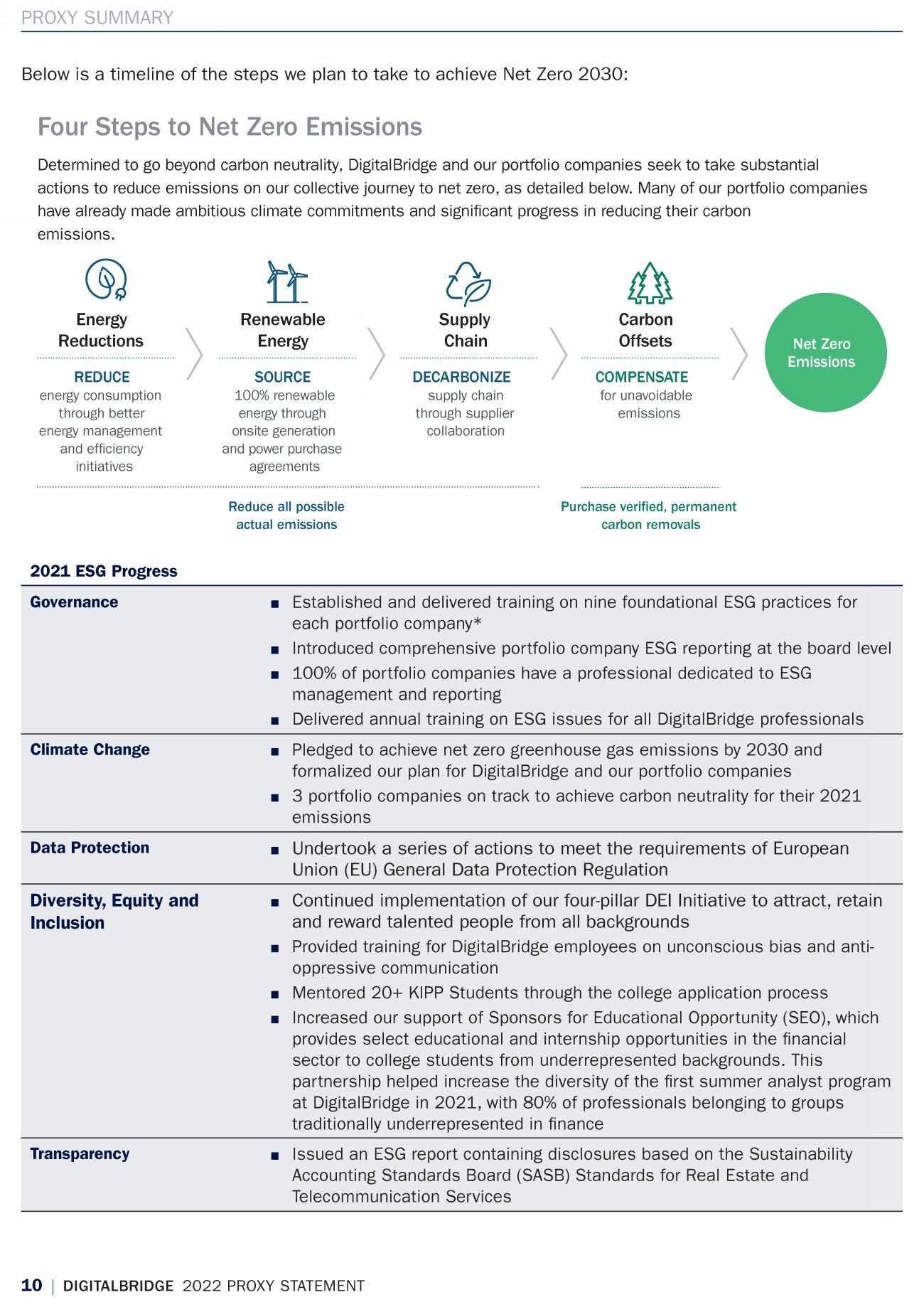

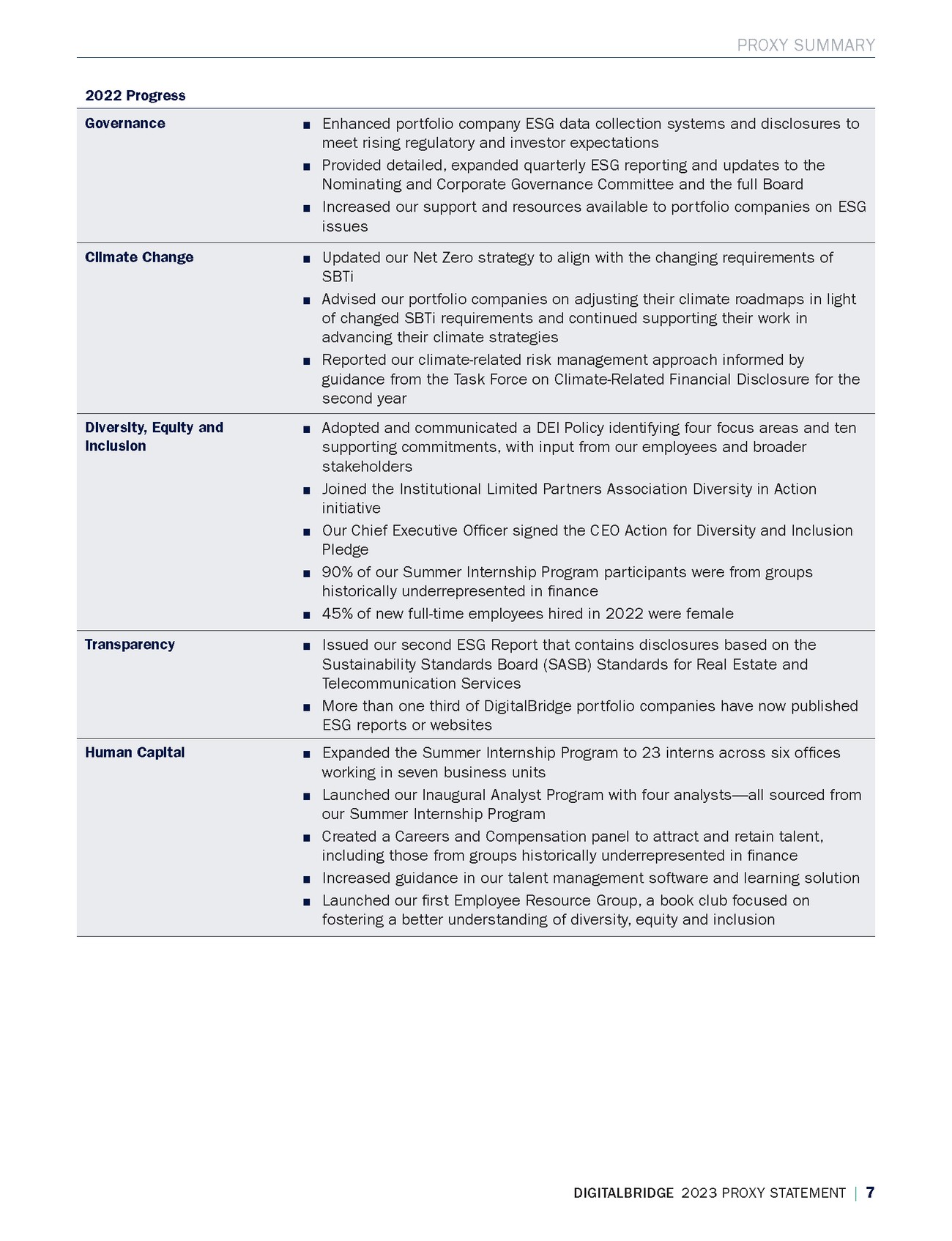

| PROXY SUMMARY 2022 Progress ■ Enhanced portfolio company ESG data collection systems and disclosures to |

|

|

| PROXY SUMMARY 8 | DIGITALBRIDGE 2023 PROXY STATEMENT Corporate Governance Highlights (1) Stockholder approval required for DBRG board to adopt a classifed board structure and other anti-takeover provisions. (2) DBRG stockholders have the ability to call special stockholders meetings, remove and replace directors, amend bylaws and approve increases in the number of shares authorized for issuance. Opted out of MUTA(1) Favorable stockholder rights(2) Stock ownership guidelines for directors and offcers No classifed board Majority voting standard for election of directors Anti-hedging/pledging policy Toppan Merrill - DigitalBridge [fka Colony Capital_ Inc.] PRE 14A [iXBRL Proxy] ED [AUX] | 105969 | 27-Mar-23 23:28 | 23-2053-3.ca | Sequence: 8 CHKSUM Content: 55621 Layout: 45216 Graphics: 10753 CLEAN JOB: 23-2053-3 CYCLE#;BL#: 8; 0 TRIM: 8.25" x 10.75" AS: New York: 212-620-5600 COLORS: DB dark green, DB lgt gray, Magenta, Yellow, Cyan, ~note-color 2, DB med blue, DB dark blue, Black, DB med gray GRAPHICS: 2053-3_green_tick_4c_icon.eps, 2053-3_green_tick_4c_icon.eps, 2053-3_green_tick_4c_icon.eps, 2053-3_green_tick_4c_icon.eps, 2053-3_green_tick_4c_icon.eps, 2053-3_green_tick_4c V1.5 |

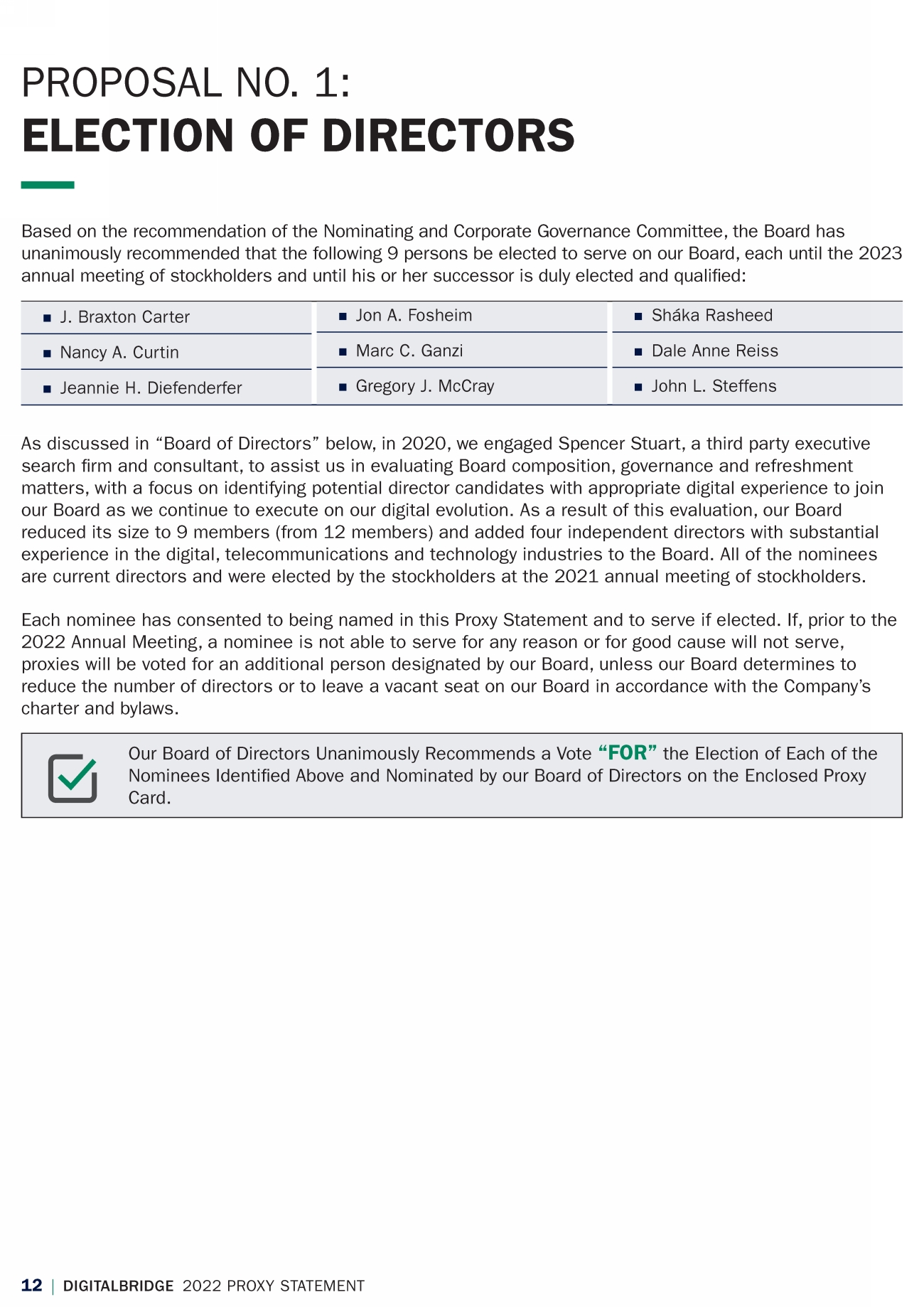

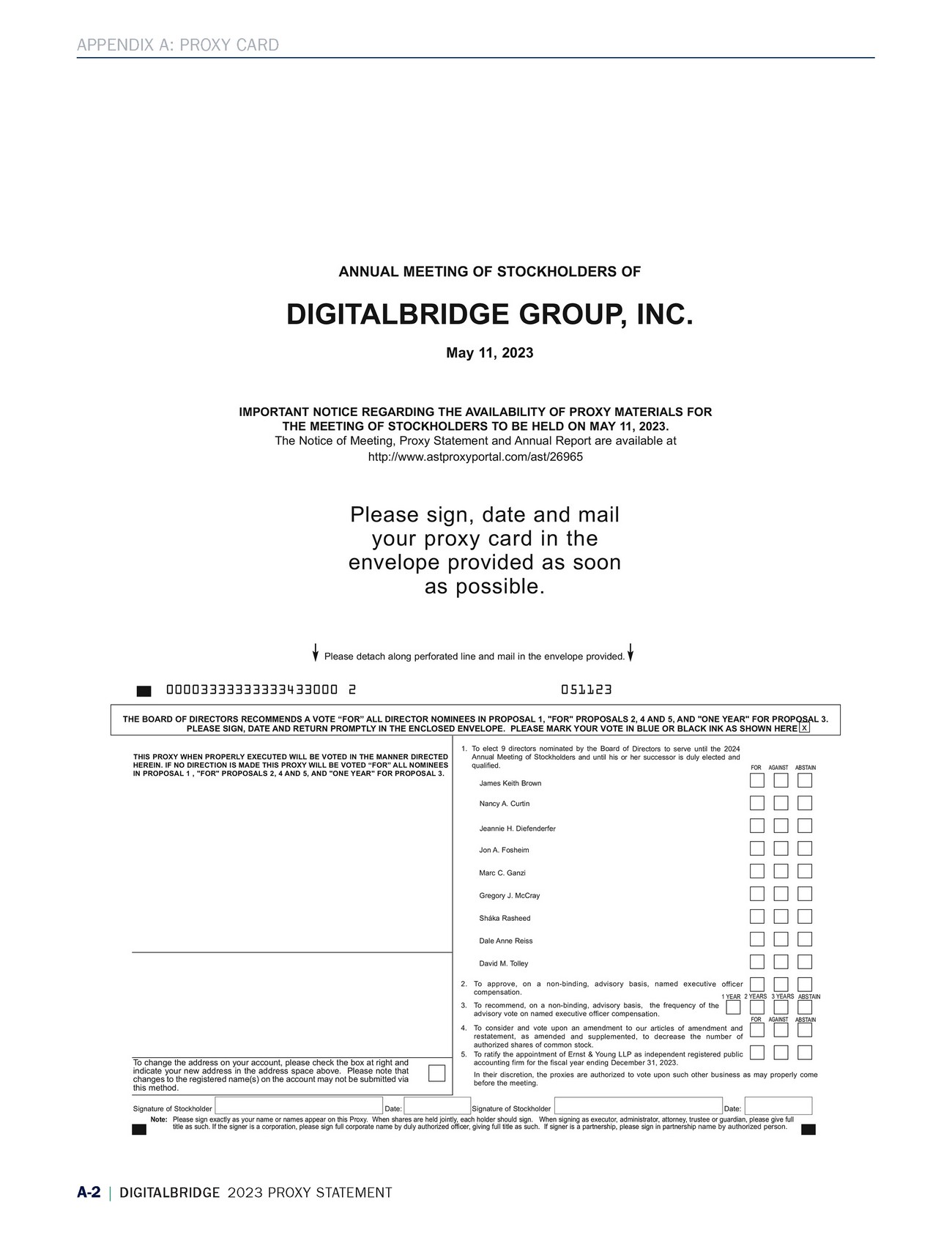

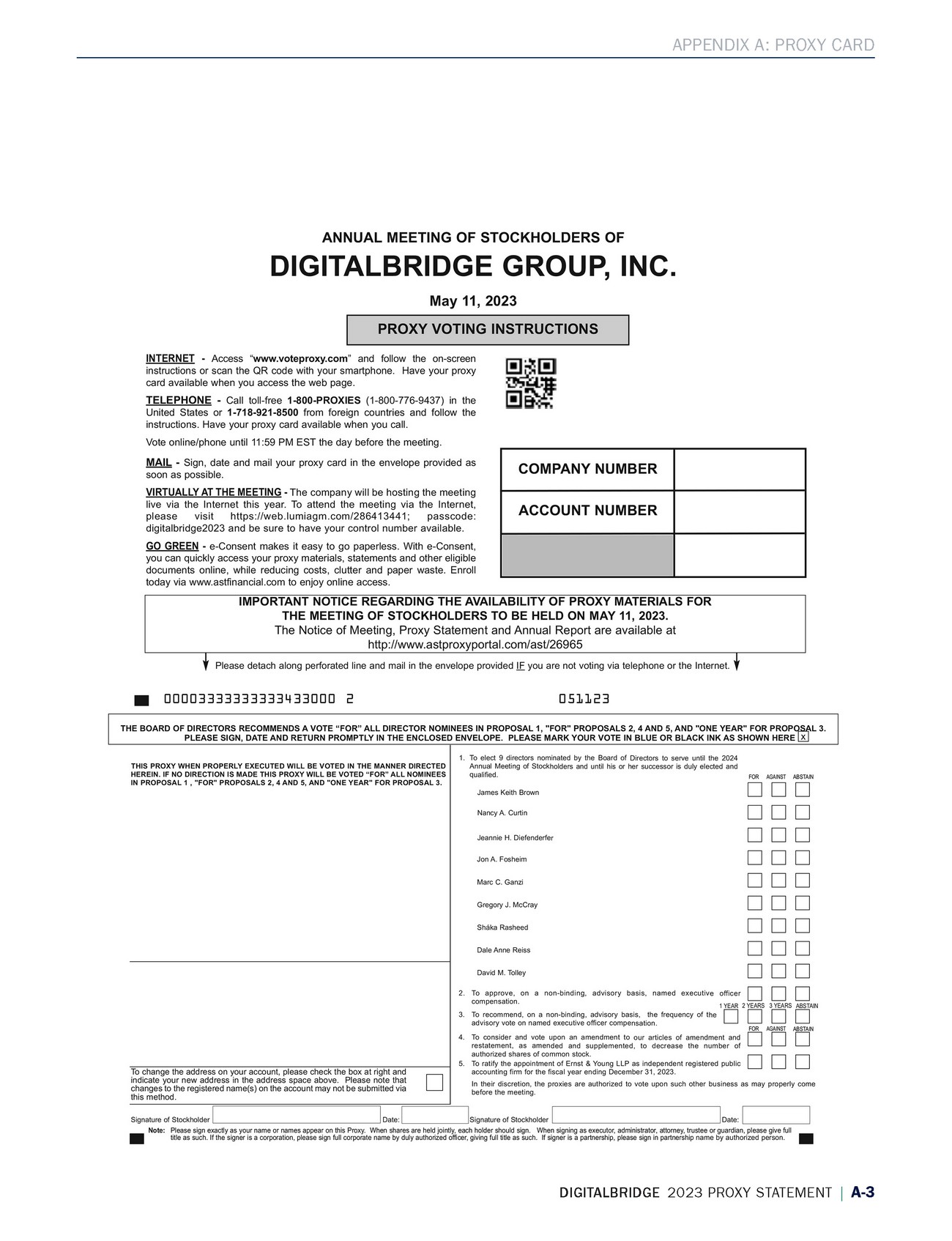

| PROPOSAL NO. 1: ELECTION OF DIRECTORS Based on the recommendation of the Nominating and Corporate Governance Committee, the Board has unanimously recommended that the following 9 persons be elected to serve on our Board, each until the |

|

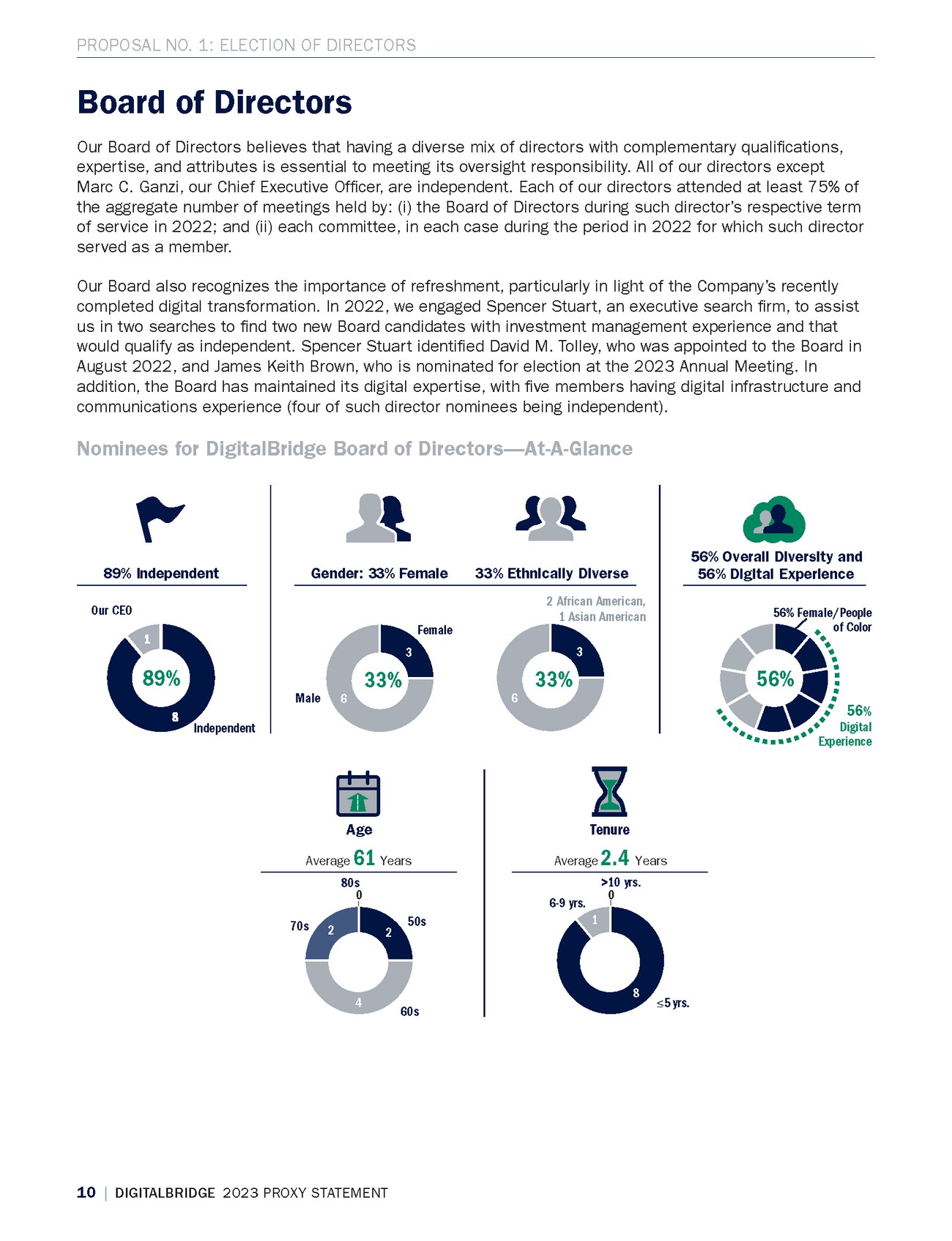

| PROPOSAL NO. 1: ELECTION OF DIRECTORS Board of Directors Our Board of Directors believes that having a diverse mix of directors with complementary |

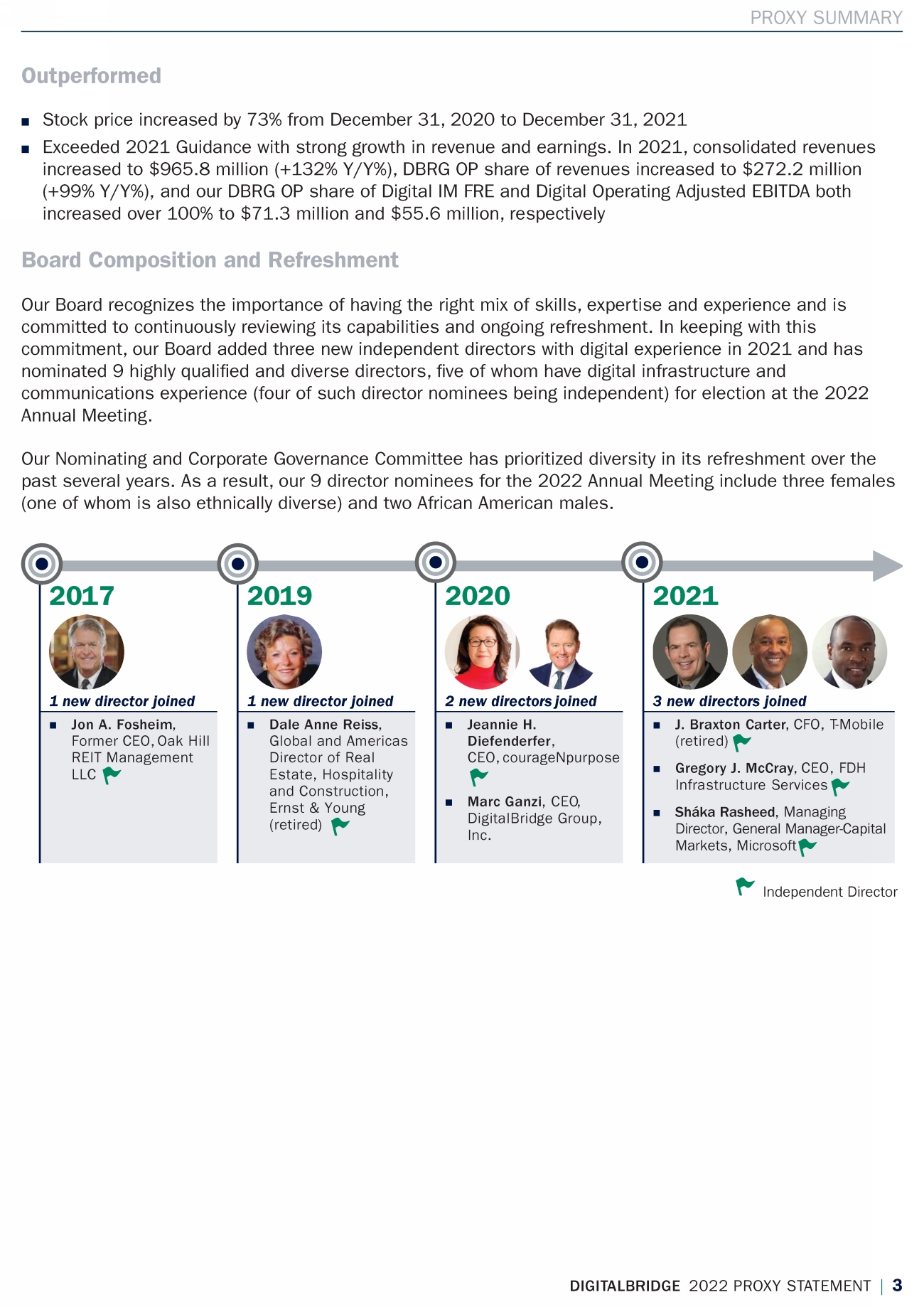

| PROPOSAL NO. 1: ELECTION OF DIRECTORS Board Composition and Refreshment Our Board recognizes the importance of having the right mix of skills, expertise and experience and is committed to continuously reviewing its capabilities in relation to our strategic direction and ongoing refreshment. In keeping with this commitment, our Board |

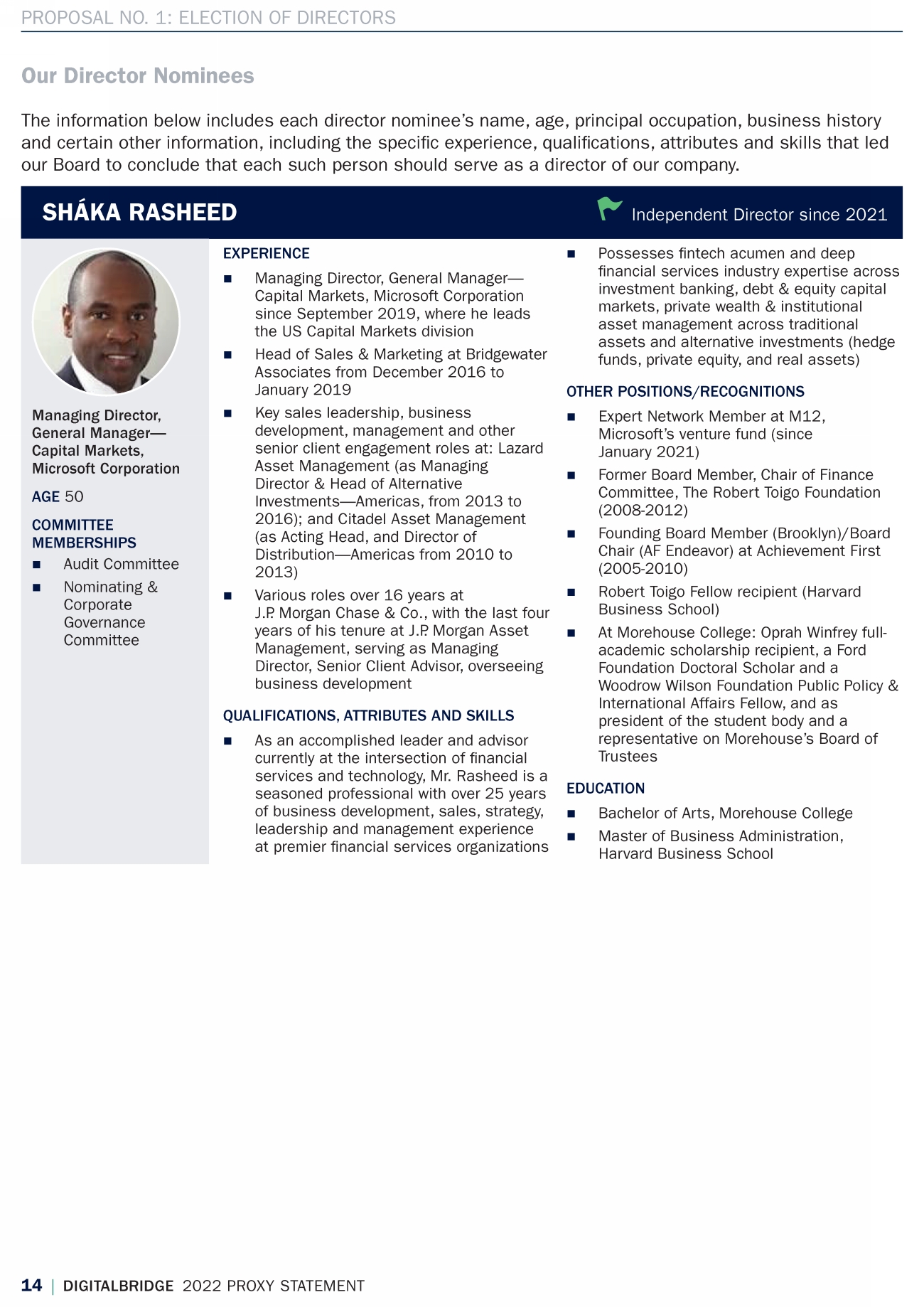

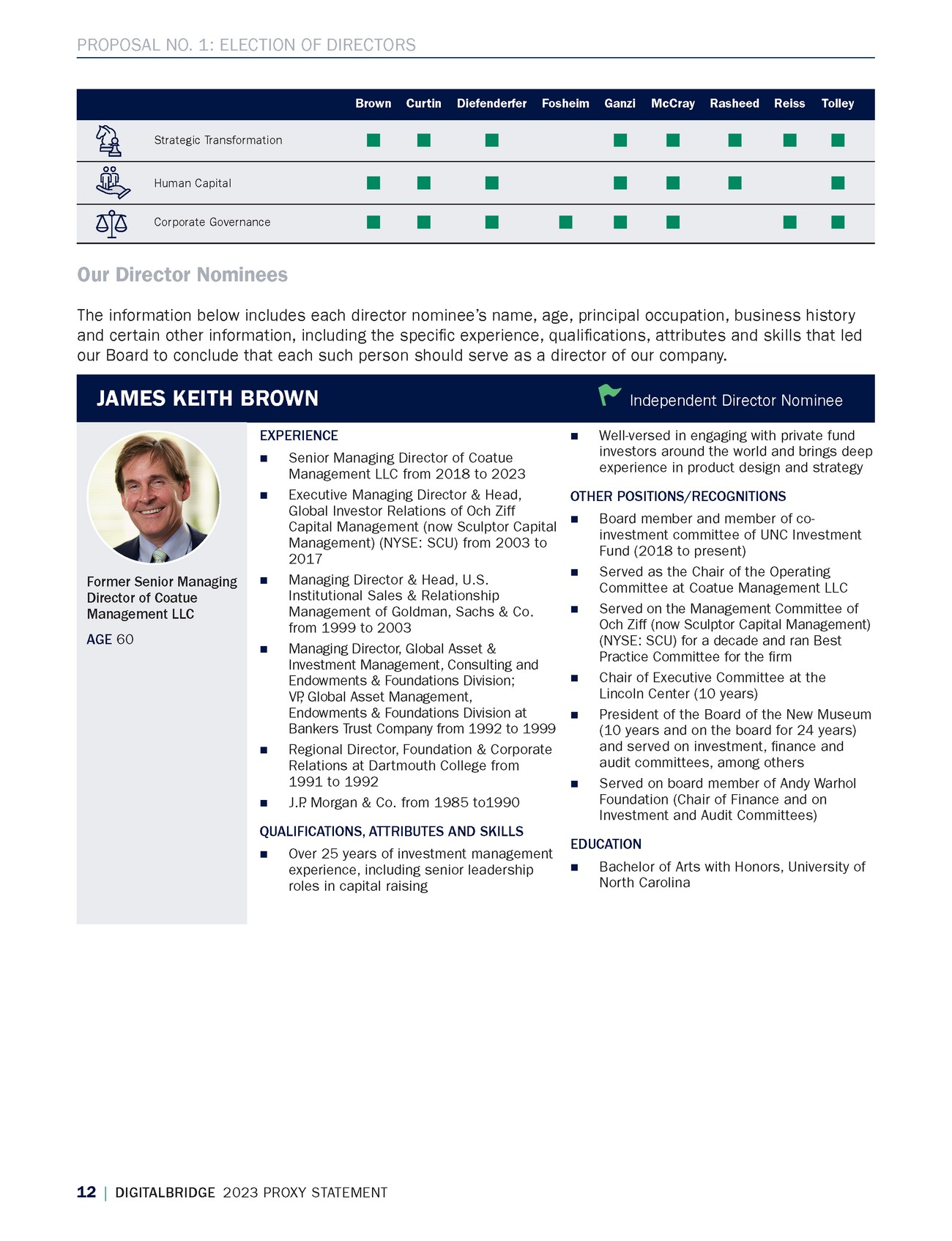

| PROPOSAL NO. 1: ELECTION OF DIRECTORS Brown Curtin Diefenderfer Fosheim Ganzi McCray Rasheed Reiss Tolley ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! Our Director Nominees The information below includes each director nominee’s name, age, principal occupation, business history and certain other information, including the |

| PROPOSAL NO. 1: ELECTION OF DIRECTORS NANCY A. CURTIN Independent Director since 2014 ! Proven business builder of global investment and wealth management businesses with C-suite and board responsibility driving signifcant AUM growth at attractive operating margins ! Successful track record of CIO execution; leading large investment teams in pursuit of institutional quality investment disciplines to deliver superior investment performance ! Deep understanding of regulatory environment for investment management, with proven ability to institute best practice front line controls, oversight, and governance OTHER BOARDS ! Right to Play, global education charity helping over 2.3 million children each year in war torn countries and areas of signifcant dislocation EDUCATION ! Bachelor of Arts, Summa Cum Laude, Princeton University ! Master of Business Administration, Harvard Business School ! 2019: Harvard Business School Executive Education, Woman on Boards Certifcate ! Harvard Business School, Corporate Director Certifcation (accepted into programme, expected completion Q4 2023): ! Audit Committees in a New Era of Governance-Completed ! Compensation Committees: New Challenges, New Solutions-November 2023 ! Making Corporate Boards More Effective-November 2023 EXPERIENCE ! Chief |

| PROPOSAL NO. 1: ELECTION OF DIRECTORS JEANNIE H. DIEFENDERFER Independent Director since 2020 JON A. FOSHEIM Independent Director since 2017 ! MRV Communications, Inc. (formerly NASDAQ:MRVC) (July 2014 to August 2017) ! Westell Technologies, Inc. (OTC WSTL) (September 2015 to September 2017) OTHER POSITIONS/RECOGNITIONS ! CEO of Center for Higher Ambition Leadership since June 2021 ! 2020 National Association of Corporate Directors (NACD) Directorship 100 list honoree ! Independent board member of Irth Solutions since March 2022 ! Trustee of Olin College of Engineering ! Board Member of NACD NJ Chapter ! Vice Chair of the Board, Women in America EDUCATION ! Bachelor of Science, Tufts University ! Master of Business Administration, Babson College EXPERIENCE ! Founder and Chief Executive Offcer of courageNpurpose, LLC since 2014 ! Executive leadership positions at Verizon Communications, including leading Verizon’s global customer care organization for its largest enterprise customers from 2010 to 2012, serving as Senior Vice President of Global Engineering & Planning from 2008 to 2010, and as Chief Procurement Offcer from 2005 to |

| PROPOSAL NO. 1: ELECTION OF DIRECTORS MARC C. GANZI Director since 2020 OTHER POSITIONS/RECOGNITIONS ! Member of boards of corporations, including: Andean Telecom Partners, ExteNet Systems, Vantage Data Centers, Vertical Bridge, and Zayo Group ! Assistant Commercial Attaché in Madrid for the U.S. Department of Commerce’s Foreign Commercial Service Department in 1990 ! Presidential Intern in the White House for the George H.W. Bush administration with the Offce of Special Activities and Initiatives for the Honorable Stephen M. Studdert in 1989 ! Board Member of the Wireless Infrastructure Association from 2008 to 2017 and served as Chairman from 2009 to 2011 ! Member of Nareit 2022 Advisory Board of Governors, Member of the Young Presidents’ Organization, the Broadband Deployment Advisory Committee of the Federal Communications Commission, and currently serves on the board of the Aspen Valley Ski Club EDUCATION ! Bachelor of Science, |

| PROPOSAL NO. 1: ELECTION OF DIRECTORS GREGORY J. |

| PROPOSAL NO. 1: ELECTION OF DIRECTORS |

| PROPOSAL NO. 1: ELECTION OF DIRECTORS |

|

| PROPOSAL NO. 1: ELECTION OF DIRECTORS |

|

|

| PROPOSAL NO. 1: ELECTION OF DIRECTORS Corporate Governance Corporate Governance Guidelines and Codes of Ethics We are committed to good corporate governance practices and, as such, we have adopted our Corporate Governance Guidelines, Code of Business Conduct and |

| PROPOSAL NO. 1: ELECTION OF DIRECTORS Board Leadership Structure Our Board has appointed Ms. Curtin as our independent, non-executive Chairperson of the Board. As Chairperson of the Board, Ms. Curtin: ! presides over all meetings of the Board (including executive sessions of the independent directors) and stockholders, ! reviews and approves meeting agendas, meeting schedules and other information, ! acts as a liaison between |

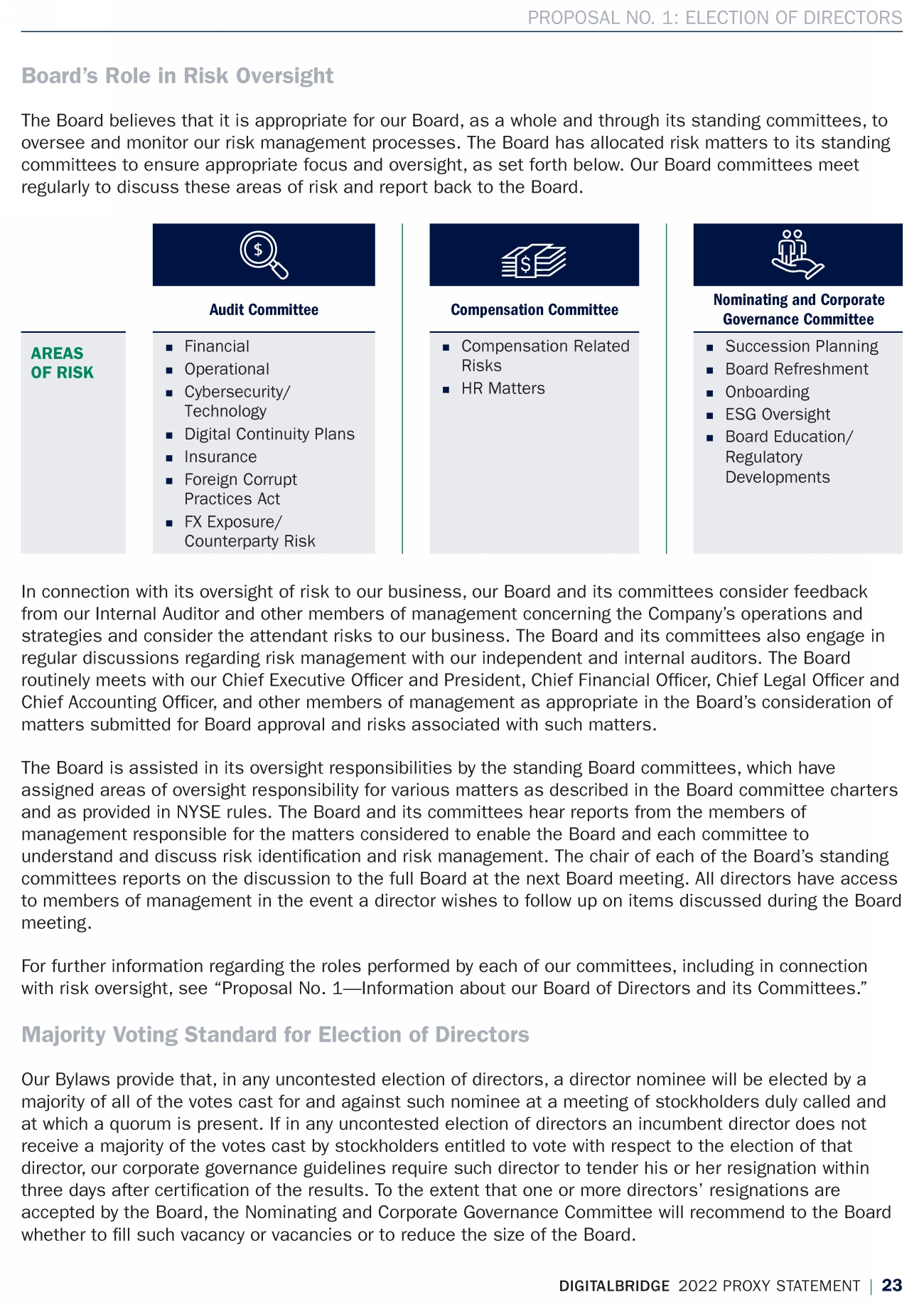

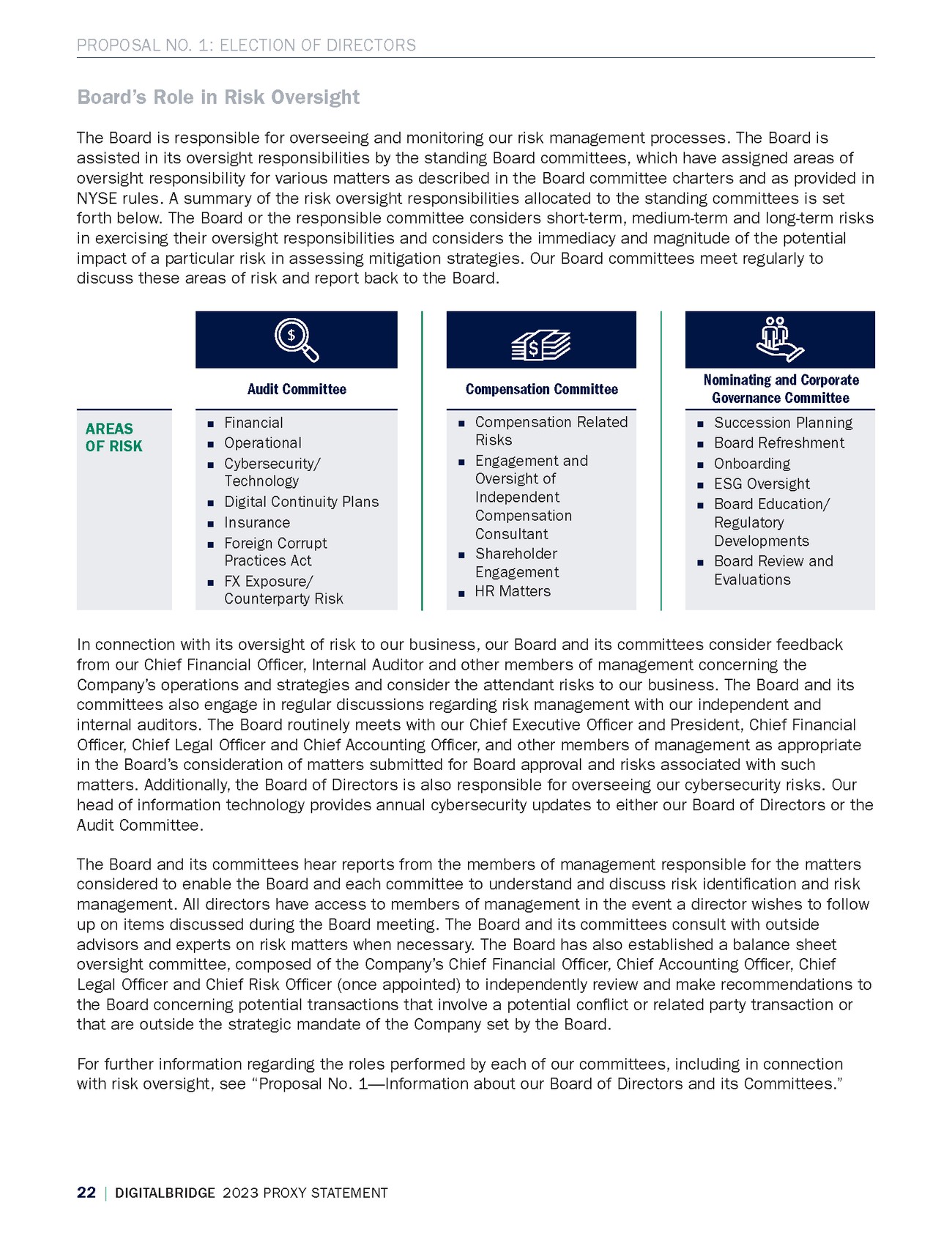

| PROPOSAL NO. 1: ELECTION OF DIRECTORS Board’s Role in Risk Oversight The Board |

| PROPOSAL NO. 1: ELECTION OF DIRECTORS Majority Voting Standard for Election of Directors Our |

|

| PROPOSAL NO. 1: ELECTION OF DIRECTORS ! knowledge and expertise in various areas deemed appropriate by the Board; and |

|

|

| PROPOSAL NO. 1: ELECTION OF DIRECTORS Information about Our Board of Directors and Its Committees During the year ended December 31, |

|

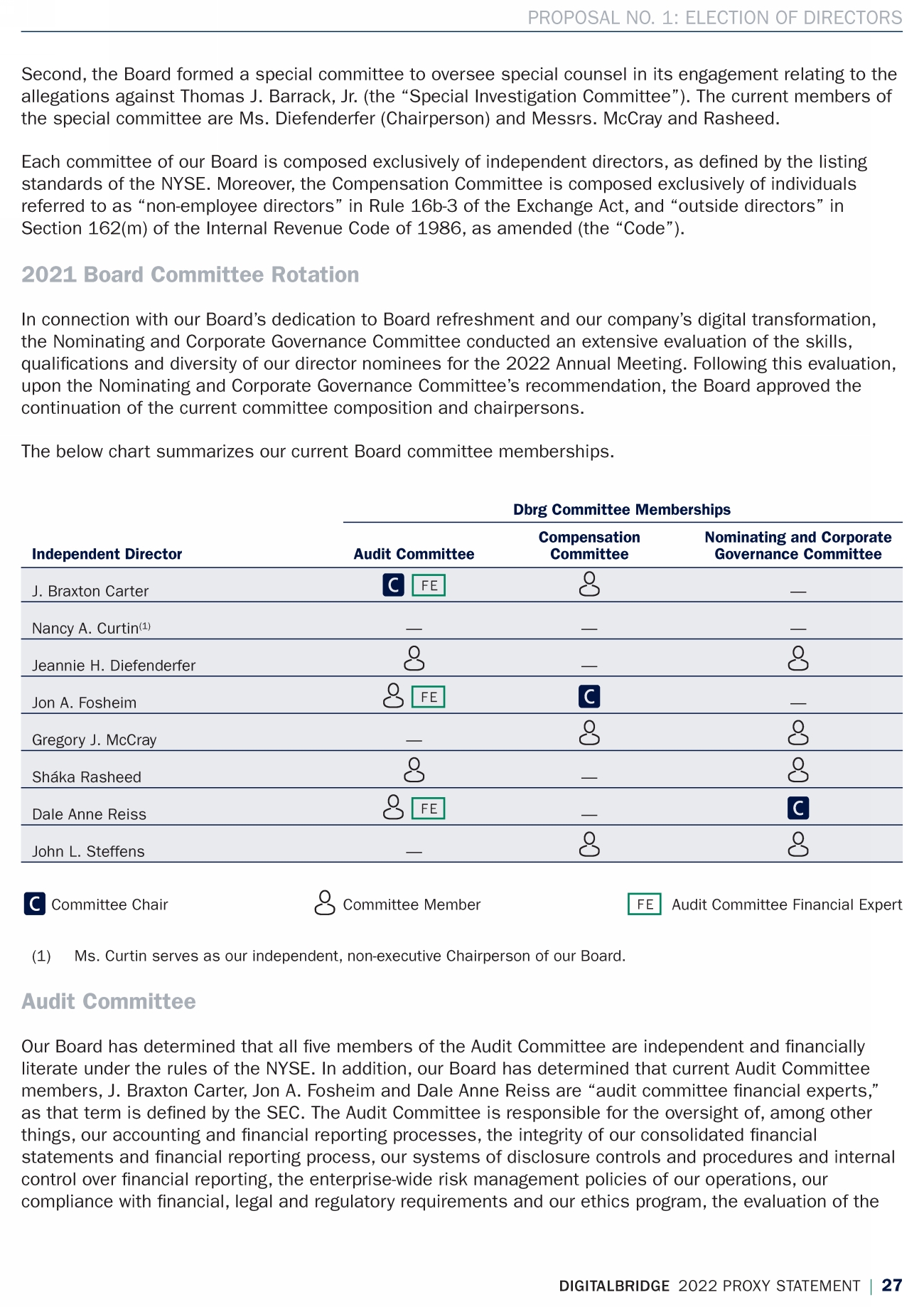

| PROPOSAL NO. 1: ELECTION OF DIRECTORS The below chart summarizes our current Board committee memberships. |

|

| PROPOSAL NO. 1: ELECTION OF DIRECTORS Compensation Committee Our Board has determined that all members of the Compensation Committee are independent under the rules of the NYSE. The Compensation Committee is responsible for, among other things, reviewing and approving on an annual basis corporate goals and objectives relevant to our Chief Executive |

|

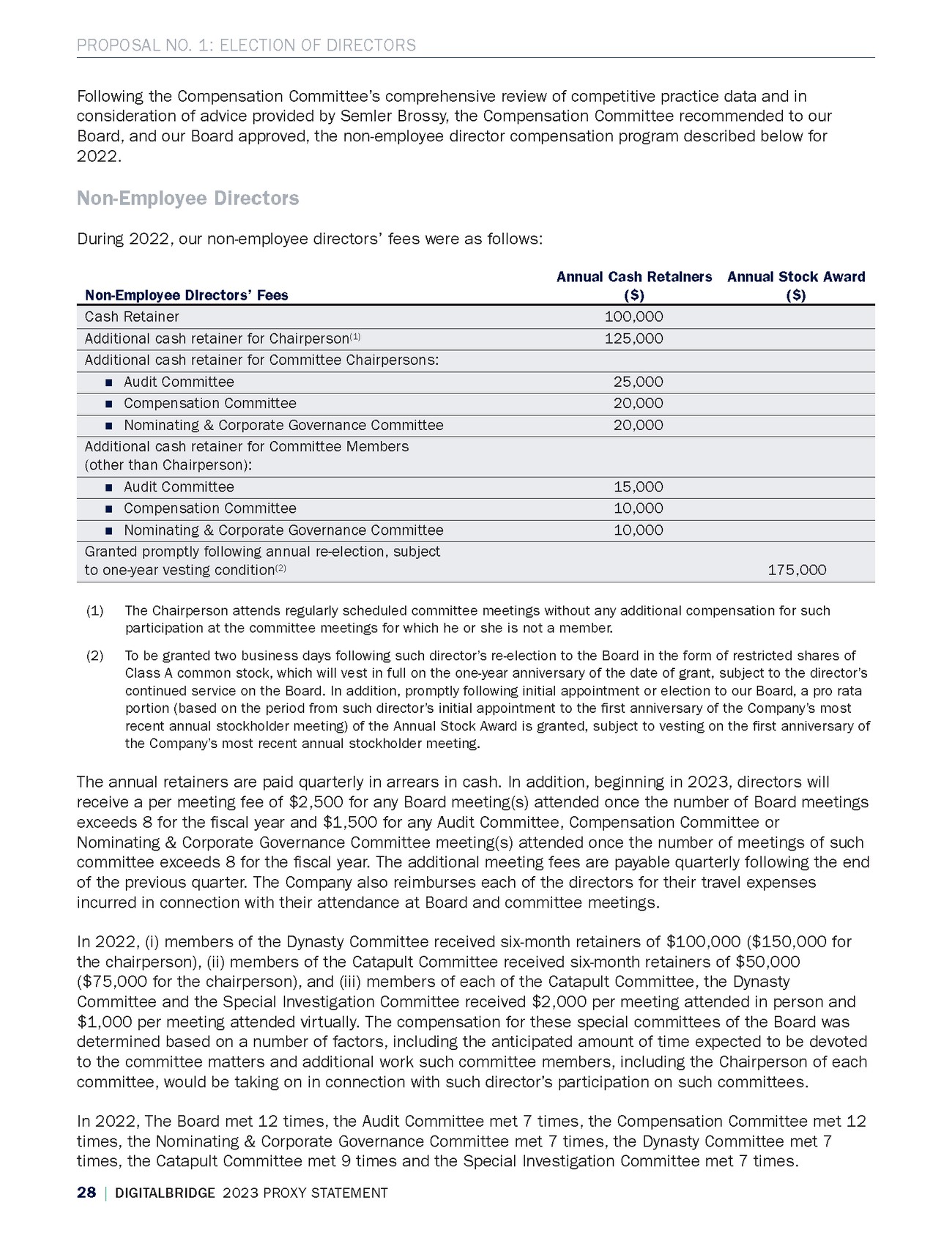

| PROPOSAL NO. 1: ELECTION OF DIRECTORS 28 | DIGITALBRIDGE 2023 PROXY STATEMENT Following the Compensation Committee’s comprehensive review of competitive practice data and in consideration of advice provided by Semler Brossy, |

|

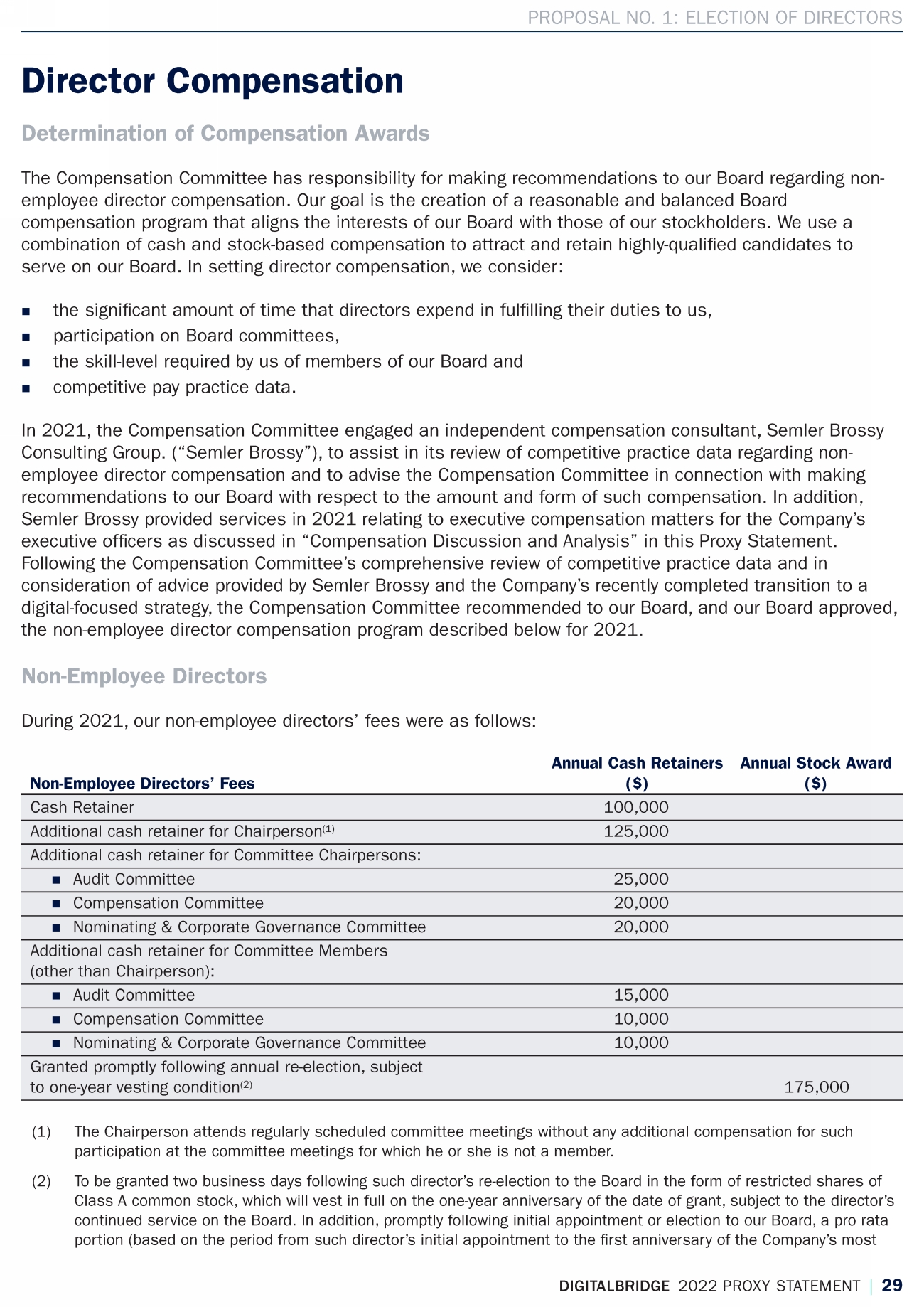

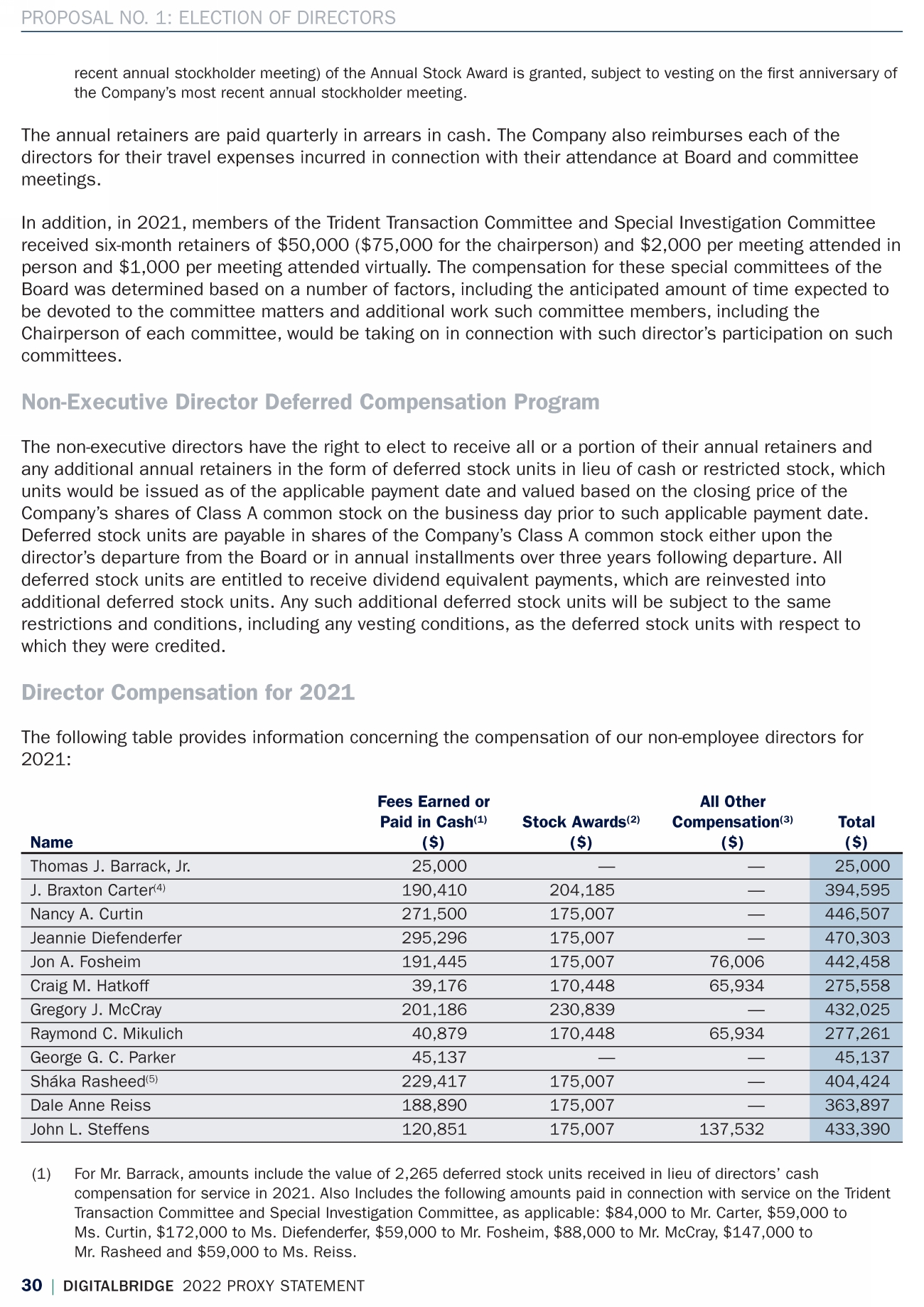

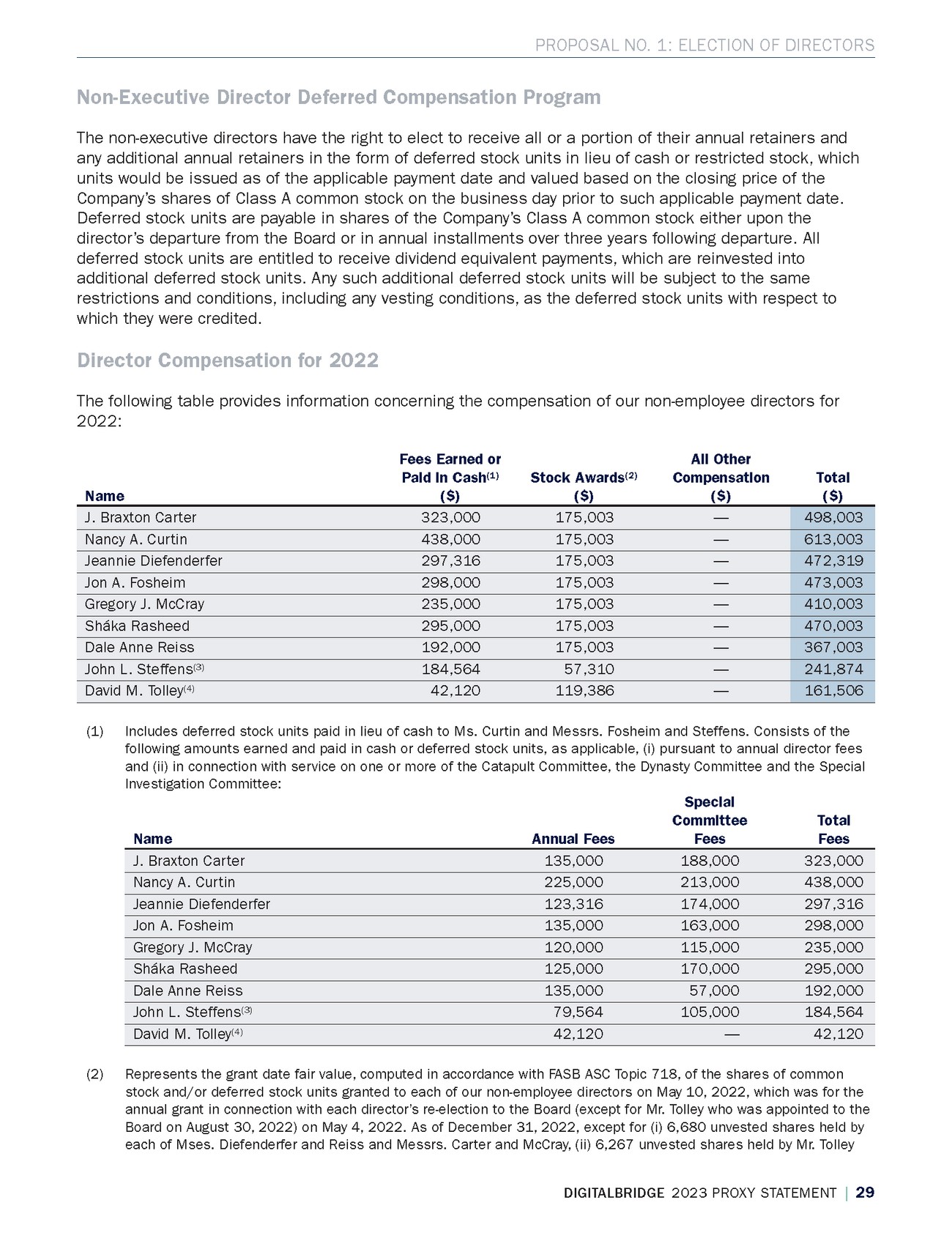

| Non-Executive Director Deferred Compensation Program The non-executive directors have the right to elect to receive all or a portion of their annual retainers and any additional annual retainers in the form of deferred stock units in lieu of cash or restricted stock, which units would be issued as of the applicable payment date and valued based on the closing price of the Company’s shares of Class A common stock on the business day prior to such applicable payment date. Deferred stock units are payable in shares of the Company’s Class A common stock either upon the director’s departure from the Board or in annual installments over three years following departure. All deferred stock units are entitled to receive dividend equivalent payments, which are reinvested into additional deferred stock units. Any such additional deferred stock units will be subject to the same restrictions and conditions, including any vesting conditions, as the deferred stock units with respect to which they were credited. Director Compensation for |

|

| PROPOSAL NO. 1: ELECTION OF DIRECTORS and (iii) |

|

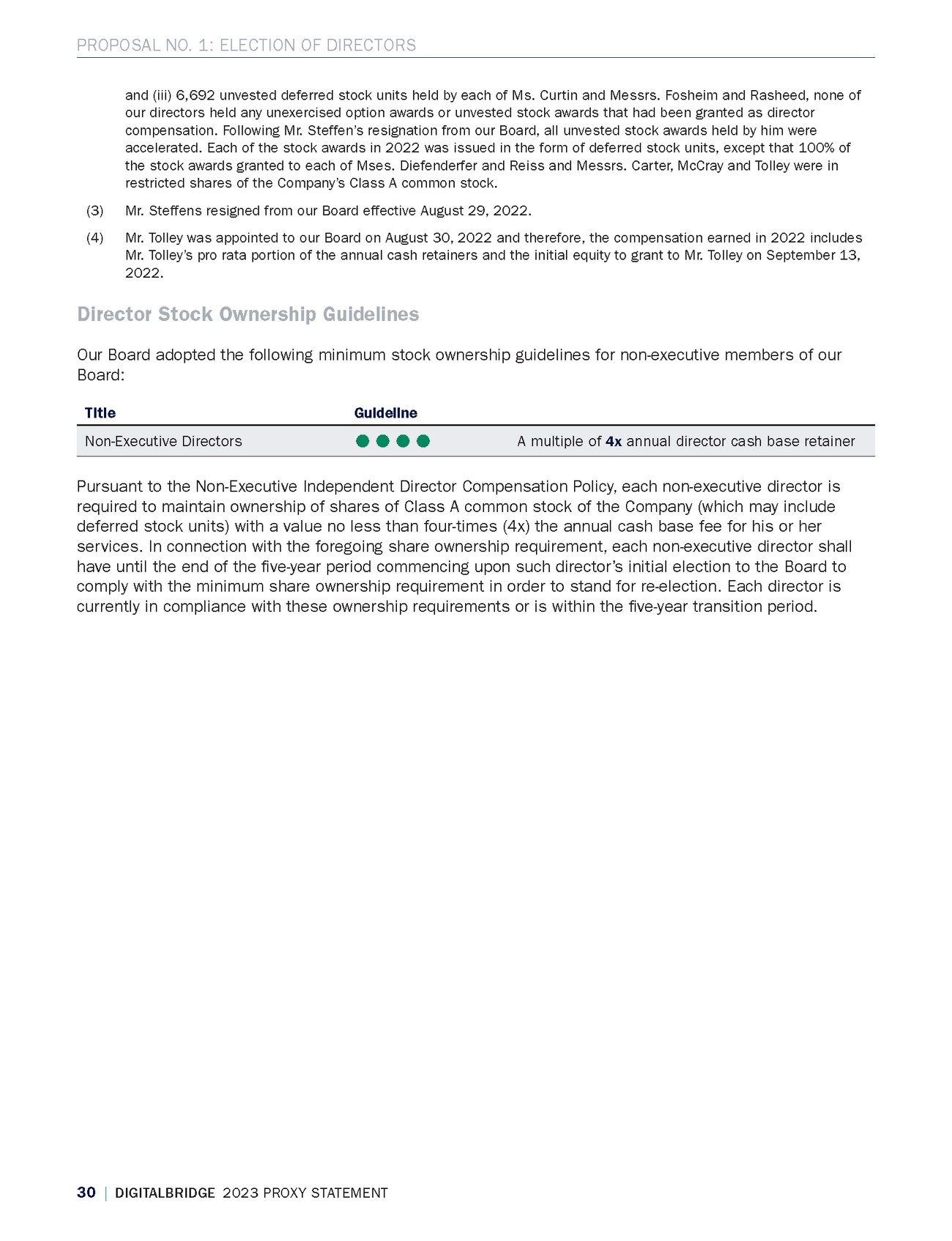

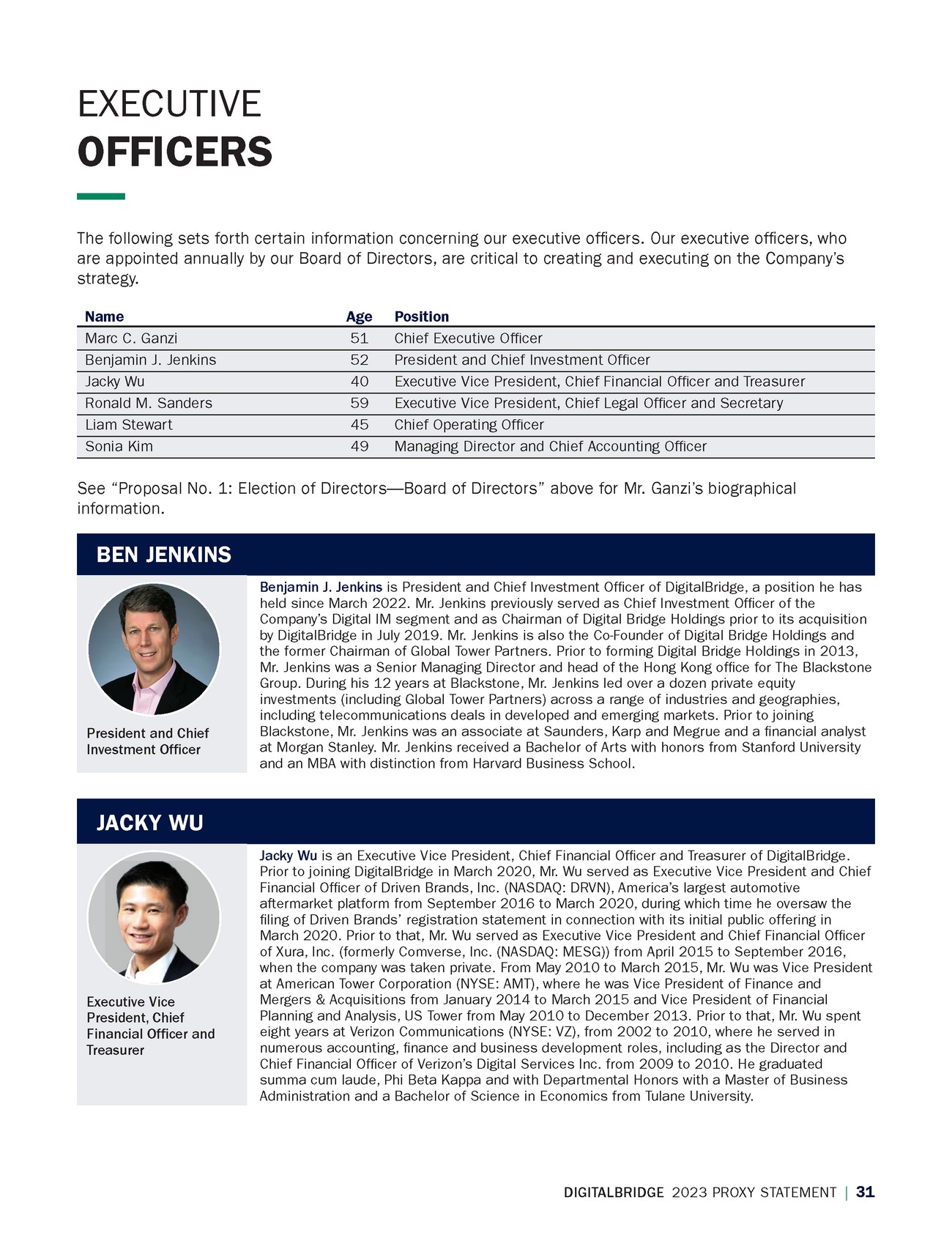

| EXECUTIVE OFFICERS The following sets forth certain information concerning our executive |

|

| EXECUTIVE OFFICERS RONALD M. SANDERS LIAM STEWART SONIA KIM Executive Vice President and the Chief Legal Offcer and Secretary Ronald M. Sanders is an Executive Vice President and the Chief Legal Offcer and Secretary of DigitalBridge. Mr. Sanders is responsible for the management of global legal affairs and generally provides legal and other support to the operations of DigitalBridge. Prior to joining the DigitalBridge business in 2004, Mr. Sanders was a Partner with the law frm of Clifford Chance US LLP. Mr. Sanders received his Bachelor of Science from the State University of |

|

| DIGITALBRIDGE 2023 PROXY STATEMENT | 33 PROPOSAL NO. 2: NON-BINDING, ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION Pursuant to Section 14A(a)(1) of the Exchange Act, we are providing stockholders with the opportunity to approve the following non-binding, advisory resolution: “RESOLVED, that the compensation paid to the Company’s named executive |

|

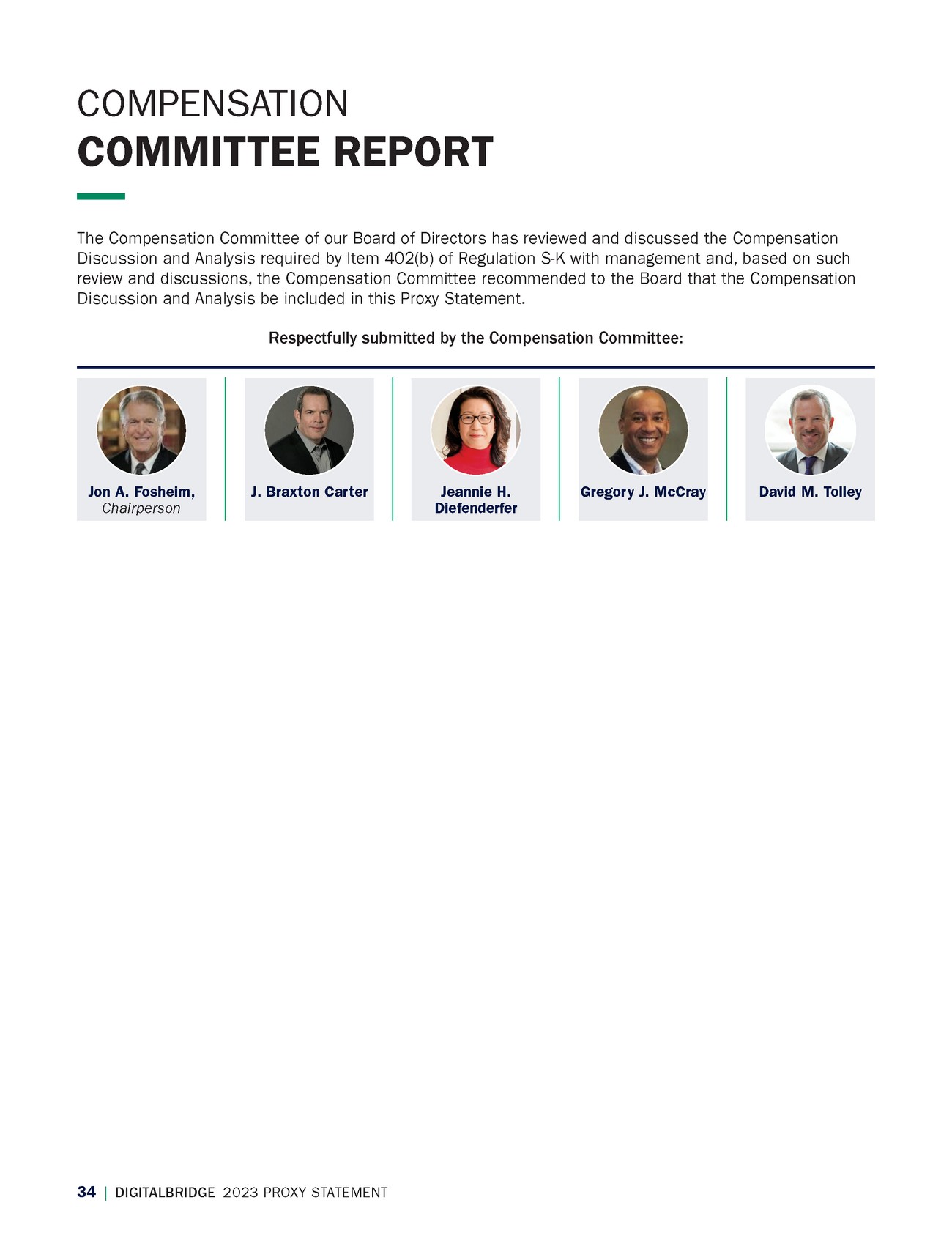

| 34 | DIGITALBRIDGE 2023 PROXY STATEMENT COMPENSATION COMMITTEE REPORT The Compensation Committee of our Board of Directors has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this |

|

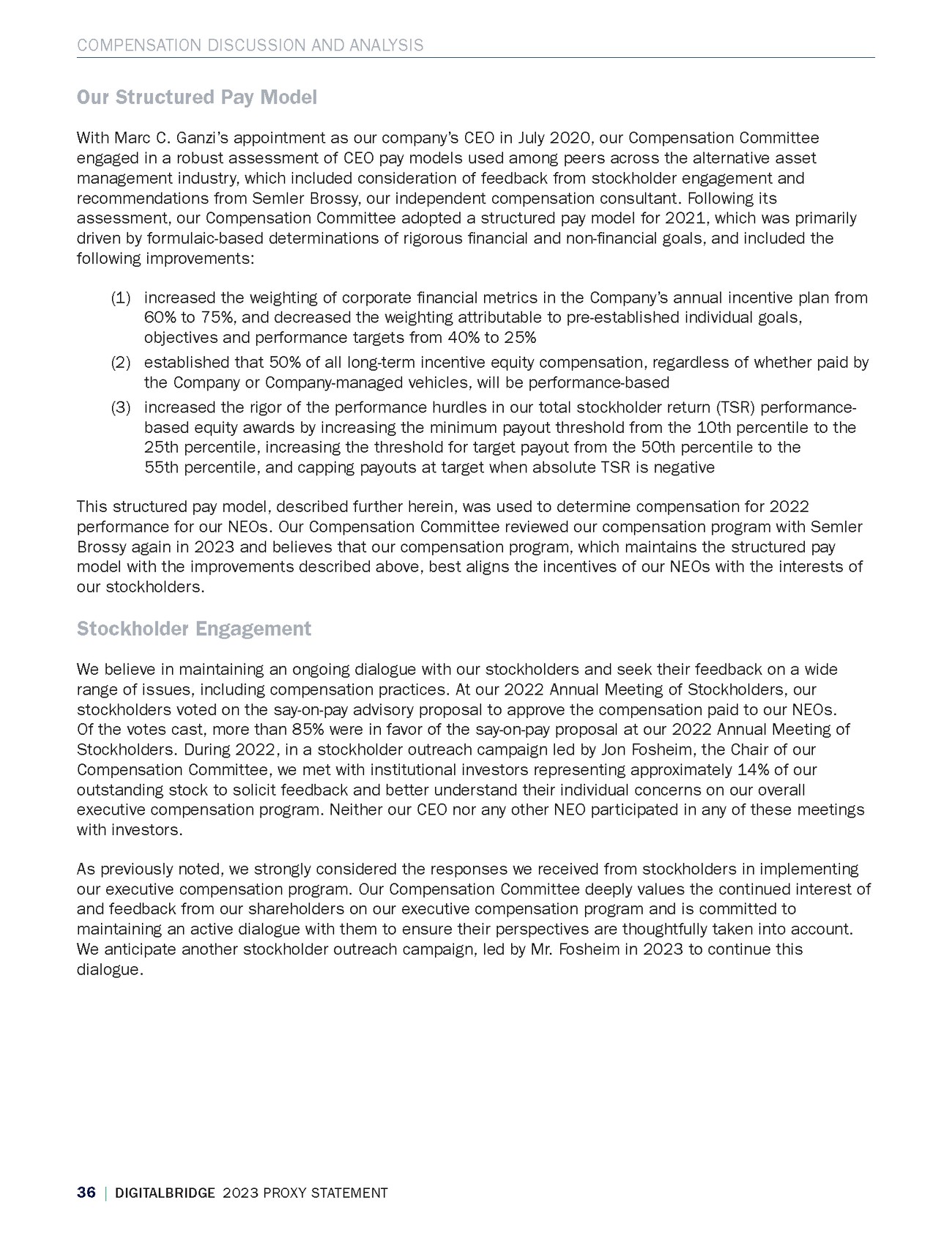

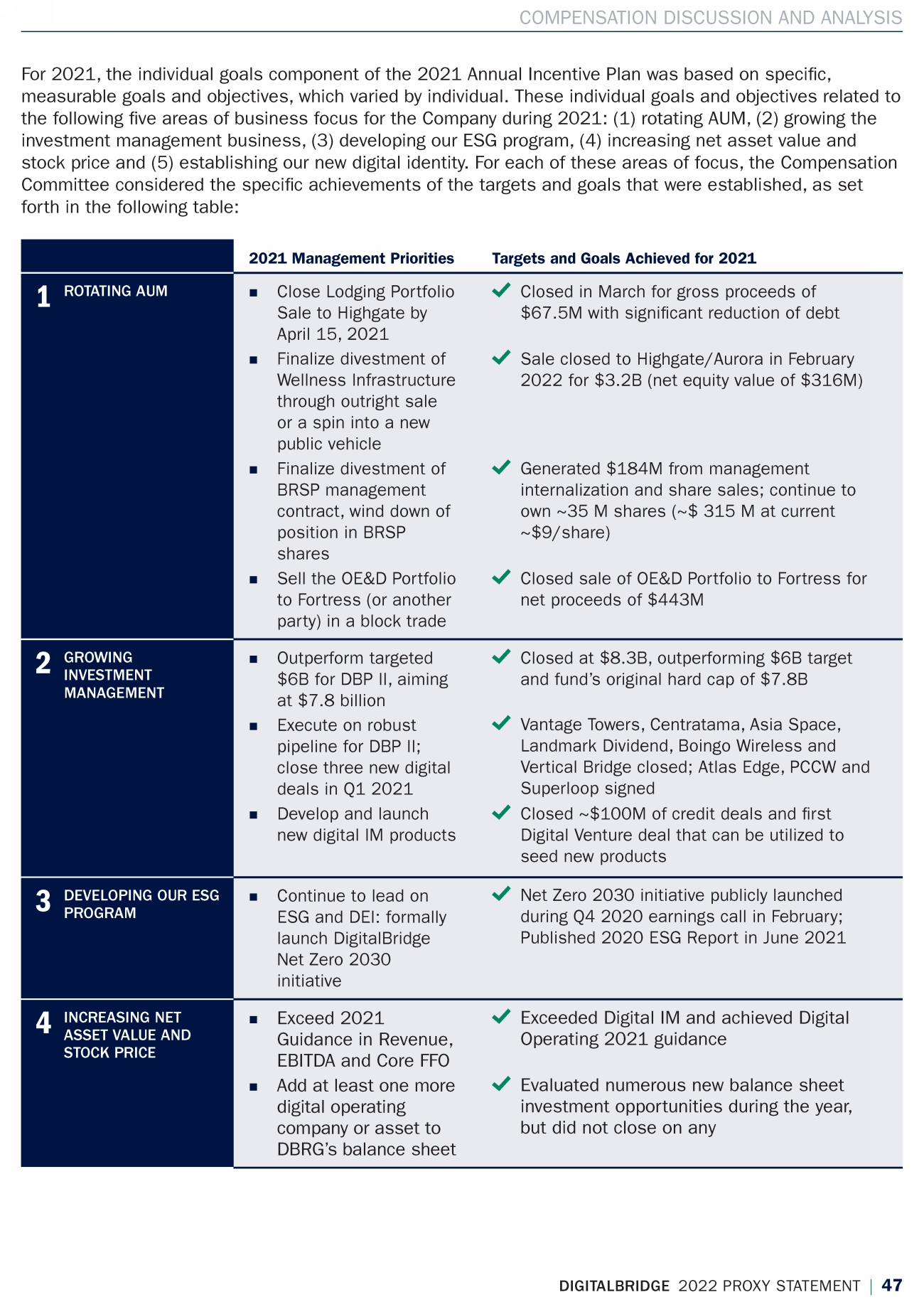

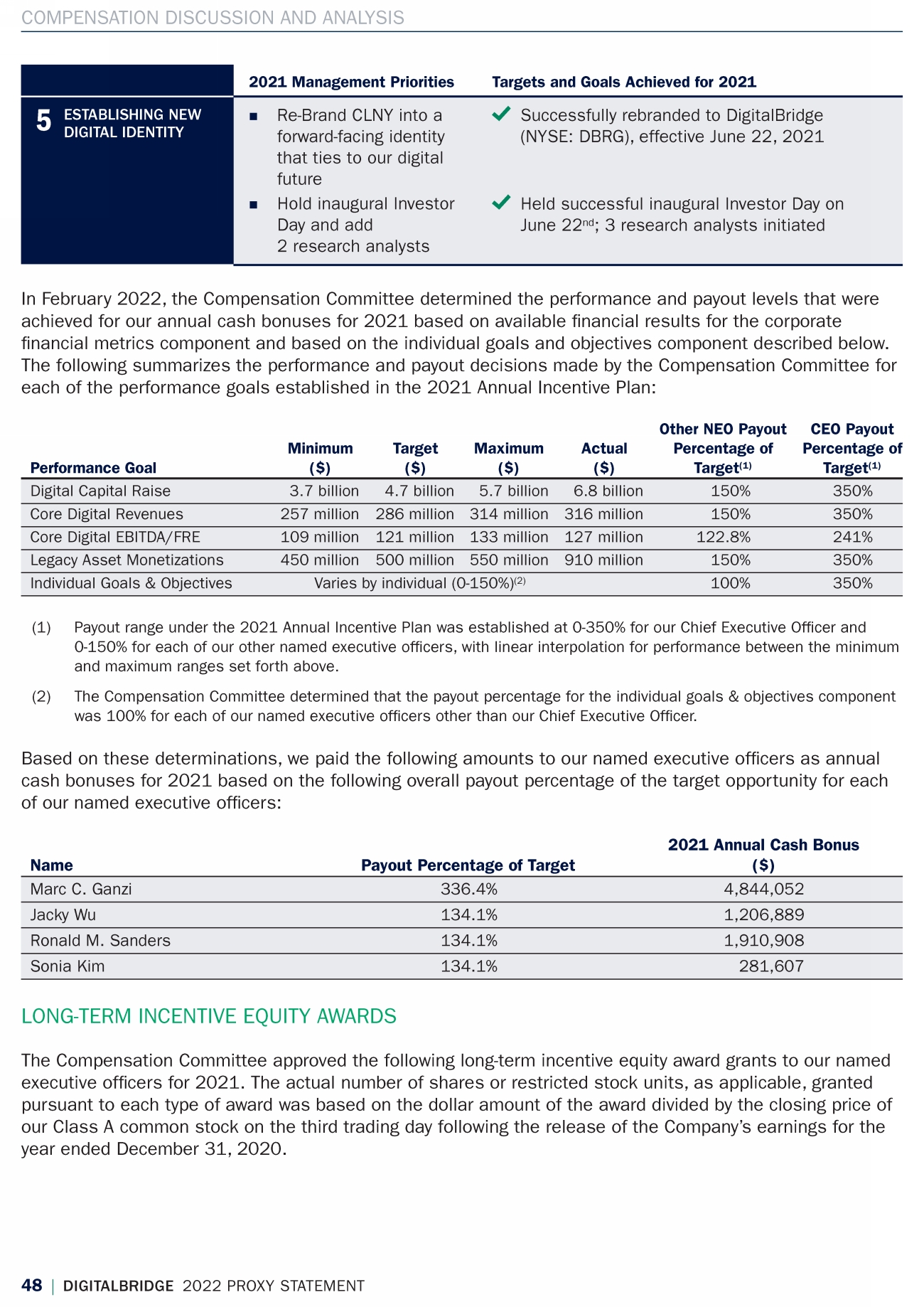

| COMPENSATION DISCUSSION AND ANALYSIS This Compensation Discussion & Analysis section discusses the compensation of our named executive |

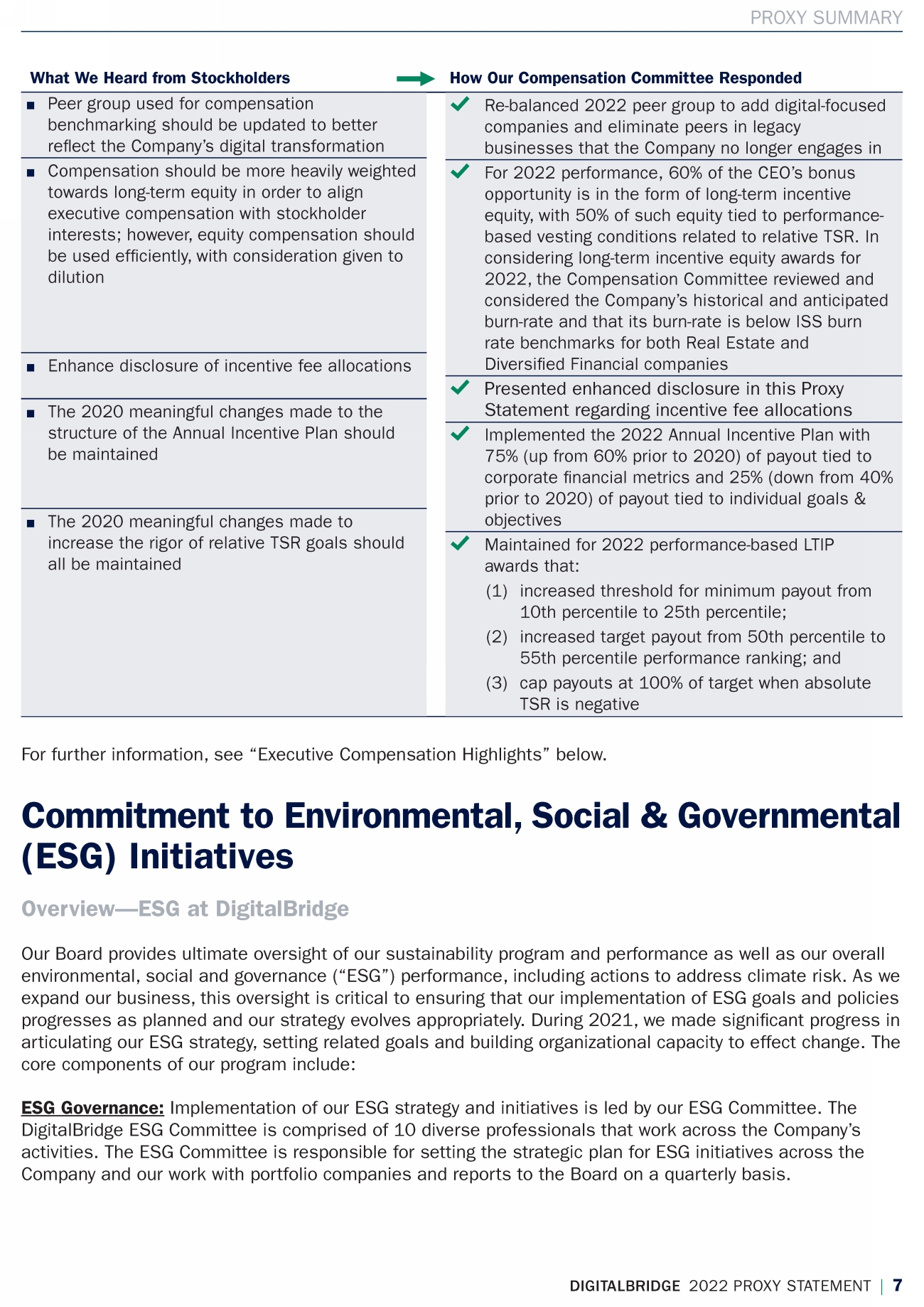

| COMPENSATION DISCUSSION AND ANALYSIS |

|

|

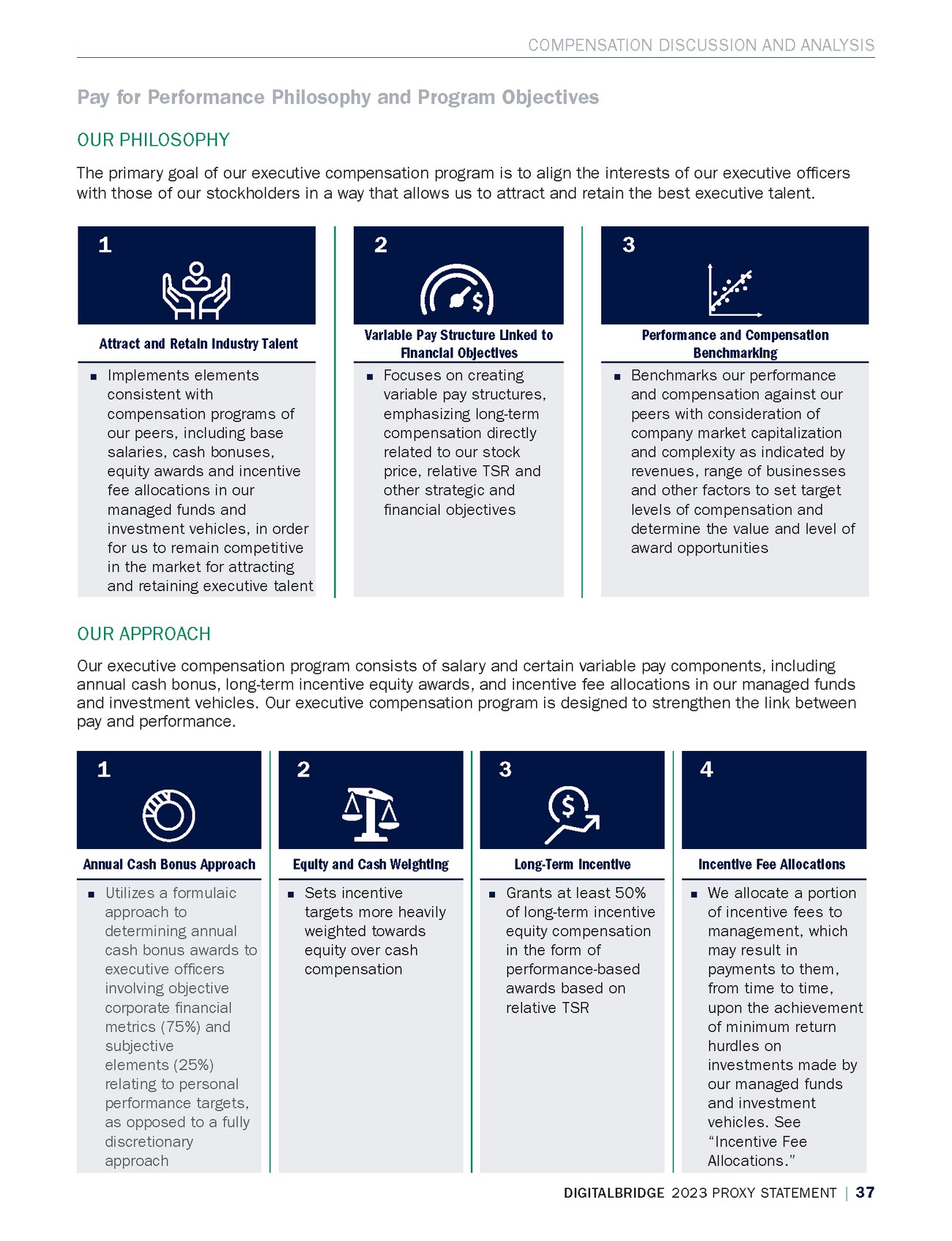

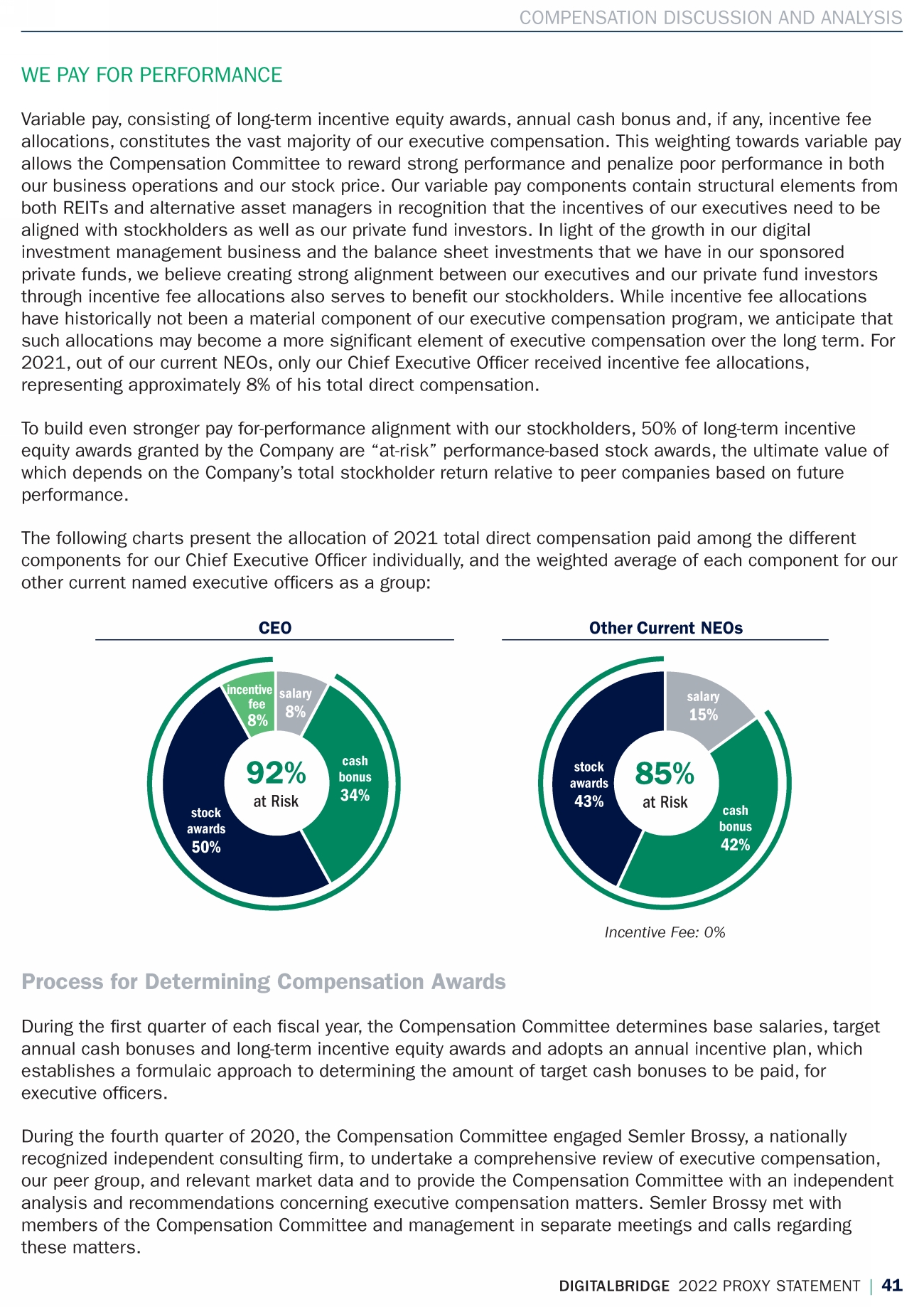

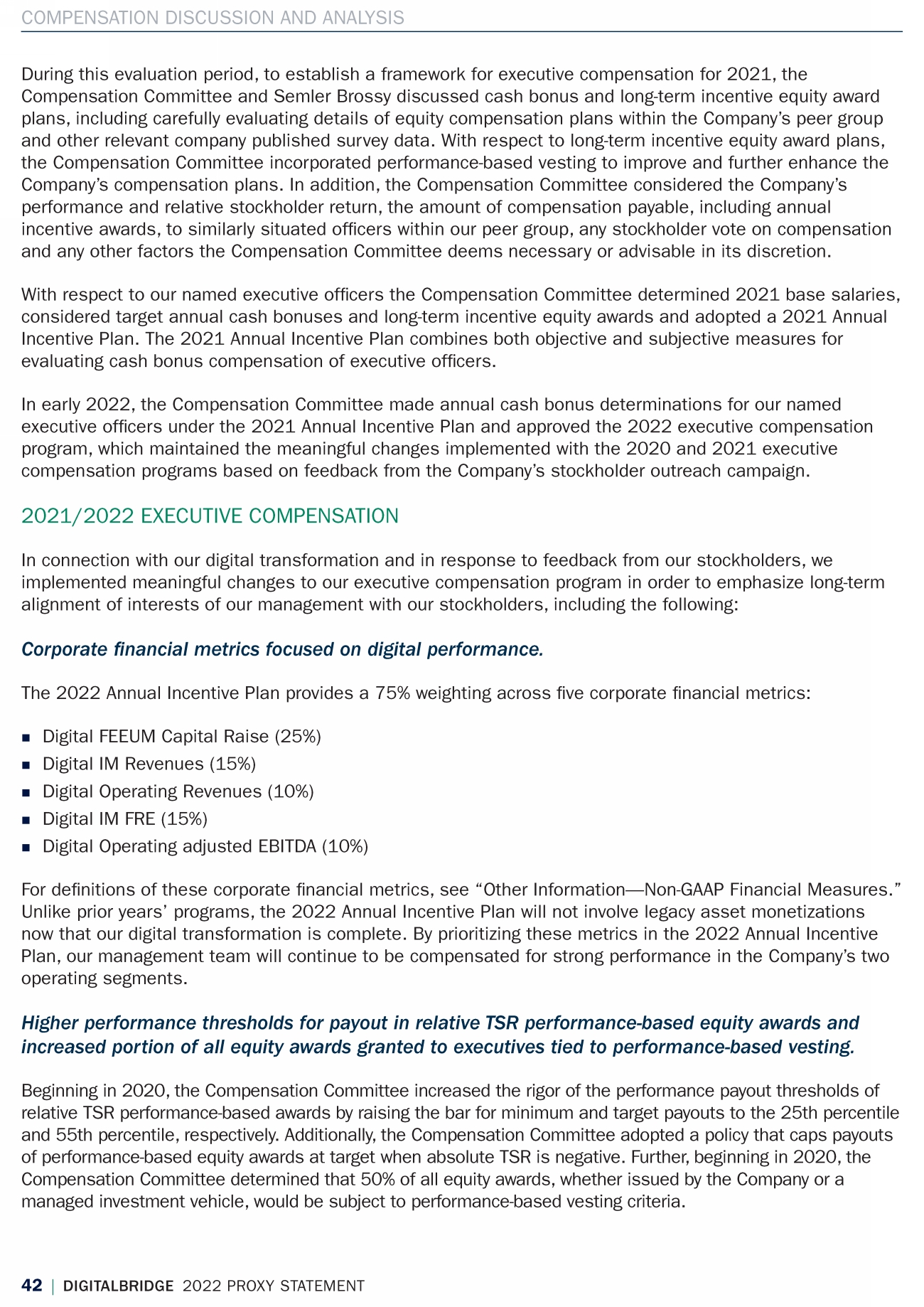

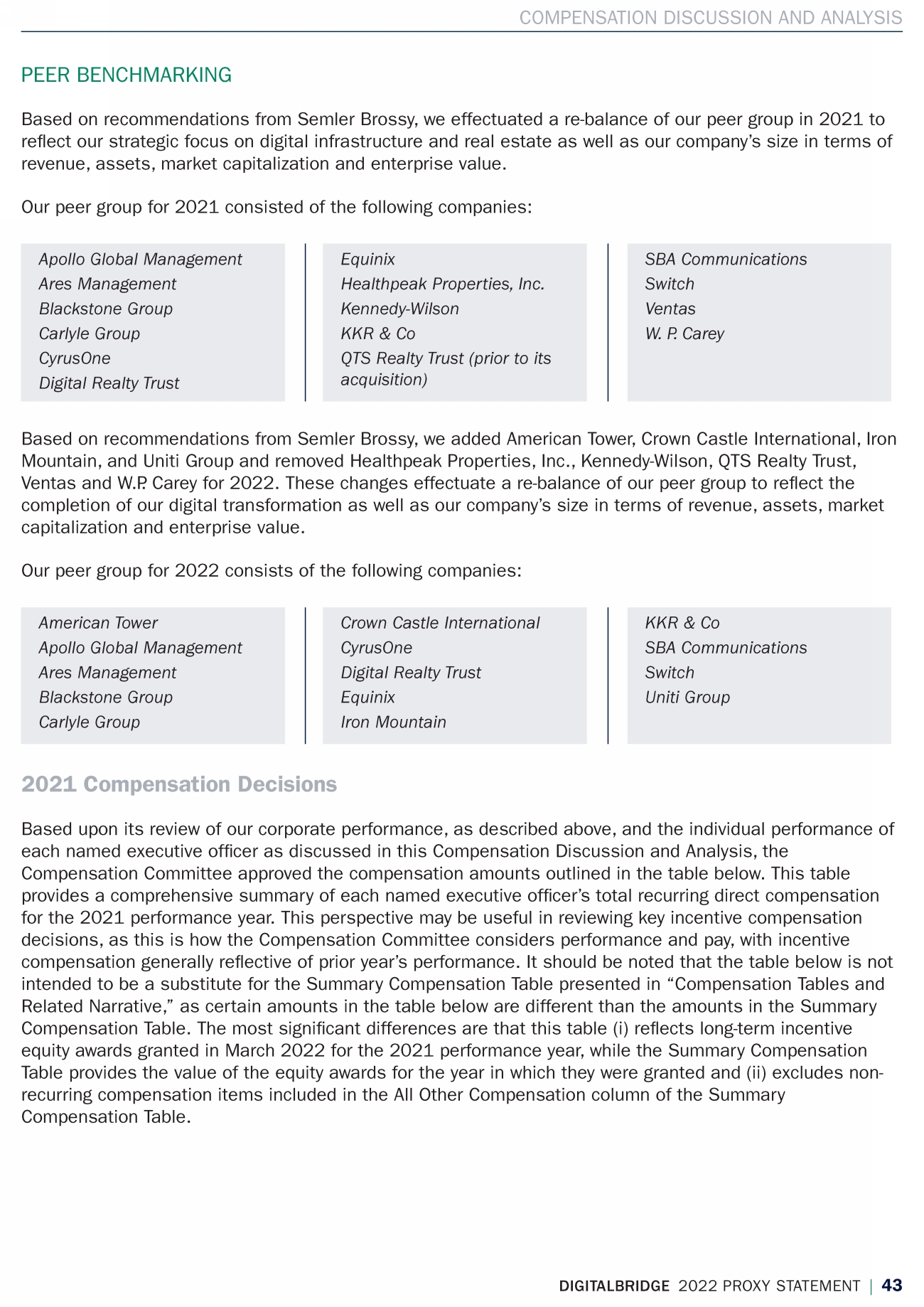

| COMPENSATION DISCUSSION AND ANALYSIS Pay for Performance Philosophy and Program Objectives OUR PHILOSOPHY The primary goal of our executive compensation program is to align the interests of our executive |

| COMPENSATION DISCUSSION AND ANALYSIS |

| COMPENSATION DISCUSSION AND ANALYSIS |

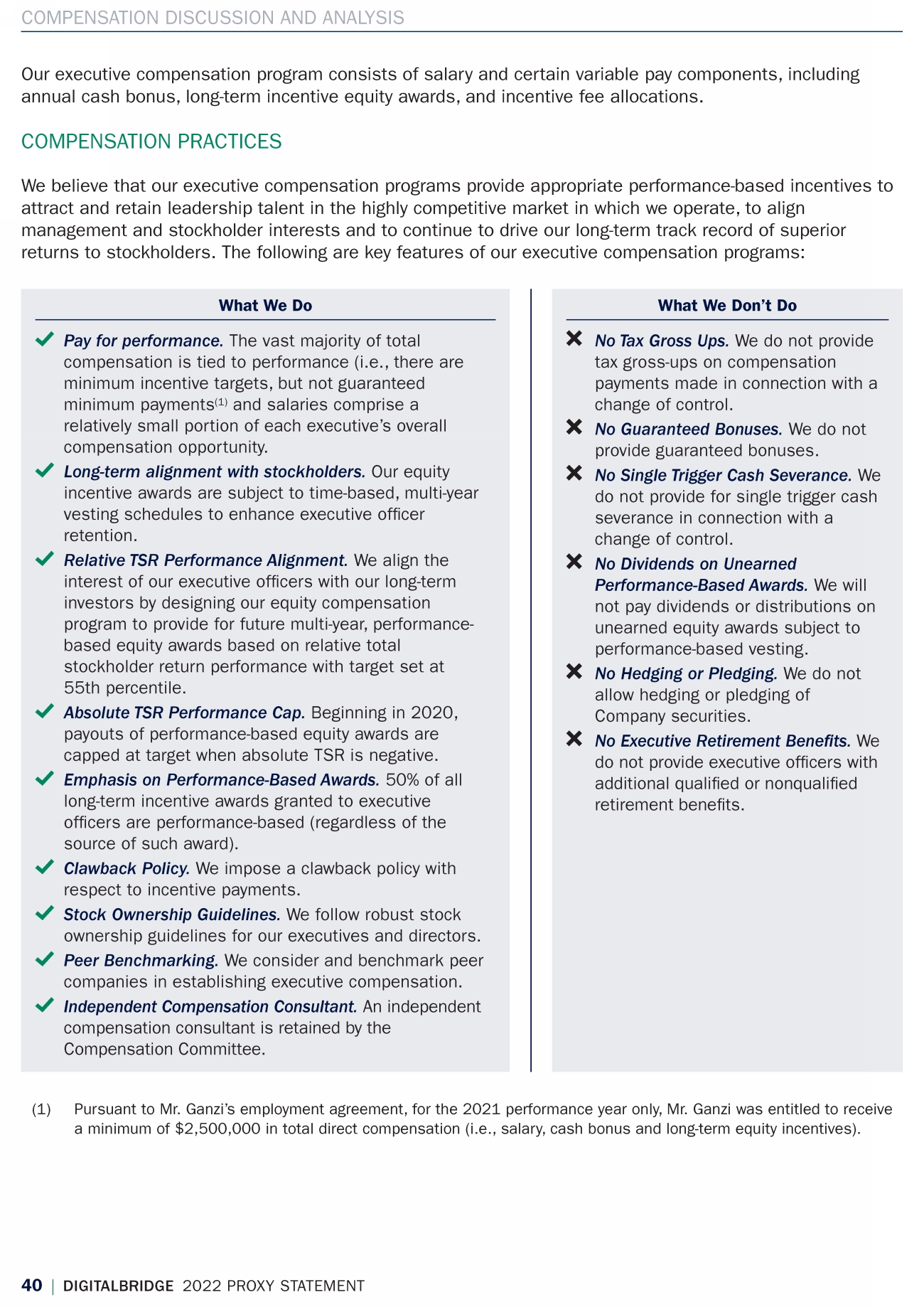

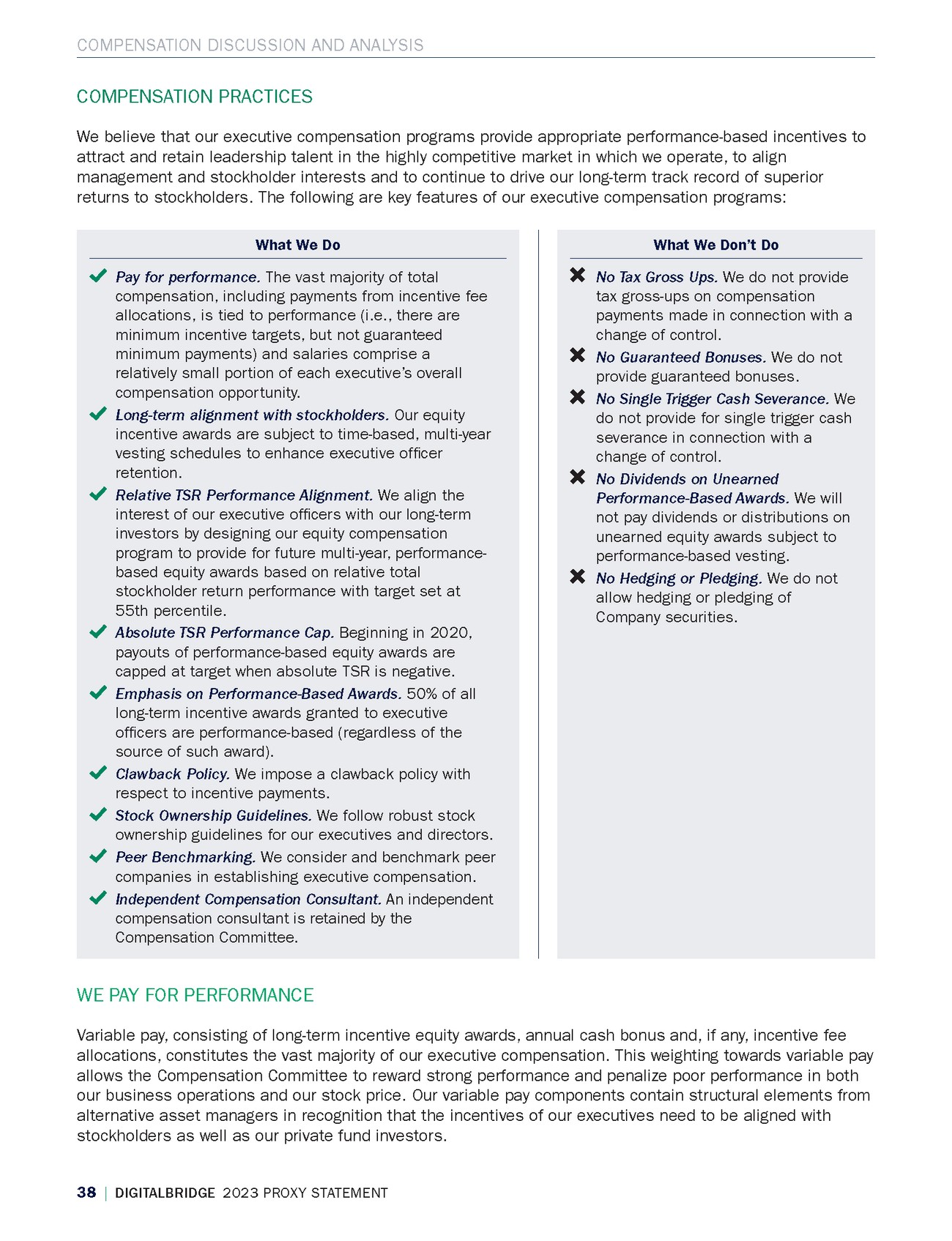

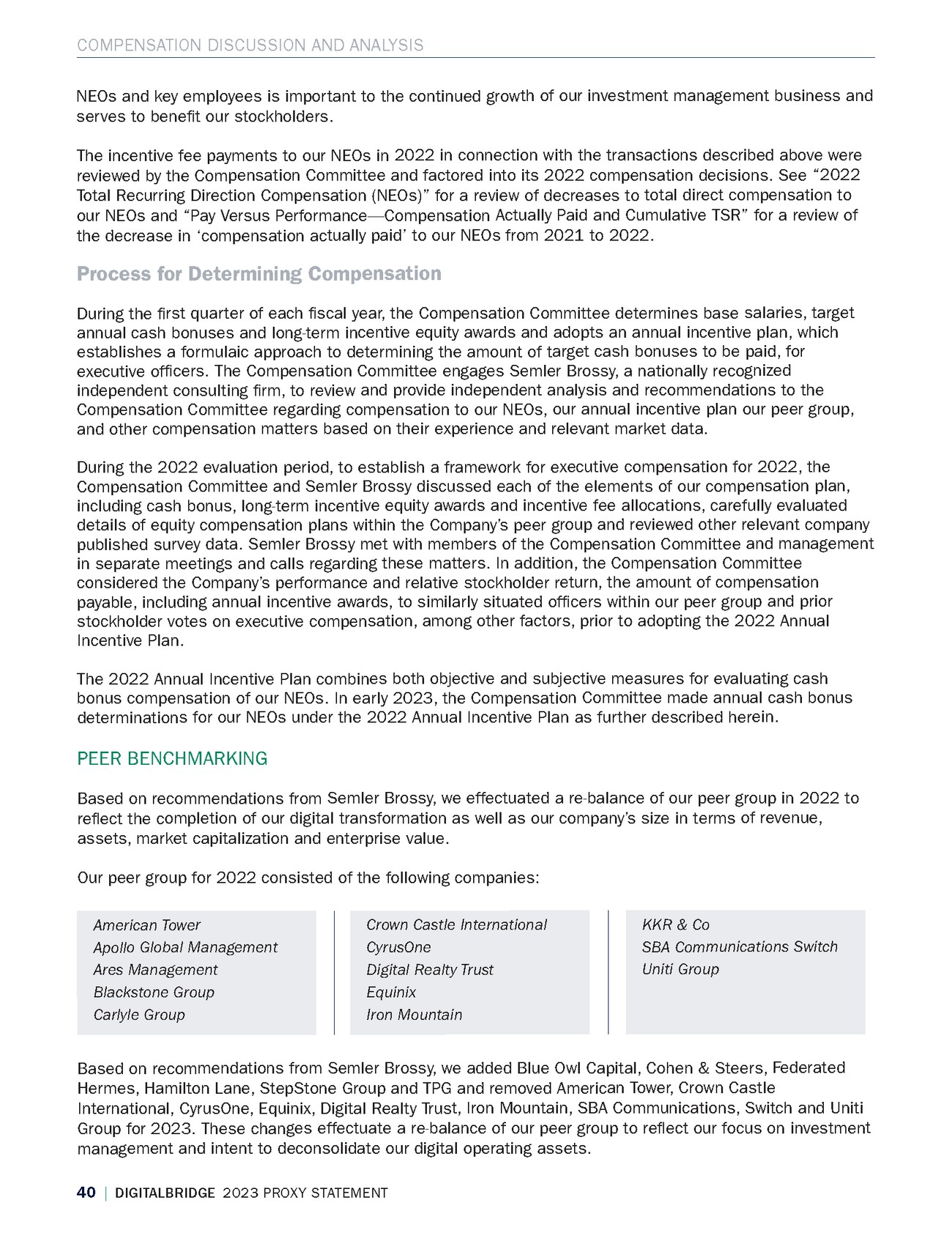

| COMPENSATION DISCUSSION AND ANALYSIS 40 | DIGITALBRIDGE 2023 PROXY STATEMENT NEOs and key employees is important to the continued growth of our investment management business and serves to beneft our stockholders. The incentive fee payments to our NEOs in 2022 in connection with the transactions described above were reviewed by the Compensation Committee and factored into its 2022 compensation decisions. See “2022 Total Recurring Direction Compensation (NEOs)” for a review of decreases to total direct compensation to our NEOs and “Pay Versus Performance—Compensation Actually Paid and Cumulative TSR” for a review of the decrease in ‘compensation actually paid’ to our NEOs from 2021 to 2022. Process for Determining Compensation |

|

|

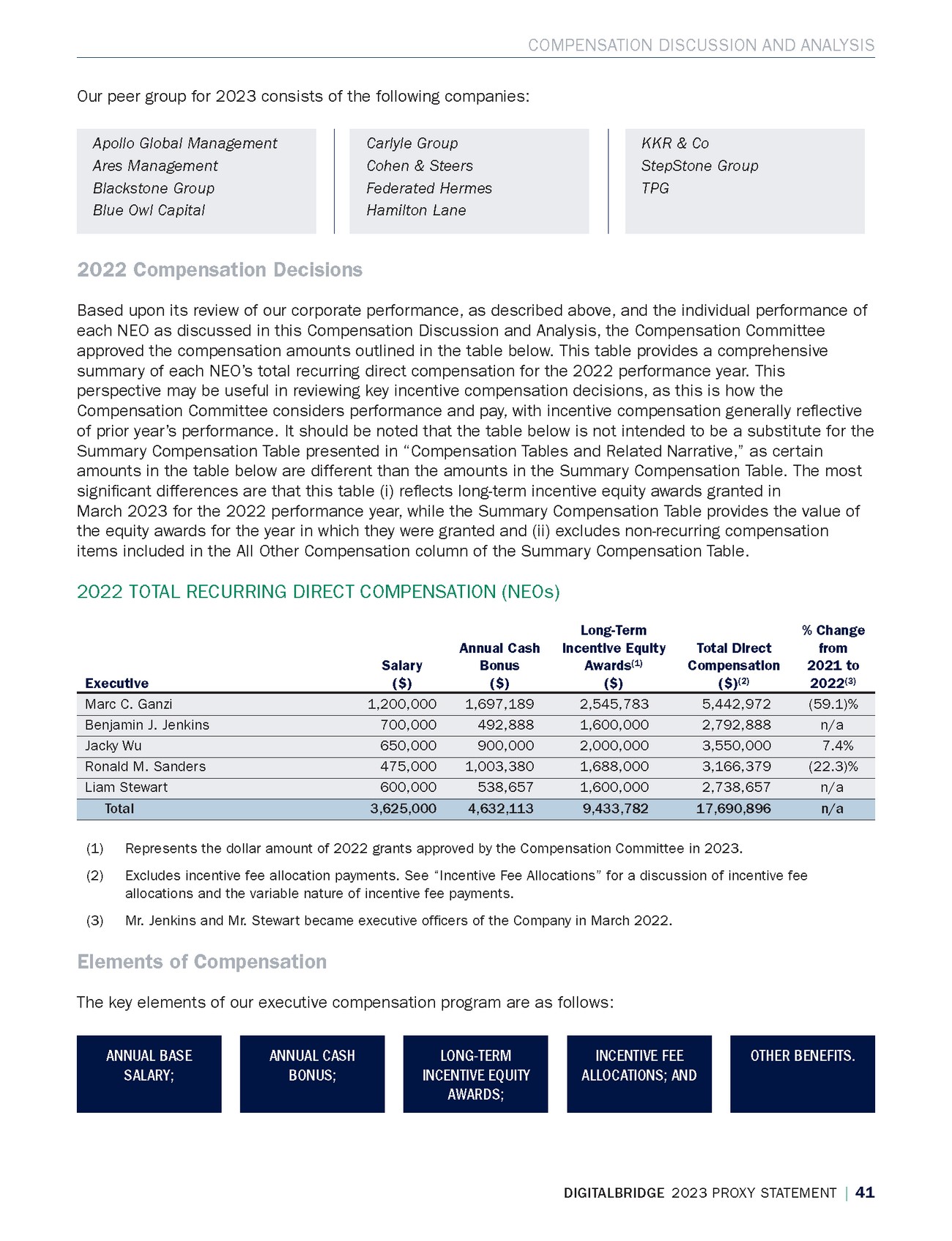

| COMPENSATION DISCUSSION AND ANALYSIS Our peer group for 2023 consists of the following companies: |

|

|

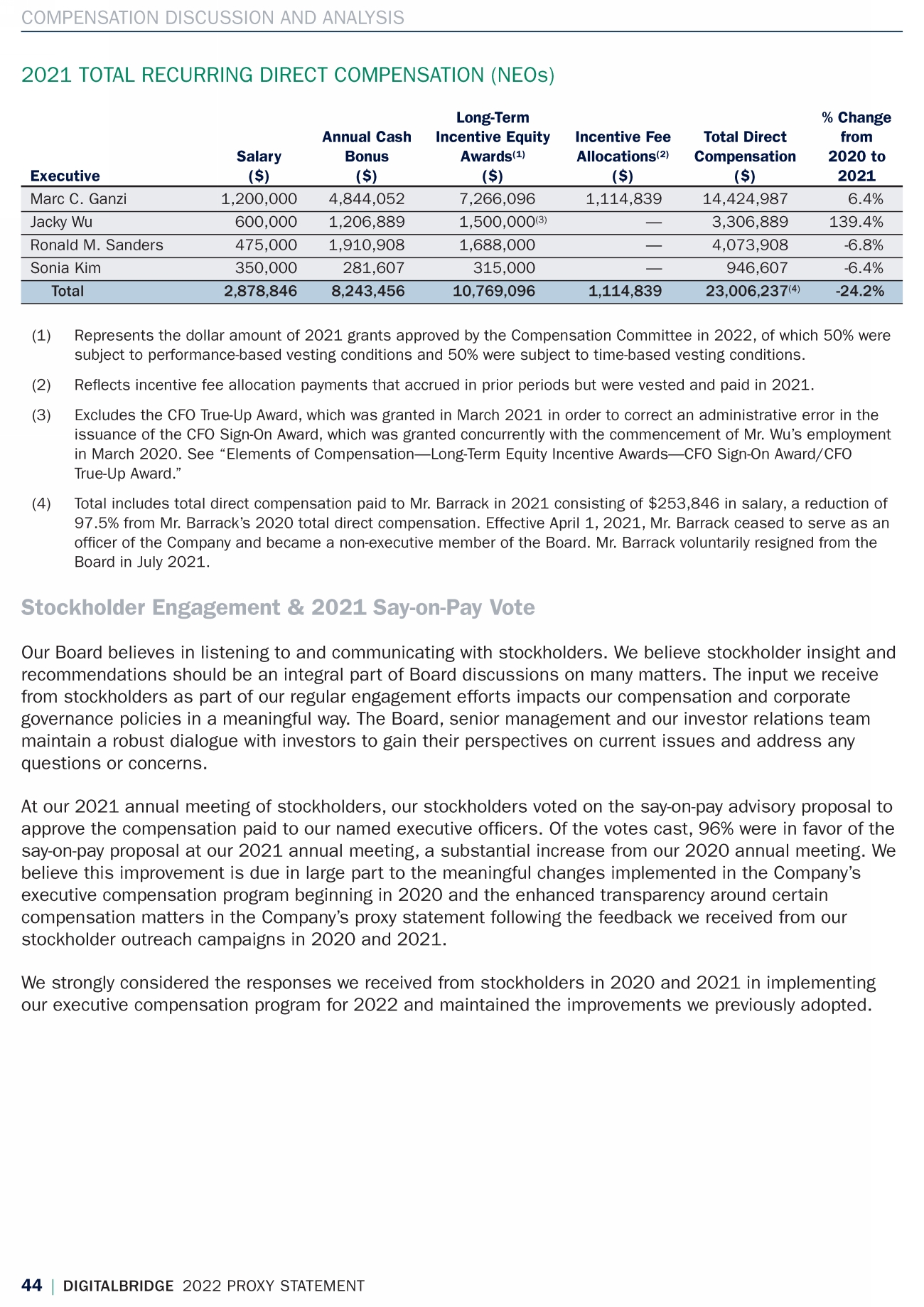

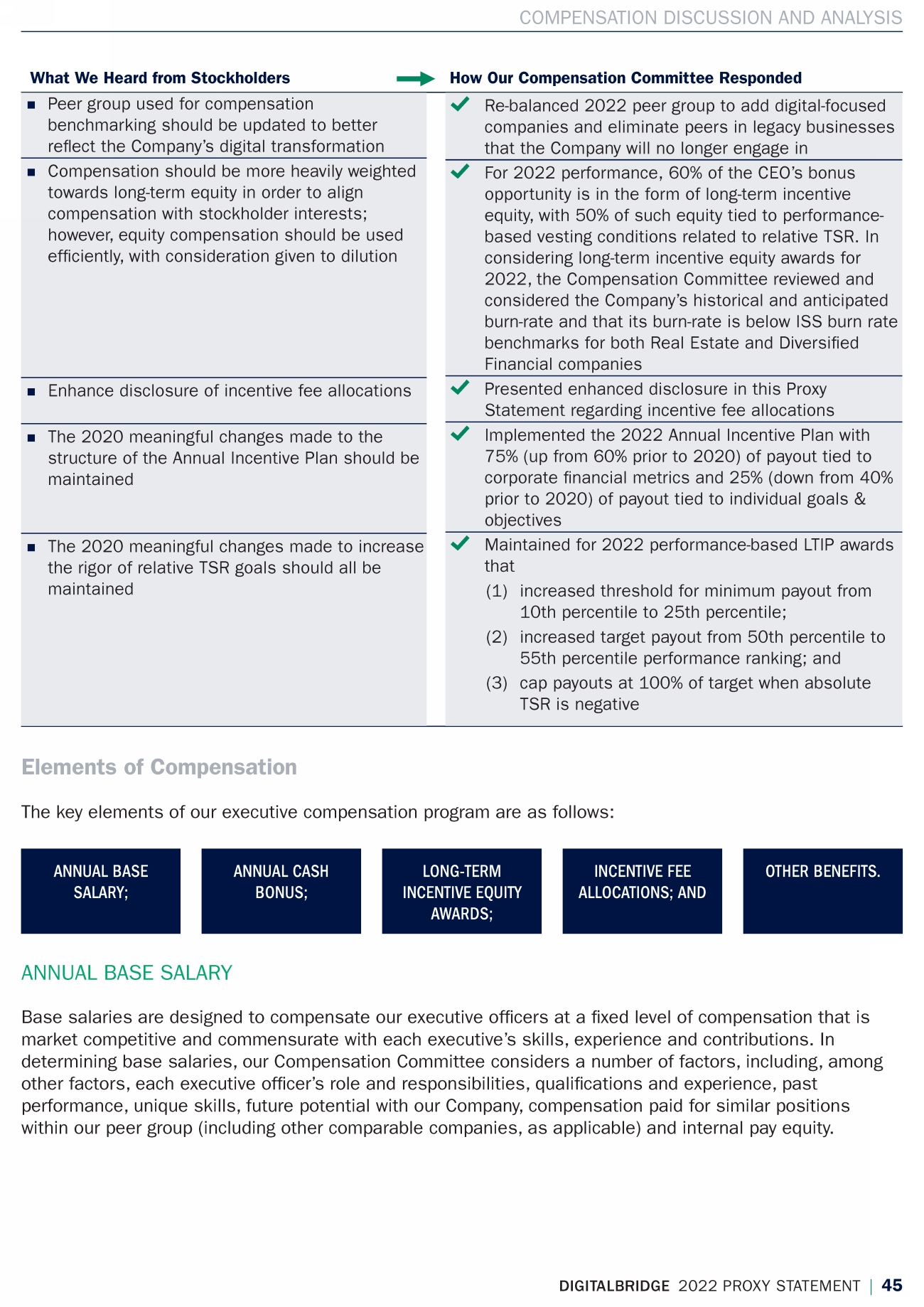

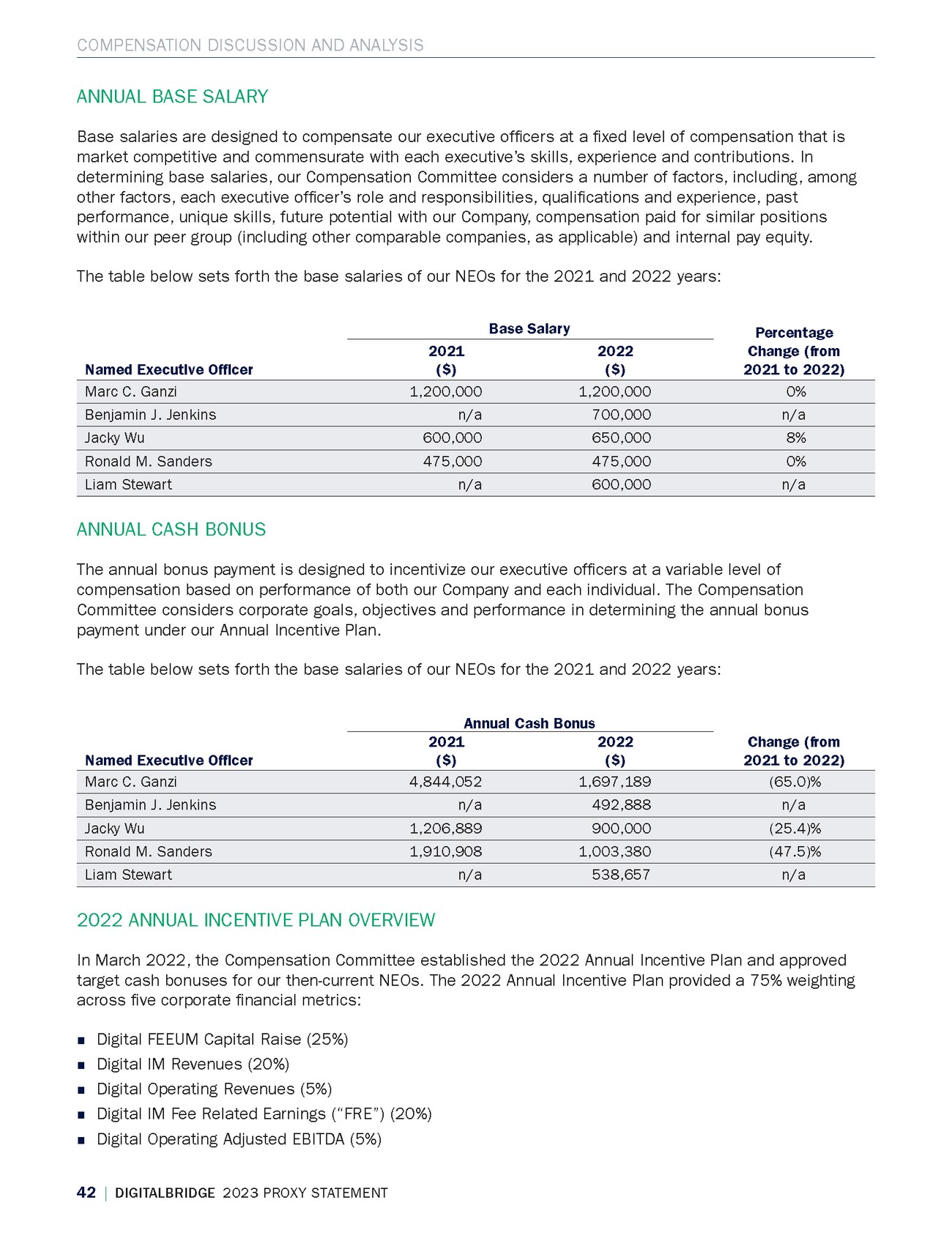

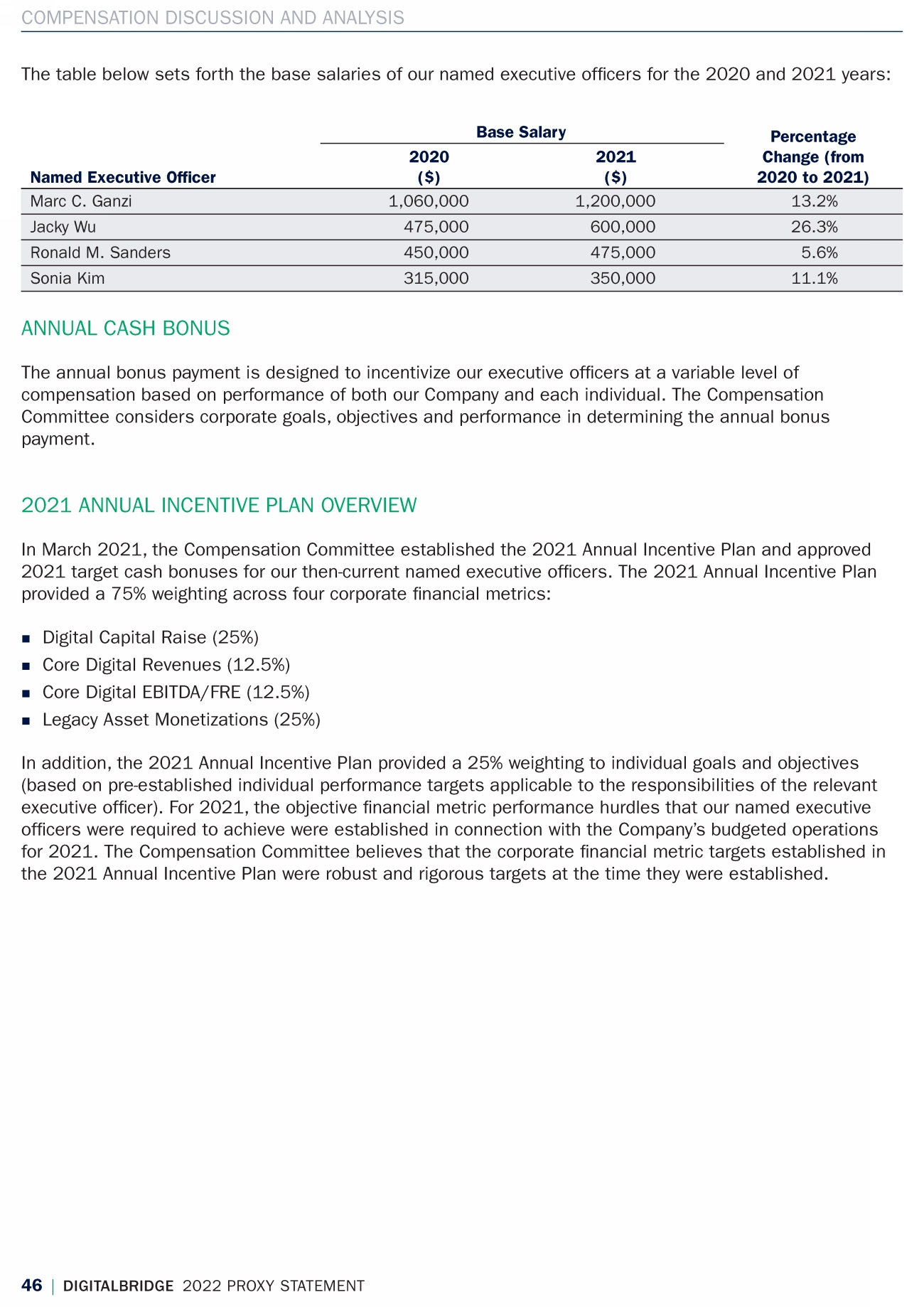

| COMPENSATION DISCUSSION AND ANALYSIS 42 | DIGITALBRIDGE 2023 PROXY STATEMENT ANNUAL BASE SALARY Base salaries are designed to compensate our executive |

|

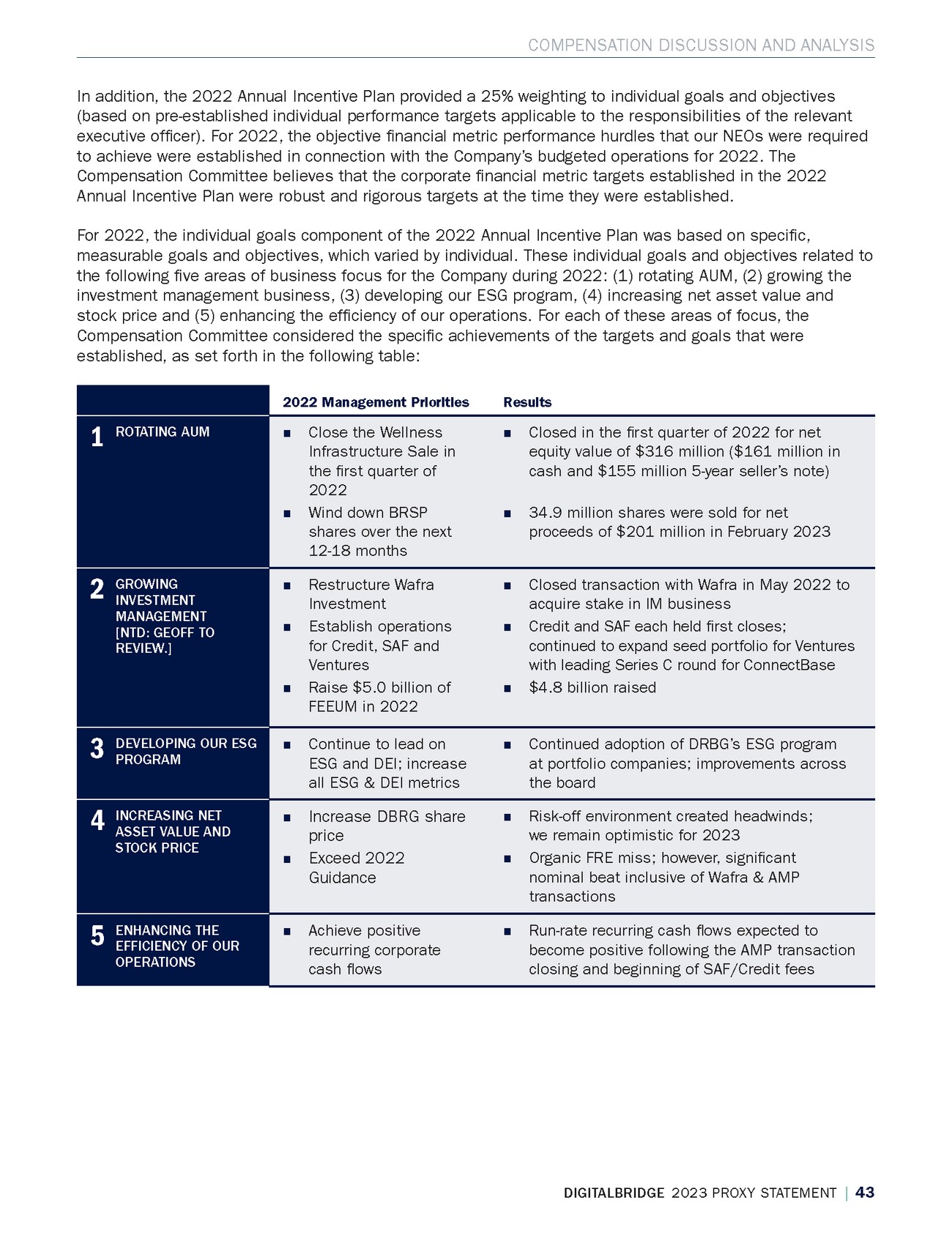

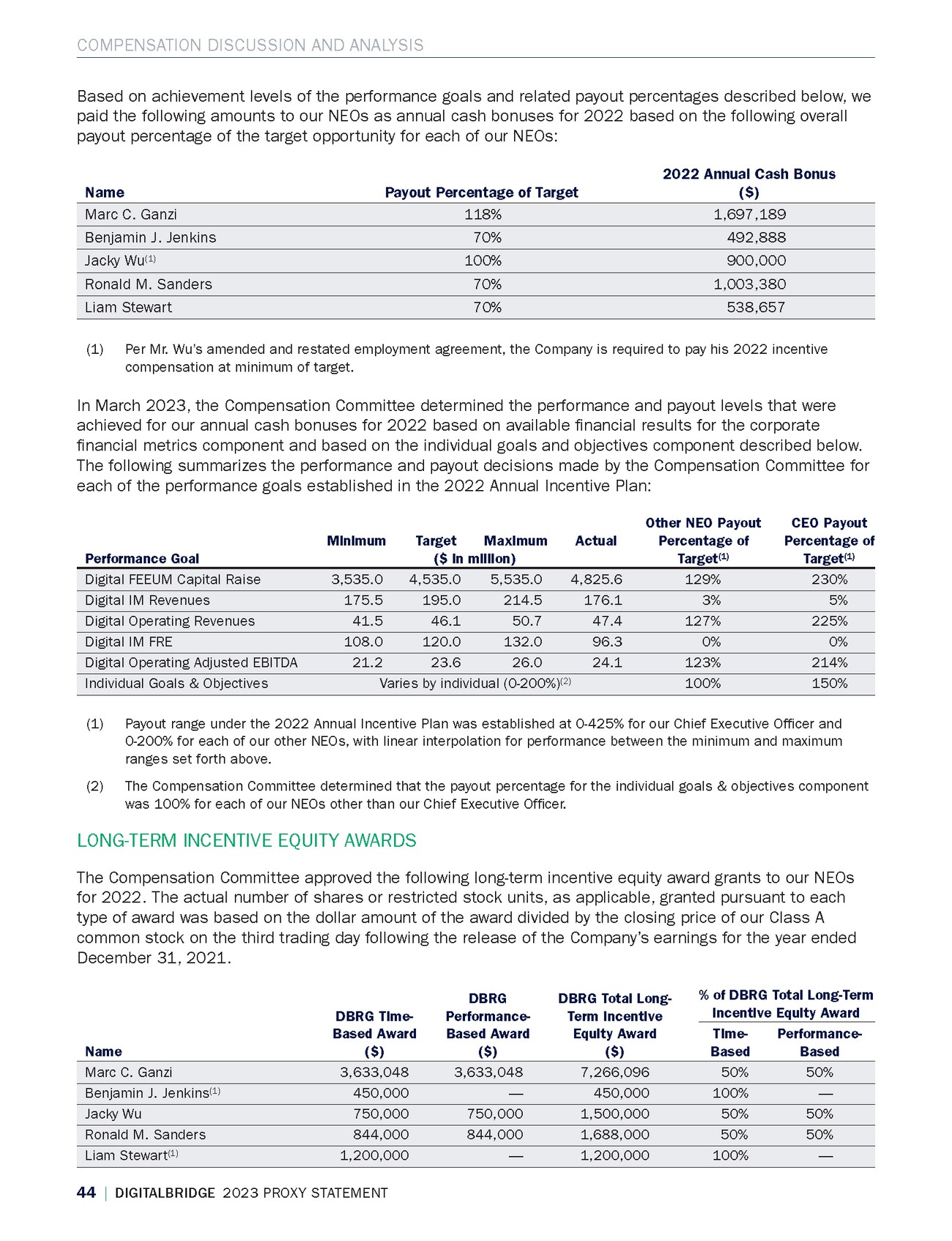

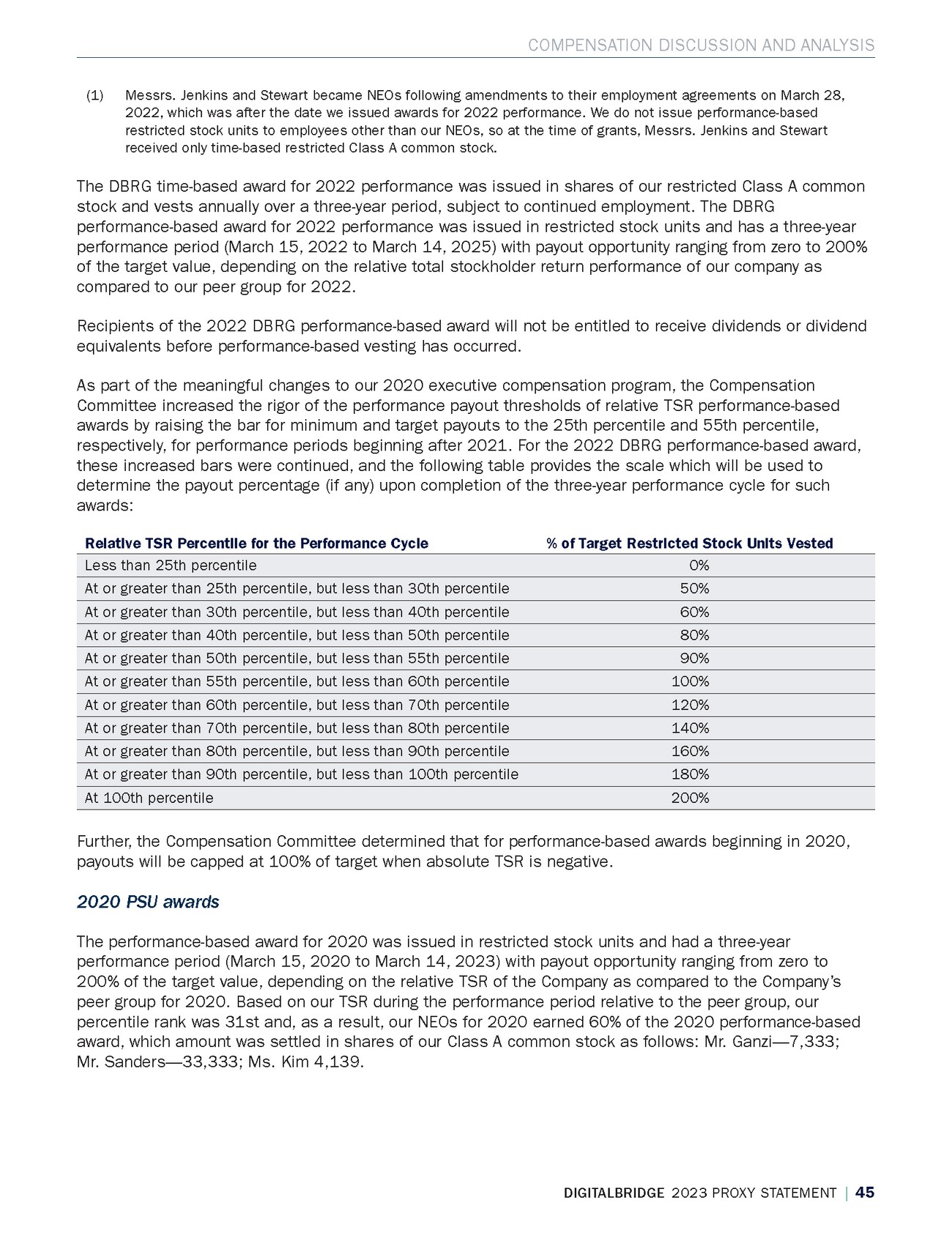

| COMPENSATION DISCUSSION AND ANALYSIS In addition, the |

|

| COMPENSATION DISCUSSION AND ANALYSIS |

|

| COMPENSATION DISCUSSION AND ANALYSIS (1) |

|

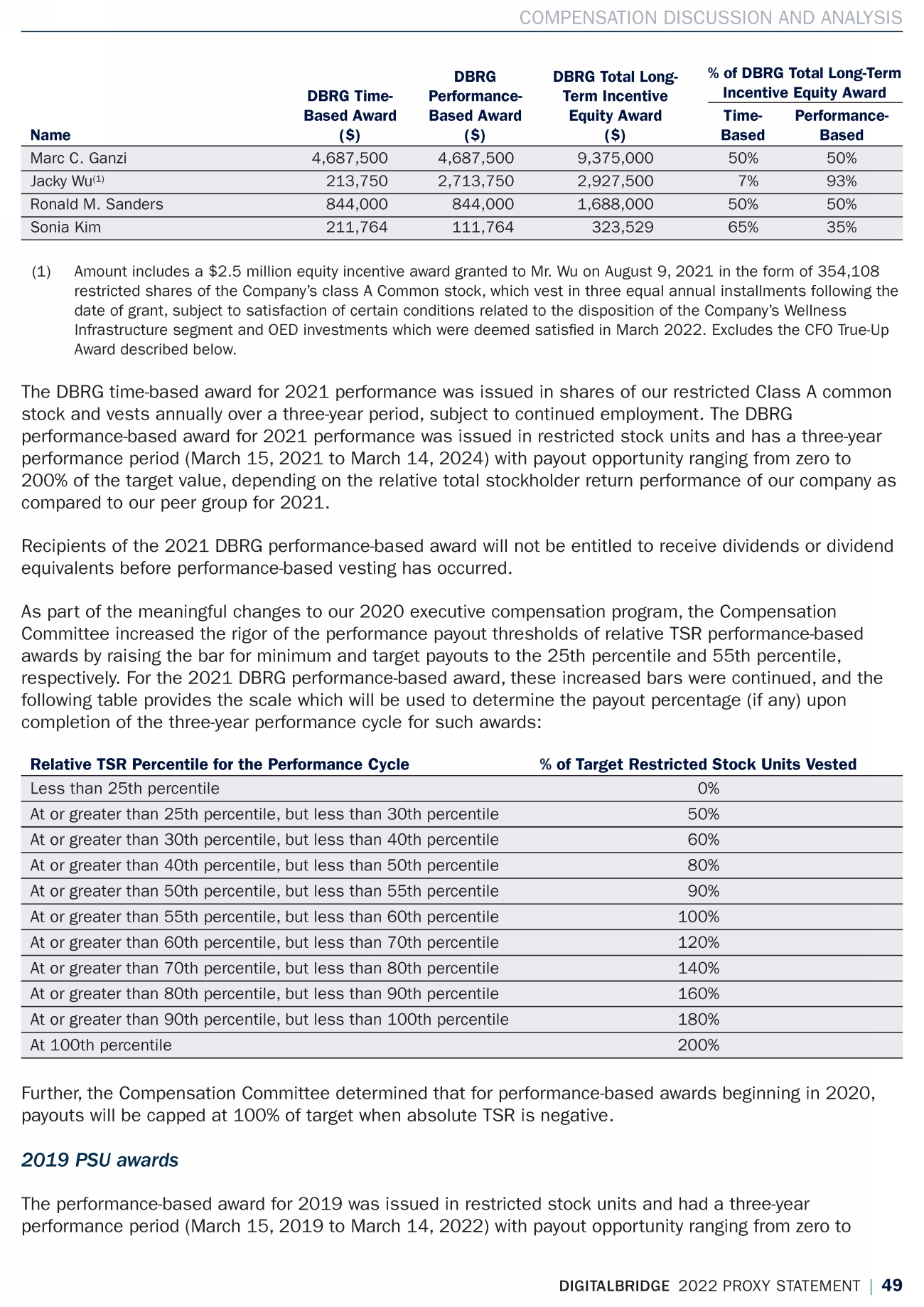

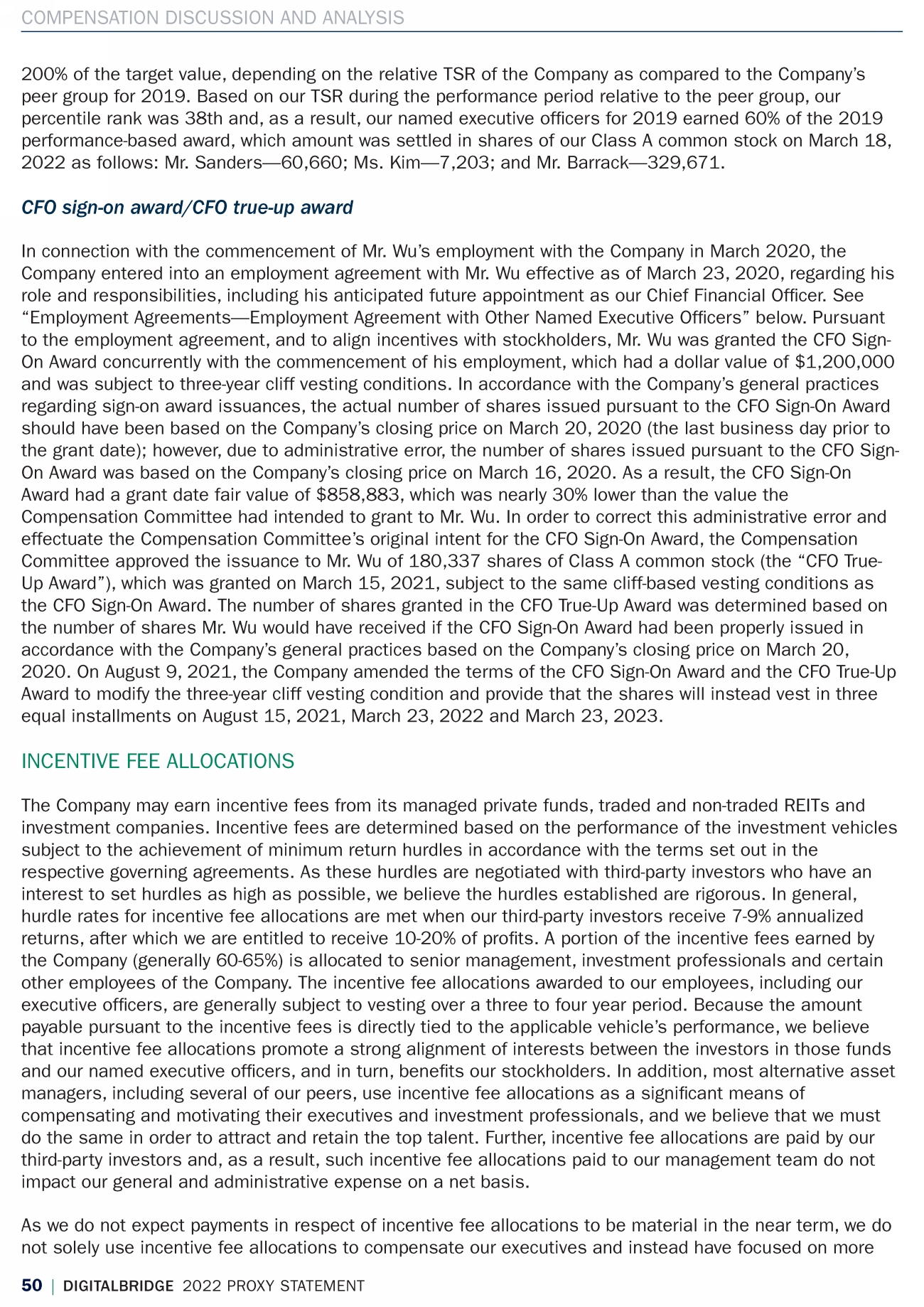

| COMPENSATION DISCUSSION AND ANALYSIS 46 | DIGITALBRIDGE 2023 PROXY STATEMENT INCENTIVE FEE ALLOCATIONS The Company may earn incentive fees from its managed private funds |

|

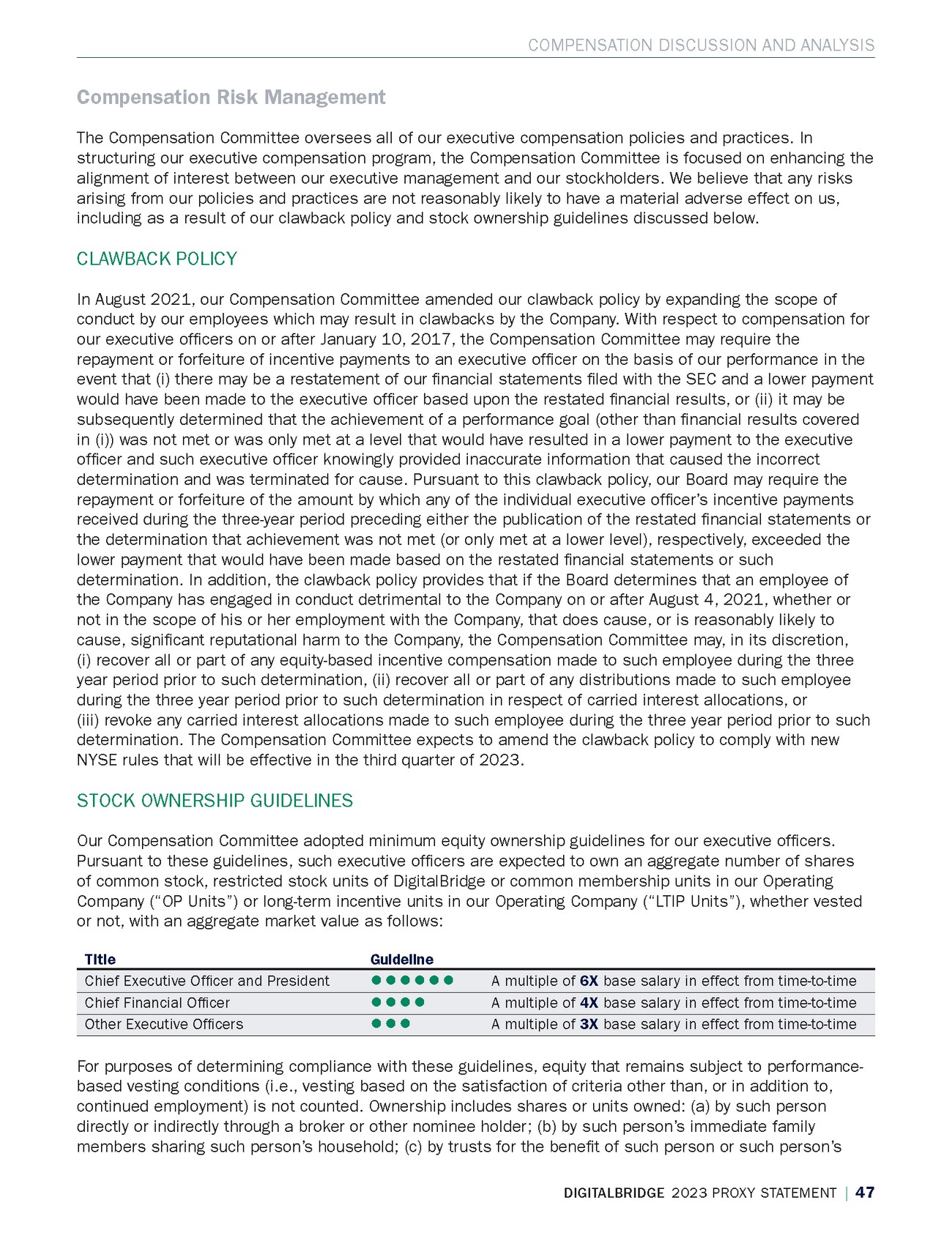

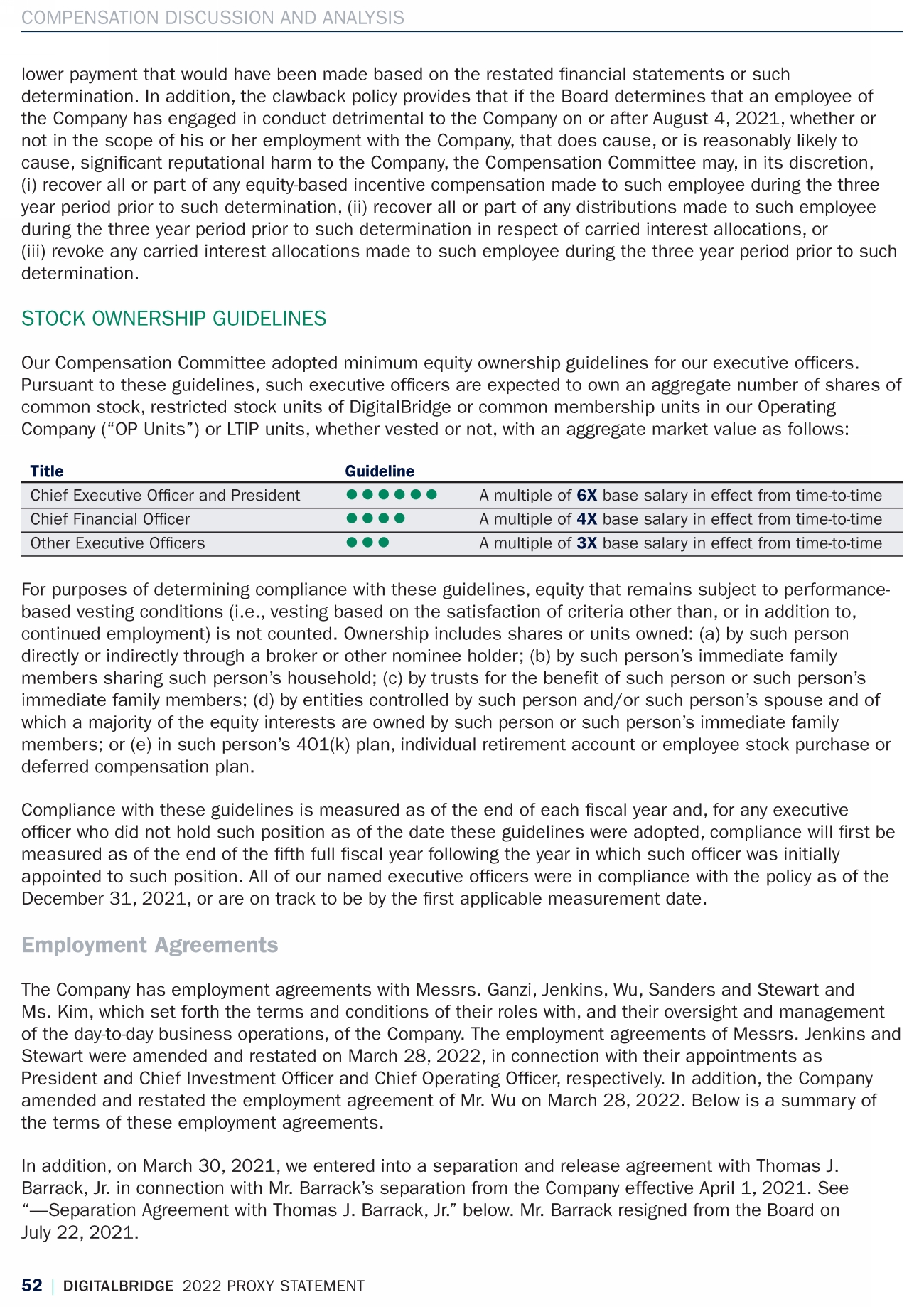

| COMPENSATION DISCUSSION AND ANALYSIS Compensation Risk Management The Compensation Committee oversees all of our executive compensation policies and practices. In structuring our executive compensation program, the Compensation Committee is focused on enhancing the alignment of interest between our executive management and our stockholders. We believe that any risks arising from our policies and practices are not reasonably likely to have a material adverse effect on us, including as a result of our clawback policy and stock ownership guidelines discussed below. CLAWBACK POLICY In August 2021, our Compensation Committee amended our clawback policy by expanding the scope of conduct by our employees which may result in clawbacks by the Company. With respect to compensation for our executive |

|

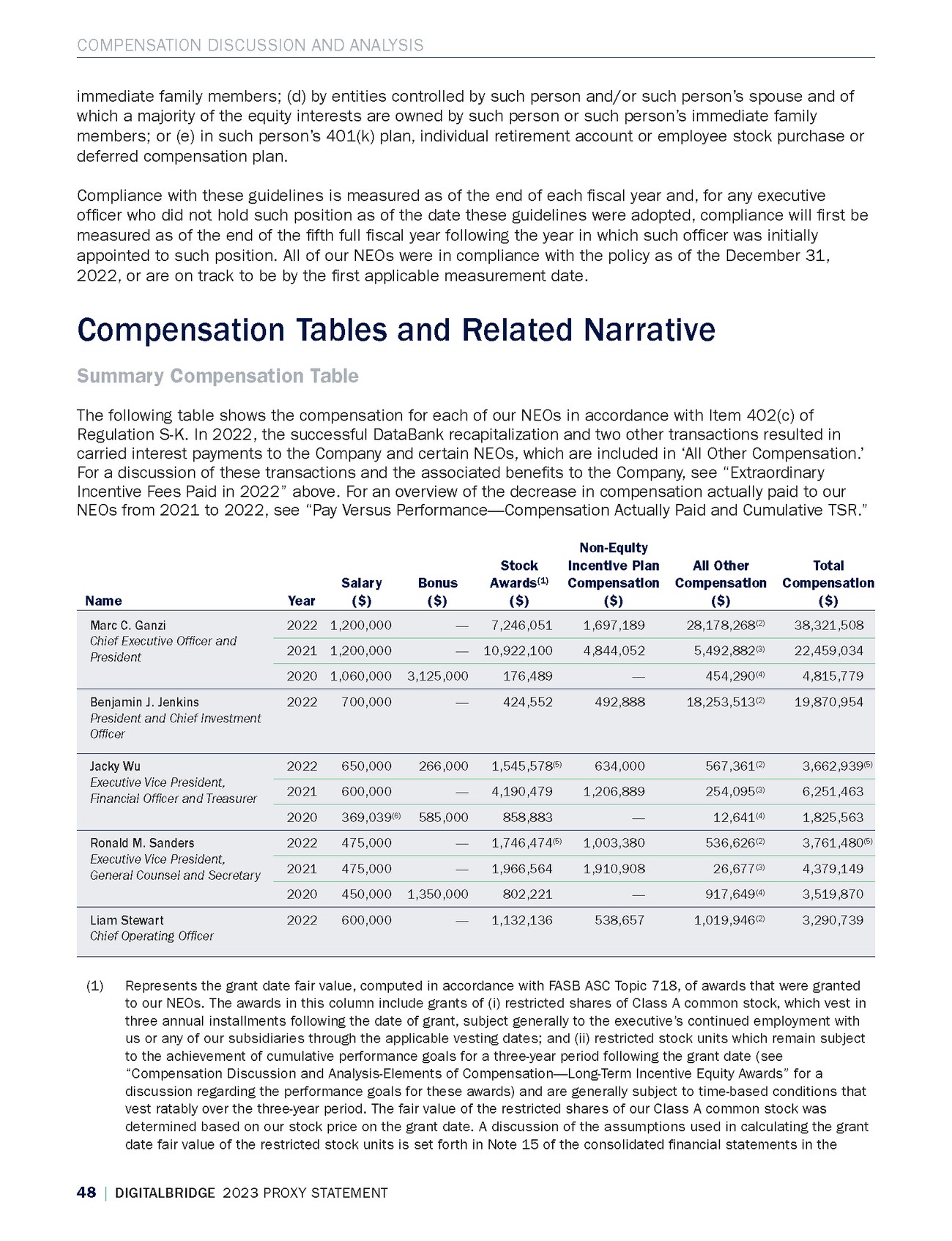

| COMPENSATION DISCUSSION AND ANALYSIS 48 | DIGITALBRIDGE 2023 PROXY STATEMENT immediate family members; (d) by entities controlled by such person and/or such person’s spouse and of which a majority of the equity interests are owned by such person or such person’s immediate family members; or (e) in such person’s 401(k) plan, individual retirement account or employee stock purchase or deferred compensation plan. Compliance with these guidelines is measured as of the end of each |

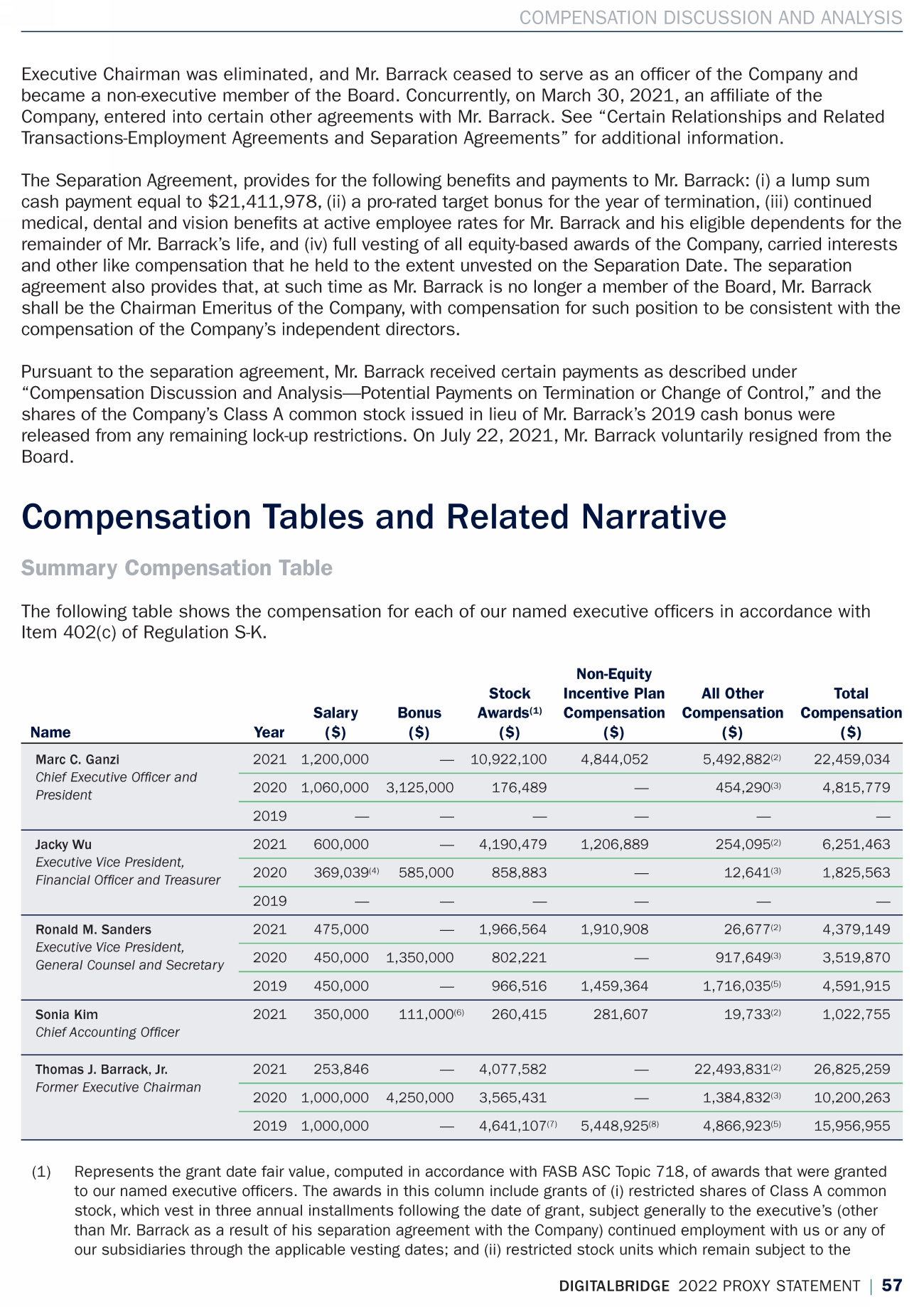

| COMPENSATION DISCUSSION AND ANALYSIS Company’s Annual Report on Form 10-K for the fscal year ended December 31, 2022. As required by SEC rules, the amounts shown in the Summary Compensation Table for the restricted stock units that are subject to performance conditions are based upon the probable outcome on the grant date, which is consistent with the estimate of aggregate compensation cost to be recognized over the service period determined as of the grant date under FASB ASC Topic 718, excluding the effect of estimated forfeitures. If we assumed achievement of the highest level of the performance goals and vesting for the restricted stock units would be achieved at the grant date, the value of the awards at the grant date would have been as follows: (A) For 2020: Marc C. Ganzi—$160,356 and Ronald M. Sanders—$728,888. (B) For 2021: Marc C. Ganzi—$11,483,984; Jacky Wu—$523,677; and Ronald M. Sanders—$2,067,733. (C) For 2022: Marc C. Ganzi—$7,636,916; Jacky Wu—$1,576,548; and Ronald M. Sanders—$1,774,149. See “Compensation Discussion and Analysis-Elements of Compensation—Long-Term Incentive Awards.” (2) Represents (i) $20,233,254, $13,201,020, $230,539, $402,697 and $554,806 paid to Messrs. Ganzi, Jenkins, Wu, Sanders and Stewart, respectively, in respect of incentive fee allocations (see “Extraordinary Incentive Fees Paid in 2022” above), (ii) $712,251 in reimbursements to Mr. Ganzi for private air travel, (iii) $5,480,739, $3,865,808, $63,670, $33,957 and $106,116 received by Messrs. Ganzi, Jenkins, Wu, Sanders and Stewart, respectively, pursuant to the allocation of 50% of the contingent consideration received from Wafra as additional bonus compensation to management to be paid on behalf of certain employees to fund a portion of their share of capital contributions to the DigitalBridge funds, as approved by the Compensation Committee, (iv) $1,707,721, $1,174,058, $213,465 and $213,465 paid to Messrs. Ganzi, Jenkins, Wu and Stewart, respectively, in respect of the MIP, (v) $103,057 and $36,388 in relocation expenses paid to Mr. Wu and Mr. Stewart, respectively, (vi) $2,576, $217, $1,576, $34,070 and $775 in cash dividends on unvested stock paid to Messrs. Ganzi, Jenkins, Wu, Sanders and Stewart, respectively, and (vii) matching contributions in connection with the Company’s 401(k) plan, the standard Company-paid portion of premiums toward the cost of health coverage under our group health insurance plan and premiums toward the cost of our standard life insurance coverage. See “Certain Relationships and Related Transactions—MIP” for a discussion of the MIP, which was terminated by the Board on March 27, 2023. Amounts with respect to incentive fee allocations (which could be used to fund potential future clawback obligations if any were to arise) and the MIP include amounts retained and allocated for distribution to the respective NEO, but not yet distributed to the NEO as of December 31, 2022. (3) Represents (i) for Mr. Ganzi, $1,114,839 in respect of incentive fee allocations, $937,992 in connection with services provided to a DBH portfolio company during 2020, $1,532,933 received pursuant to the allocation of 50% of the contingent consideration received from Wafra as additional bonus compensation to management to be paid on behalf of certain employees to fund a portion of their share of capital contributions to the DigitalBridge funds, as approved by the Compensation Committee, and $491,379 in reimbursements for private air travel, (ii) $1,390,000 and $173,750 paid to Messrs. Ganzi and Wu, respectively, in respect of the MIP, (iii) $68,353 in relocation expenses paid to Mr. Wu, and (iv) matching contributions in connection with the Company’s 401(k) plan, the standard Company-paid portion of premiums toward the cost of health coverage under our group health insurance plan, premiums toward the cost of our standard life insurance coverage. See “Certain Relationships and Related Transactions—MIP” for a discussion of the MIP, which was terminated by the Board on March 27, 2023. Amounts with respect to incentive fee allocations (which could be used to fund potential future clawback obligations if any were to arise) and the MIP include amounts retained and allocated for distribution to the respective NEO, but not yet distributed to the NEO as of December 31, 2022. (4) Represents (i) $885,009 paid to Mr. Sanders in respect of incentive fee allocations, (ii) for Mr. Ganzi, $430,448 in connection with services provided to a DBH portfolio company during 2019, and (iii) matching contributions in connection with the Company’s 401(k) plan, the standard Company-paid portion of premiums toward the cost of health coverage under our group health insurance plan and premiums toward the cost of our standard life insurance coverage. Amounts with respect to incentive fee allocations (which could be used to fund potential future clawback obligations if any were to arise) include amounts retained and allocated for distribution to the respective NEO, but not yet distributed to the NEO as of December 31, 2022. (5) Includes incremental value resulting from the modifcation of certain equity awards outstanding as of December 9, 2022, in the case of Mr. Sanders, and September 27, 2022, in the case of Mr. Wu, in connection with amendments to their respective employment agreements. See “Employment Agreements” below. (6) Represents the pro rata portion of Mr. Wu’s annual base salary based on the commencement of his employment with the Company on March 23, 2020. DIGITALBRIDGE 2023 PROXY STATEMENT | 49 Toppan Merrill - DigitalBridge [fka Colony Capital_ Inc.] PRE 14A [iXBRL Proxy] ED [AUX] | ltolend | 28-Mar-23 09:40 | 23-2053-3.ea | Sequence: 17 CHKSUM Content: 55102 Layout: 13530 Graphics: 0 CLEAN JOB: 23-2053-3 CYCLE#;BL#: 9; 0 TRIM: 8.25" x 10.75" AS: New York: 212-620-5600 COLORS: DB dark green, ~note-color 2, DB med blue, DB dark blue, Black, DB med gray GRAPHICS: none V1.5 |

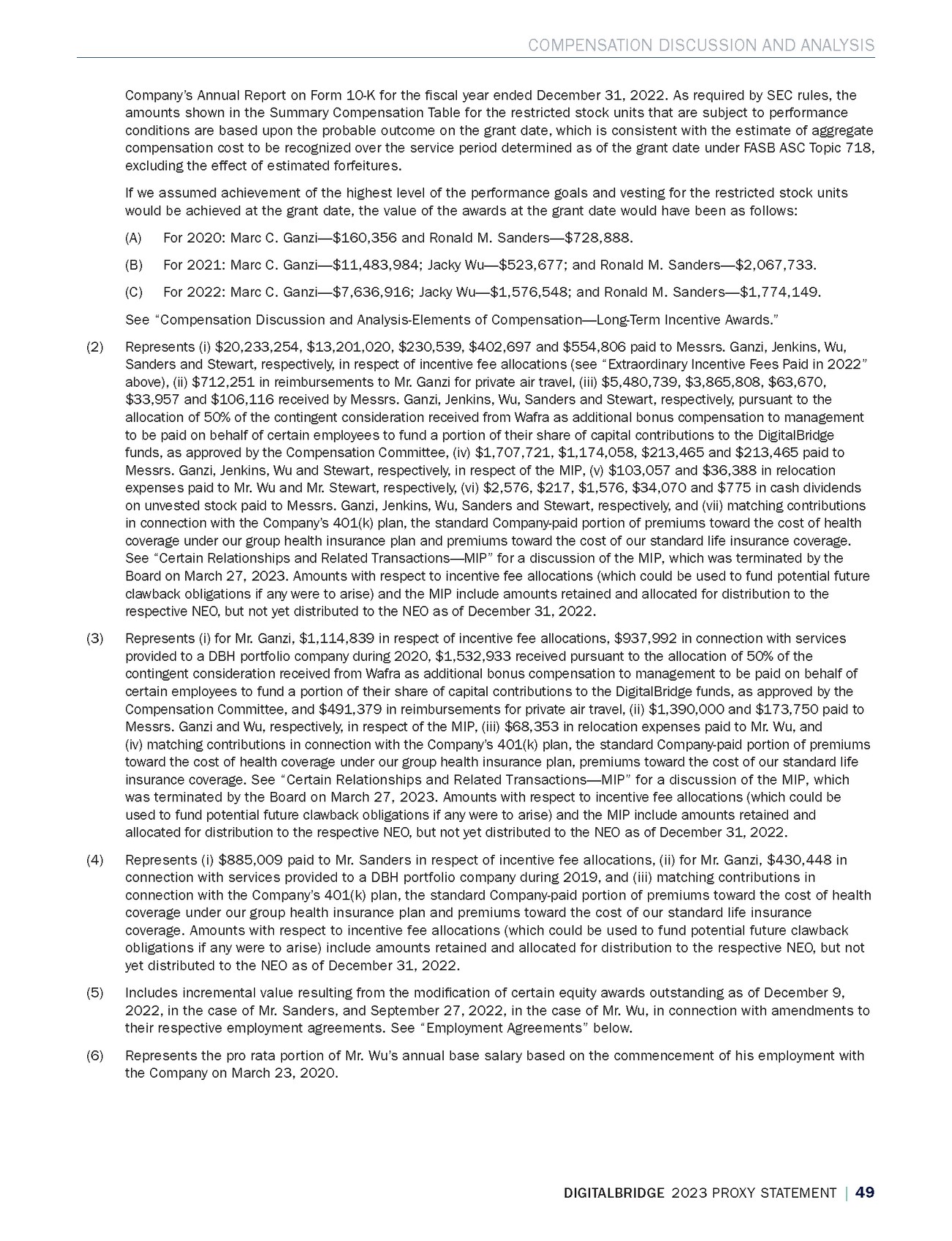

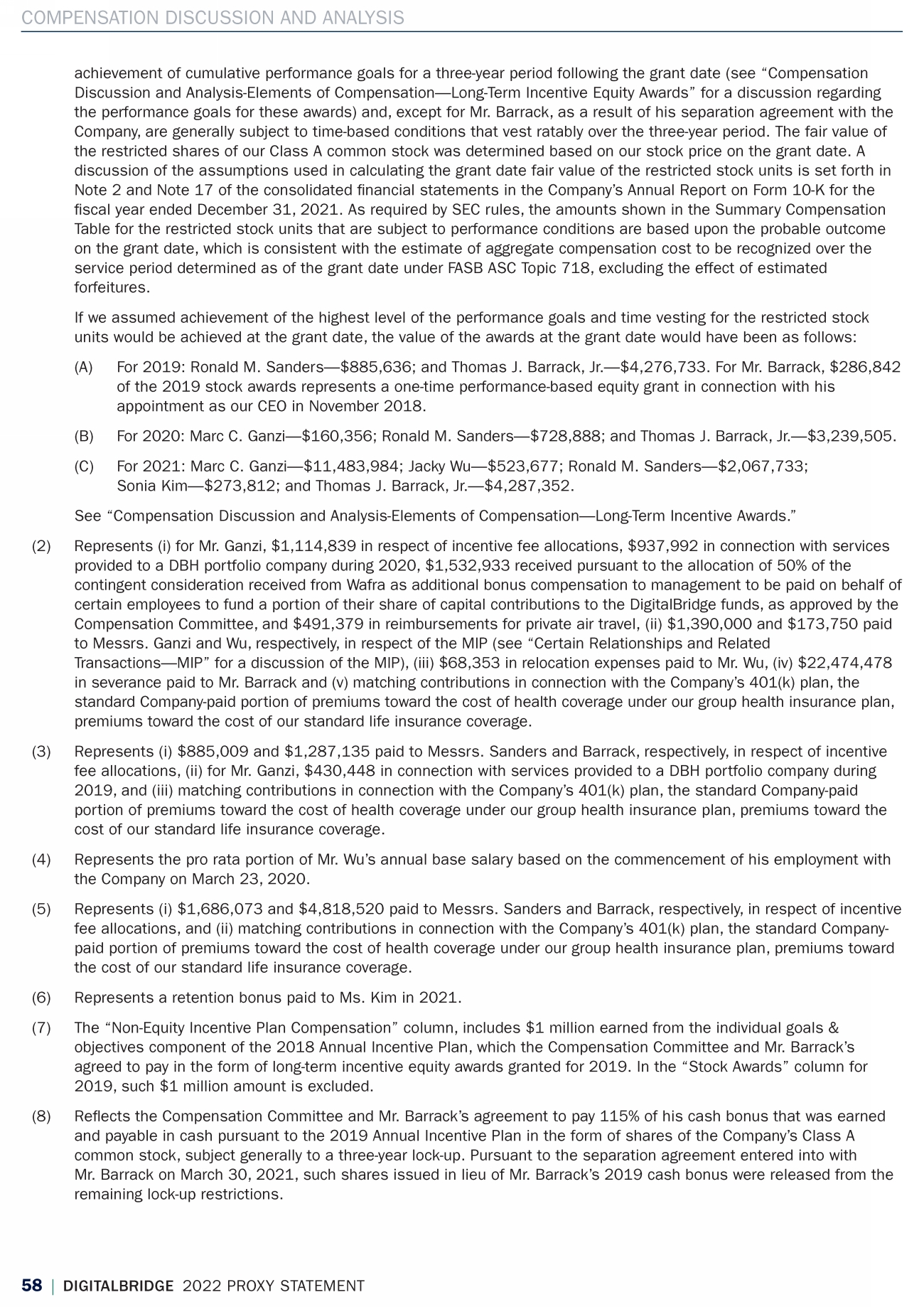

| COMPENSATION DISCUSSION AND ANALYSIS 50 | DIGITALBRIDGE 2023 PROXY STATEMENT 2022 Grants of Plan-Based Awards Table The following table provides information about awards granted in 2022 to each of our NEOs. There were no option awards in 2022. Estimated Possible Payouts Estimated Possible Payouts All Other Stock Under Non-Equity Incentive Under Equity Incentive Awards: Number Plan Awards Plan Awards of Shares of Grant Date Approval Grant Threshold Target(1) Maximum Threshold Target(2) Maximum(2) Stock or Units(3) Fair Value Name Date Date ($) ($) ($) (#) (#) (#) (#) ($) 2/15/2022 3/15/2022 — — — — — — 125,278 3,427,606 2/15/2022 3/15/2022 — — — 62,639 125,278 250,556 — 3,818,473 3/25/2022 3/25/2022 — 1,440,000 6,120,000 — — — — — 2/15/2022 3/15/2022 — — — — — — 15,517 424,545 3/25/2022 3/25/2022 — 700,000 1,400,000 — — — — — 2/15/2022 3/15/2022 — — — — — — 25,862 707,584 2/15/2022 3/15/2022 — — — 12,931 25,862 51,724 — 788,274 3/25/2022 3/25/2022 — 900,000 1,800,000 — — — — — 2/15/2022 3/15/2022 — — — — — — 29,104 796,285 2/15/2022 3/15/2022 — — — 14,552 29,104 58,208 — 887,090 3/25/2022 3/25/2022 — 1,425,000 2,850,000 — — — — — 2/15/2022 3/15/2022 — — — — — — 41,379 1,132,129 3/25/2022 3/25/2022 — 765,000 1,530,000 — — — — — (1) Represents the target cash bonuses approved by the Compensation Committee on March 25, 2022 under the 2022 Annual Incentive Plan for our NEOs. For information about the cash bonus amounts actually earned by each of our NEOs, please refer to the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table above. Amounts are considered earned in fscal year 2022, although they were not paid until 2023. For additional information about the 2022 Annual Incentive Plan, see “Compensation Discussion and Analysis-Elements of Compensation-Annual Cash Bonus.” (2) Represents awards of restricted stock units, which are subject to vesting based on the achievement of performance goals for the three-year period ending March 15, 2025 and, other than for Messrs. Wu and Sanders as a result of their employment agreements with the Company, are generally subject to continued employment through such date. Dividends (if any) are accrued with respect to these equity awards, and are paid only if and when the restricted stock units are earned. For additional information about the 2022 performance-based awards, see “Compensation Discussion and Analysis-Elements of Compensation-Long-Term Incentive Equity Awards.” Other than with respect to Messrs. Jenkins and Stewart, represents 50% of the long-term equity incentive award for 2022 granted by the Company to our NEOs. (3) Represents awards of restricted shares of our Class A common stock, which are subject to time-based vesting in three equal installments beginning on March 15, 2022 and, other than for Messrs. Wu and Sanders as a result of their employment agreements with the Company, are generally subject to continued employment. Dividends (if any) are paid currently with respect to these equity awards prior to vesting, including all dividends with a record date on or after March 15, 2022. Other than with respect to Messrs. Jenkins and Stewart, represents 50% of the long-term equity incentive award for 2022 granted by the Company to our NEOs. Marc C. Ganzi Benjamin J. Jenkins Jacky Wu Ronald M. Sanders Liam Stewart Toppan Merrill - DigitalBridge [fka Colony Capital_ Inc.] PRE 14A [iXBRL Proxy] ED [AUX] | ltolend | 28-Mar-23 09:40 | 23-2053-3.ea | Sequence: 18 CHKSUM Content: 43825 Layout: 14747 Graphics: 0 CLEAN JOB: 23-2053-3 CYCLE#;BL#: 9; 0 TRIM: 8.25" x 10.75" AS: New York: 212-620-5600 COLORS: DB dark green, DB lgt green, ~note-color 2, DB med blue, DB dark blue, Black, DB med gray GRAPHICS: none V1.5 |

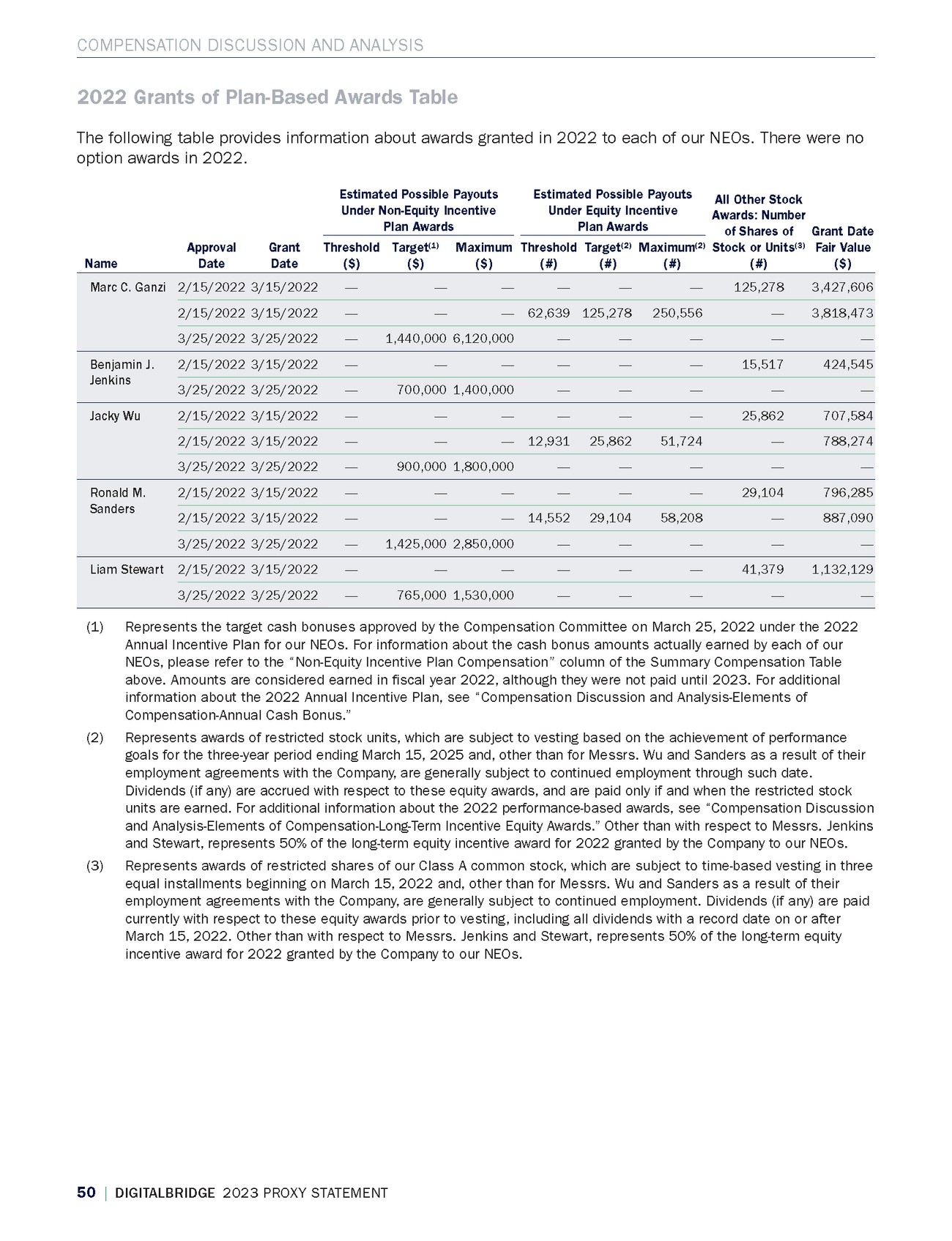

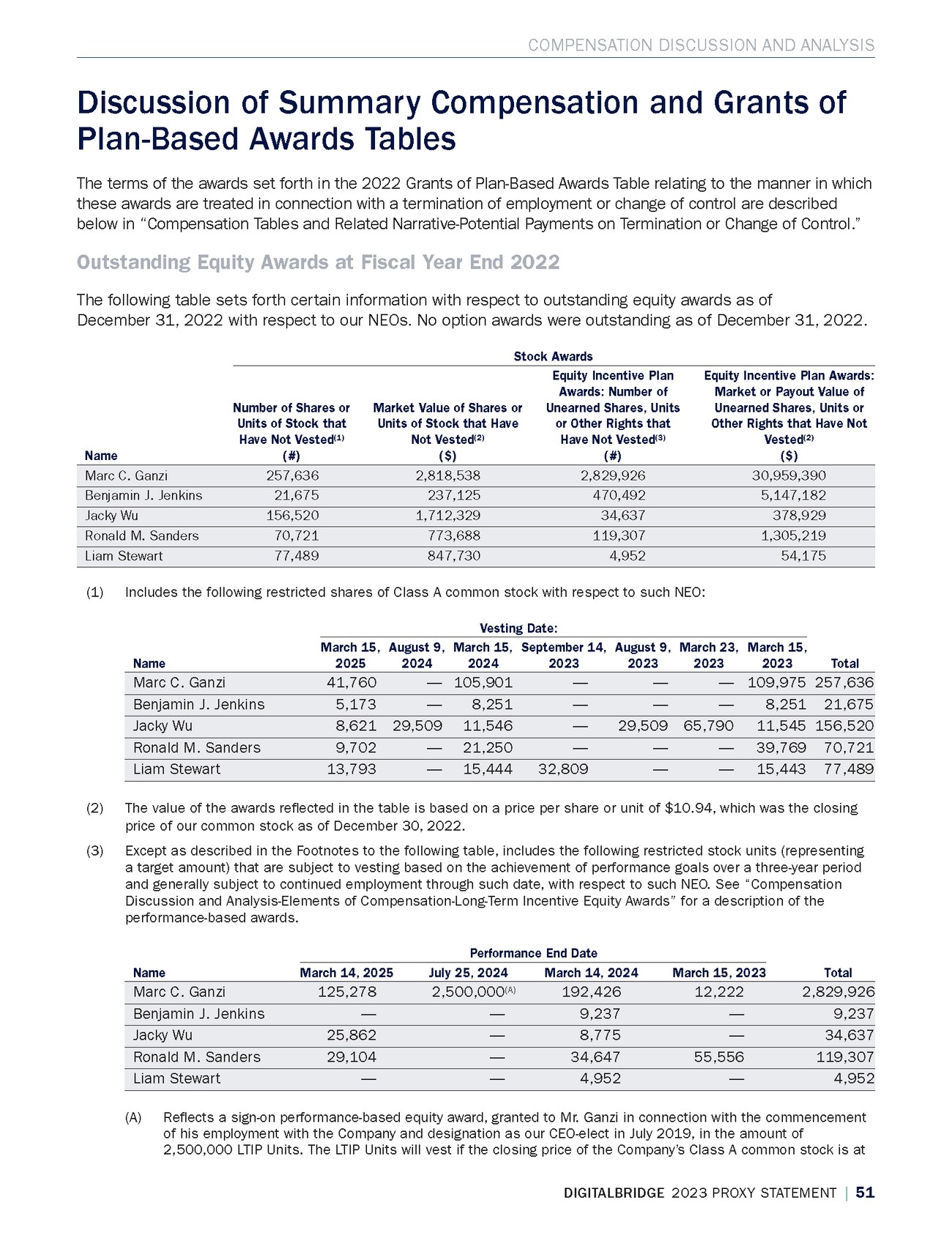

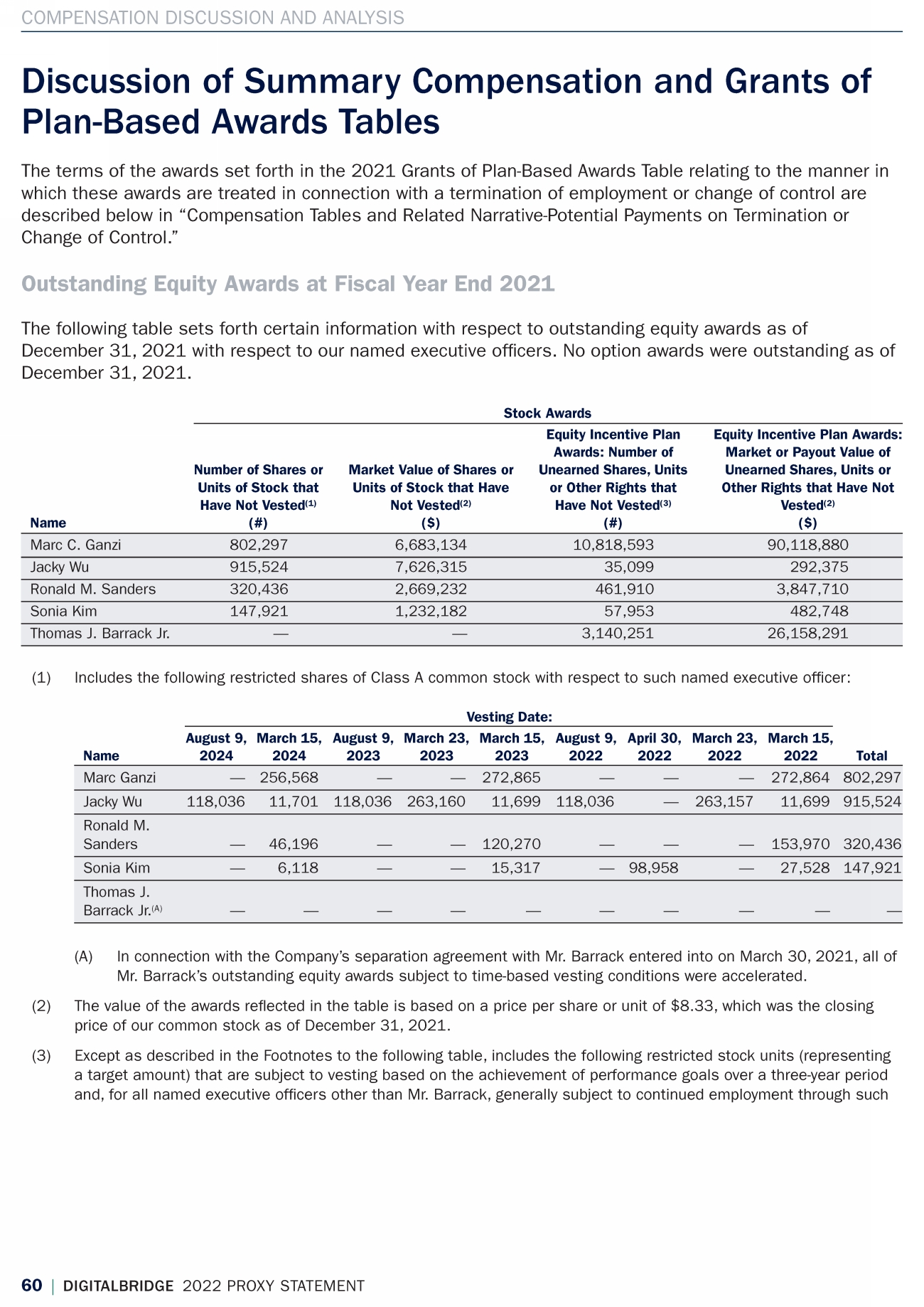

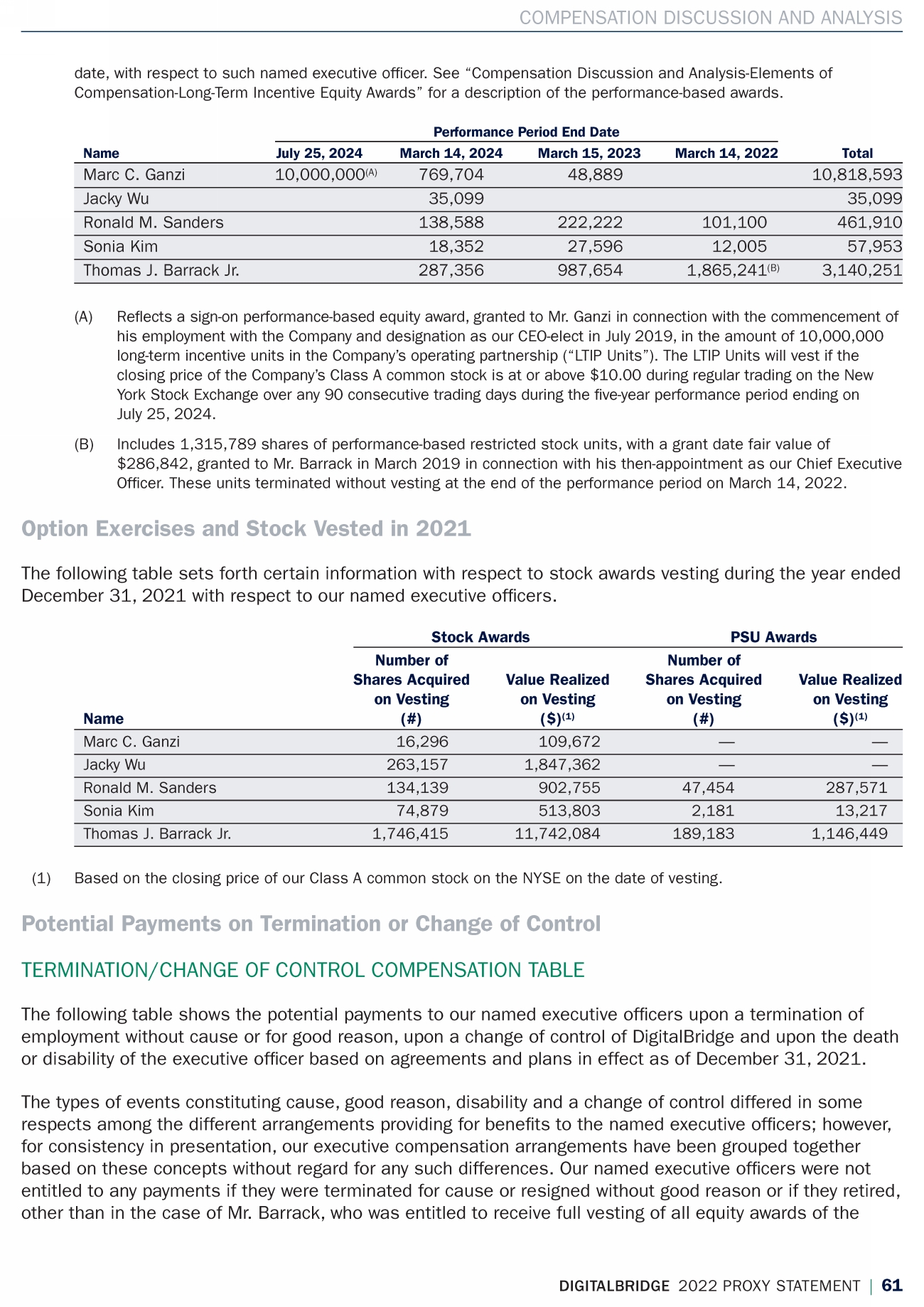

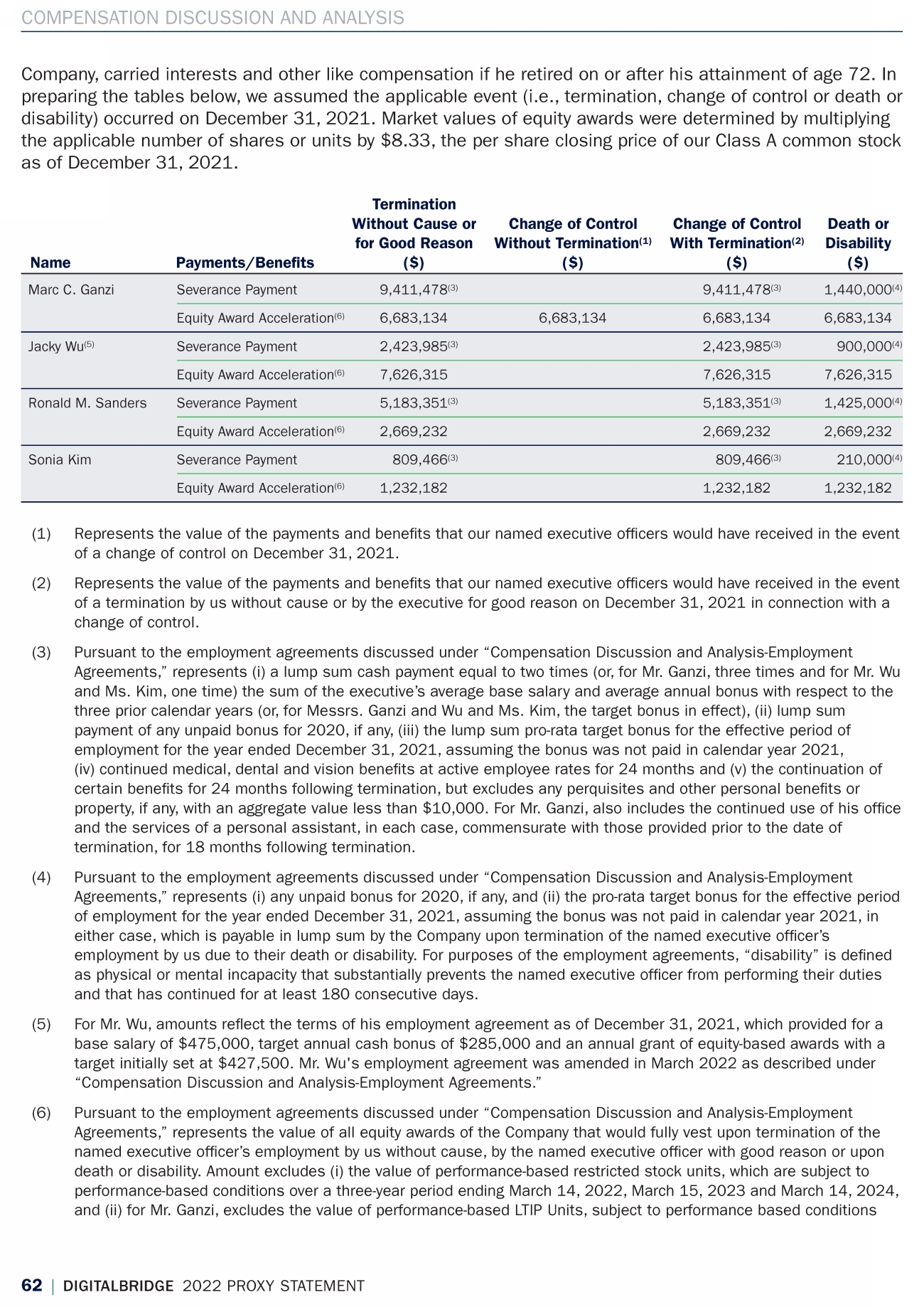

| COMPENSATION DISCUSSION AND ANALYSIS Discussion of Summary Compensation and Grants of Plan-Based Awards Tables The terms of the awards set forth in the 2022 Grants of Plan-Based Awards Table relating to the manner in which these awards are treated in connection with a termination of employment or change of control are described below in “Compensation Tables and Related Narrative-Potential Payments on Termination or Change of Control.” Outstanding Equity Awards at Fiscal Year End 2022 The following table sets forth certain information with respect to outstanding equity awards as of December 31, 2022 with respect to our NEOs. No option awards were outstanding as of December 31, 2022. Stock Awards Equity Incentive Plan Equity Incentive Plan Awards: Awards: Number of Market or Payout Value of Number of Shares or Market Value of Shares or Unearned Shares, Units Unearned Shares, Units or Units of Stock that Units of Stock that Have or Other Rights that Other Rights that Have Not Have Not Vested(1) Not Vested(2) Have Not Vested(3) Vested(2) Name (#) ($) (#) ($) Marc C. Ganzi 257,636 2,818,538 2,829,926 30,959,390 Benjamin J. Jenkins 21,675 237,125 470,492 5,147,182 Jacky Wu 156,520 1,712,329 34,637 378,929 Ronald M. Sanders 70,721 773,688 119,307 1,305,219 Liam Stewart 77,489 847,730 4,952 54,175 (1) Includes the following restricted shares of Class A common stock with respect to such NEO: Vesting Date: March 15, August 9, March 15, September 14, August 9, March 23, March 15, Name 2025 2024 2024 2023 2023 2023 2023 Total Marc C. Ganzi 41,760 — 105,901 — — — 109,975 257,636 Benjamin J. Jenkins 5,173 — 8,251 — — — 8,251 21,675 Jacky Wu 8,621 29,509 11,546 — 29,509 65,790 11,545 156,520 Ronald M. Sanders 9,702 — 21,250 — — — 39,769 70,721 Liam Stewart 13,793 — 15,444 32,809 — — 15,443 77,489 (2) The value of the awards refected in the table is based on a price per share or unit of $10.94, which was the closing price of our common stock as of December 30, 2022. (3) Except as described in the Footnotes to the following table, includes the following restricted stock units (representing a target amount) that are subject to vesting based on the achievement of performance goals over a three-year period and generally subject to continued employment through such date, with respect to such NEO. See “Compensation Discussion and Analysis-Elements of Compensation-Long-Term Incentive Equity Awards” for a description of the performance-based awards. Performance End Date Name March 14, 2025 July 25, 2024 March 14, 2024 March 15, 2023 Total Marc C. Ganzi 125,278 2,500,000(A) 192,426 12,222 2,829,926 Benjamin J. Jenkins — — 9,237 — 9,237 Jacky Wu 25,862 — 8,775 — 34,637 Ronald M. Sanders 29,104 — 34,647 55,556 119,307 Liam Stewart — — 4,952 — 4,952 (A) Refects a sign-on performance-based equity award, granted to Mr. Ganzi in connection with the commencement of his employment with the Company and designation as our CEO-elect in July 2019, in the amount of 2,500,000 LTIP Units. The LTIP Units will vest if the closing price of the Company’s Class A common stock is at DIGITALBRIDGE 2023 PROXY STATEMENT | 51 Toppan Merrill - DigitalBridge [fka Colony Capital_ Inc.] PRE 14A [iXBRL Proxy] ED [AUX] | ltolend | 28-Mar-23 09:40 | 23-2053-3.ea | Sequence: 19 CHKSUM Content: 35239 Layout: 14478 Graphics: 0 CLEAN JOB: 23-2053-3 CYCLE#;BL#: 9; 0 TRIM: 8.25" x 10.75" AS: New York: 212-620-5600 COLORS: DB dark green, ~note-color 2, DB med blue, DB dark blue, Black, DB med gray GRAPHICS: none V1.5 |

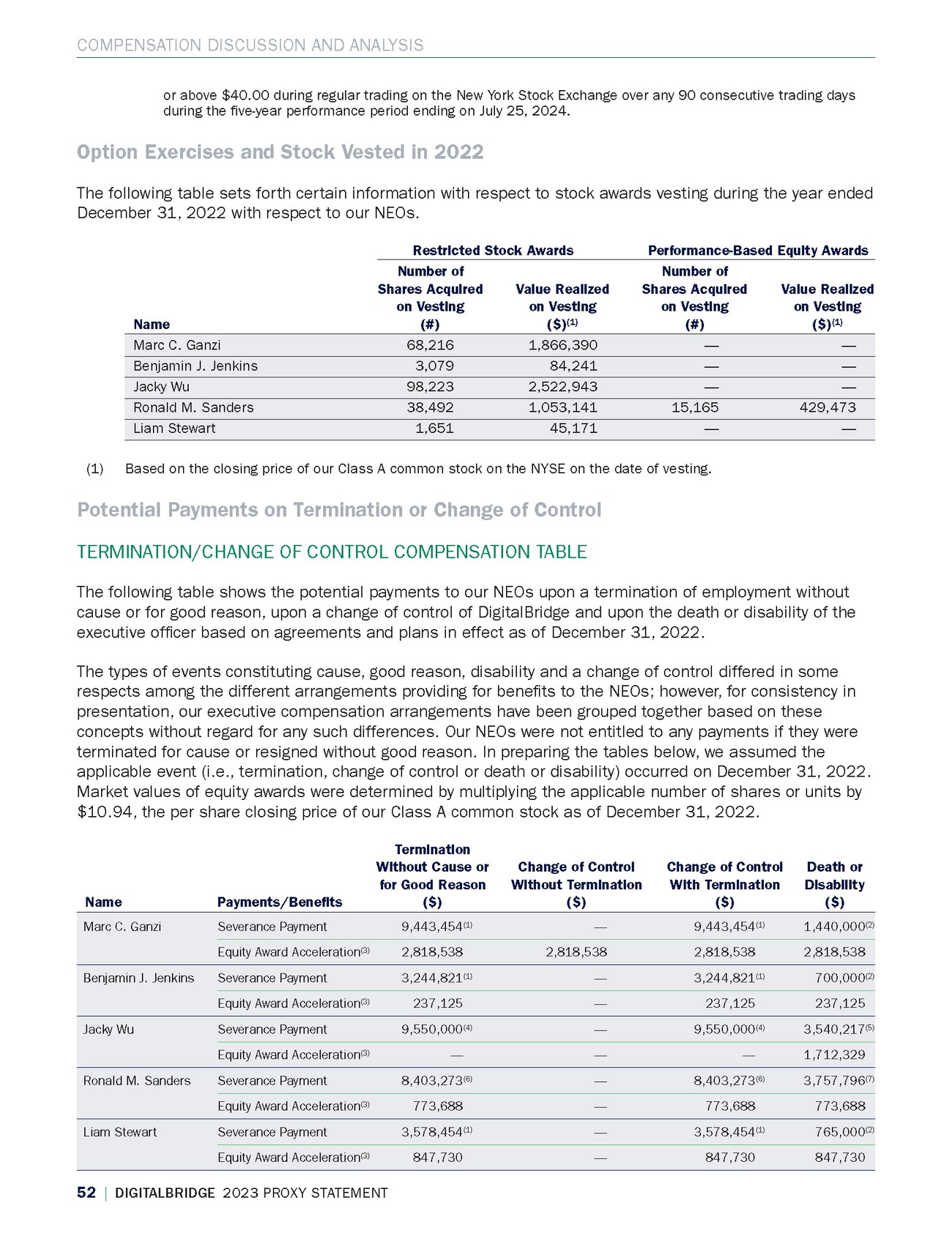

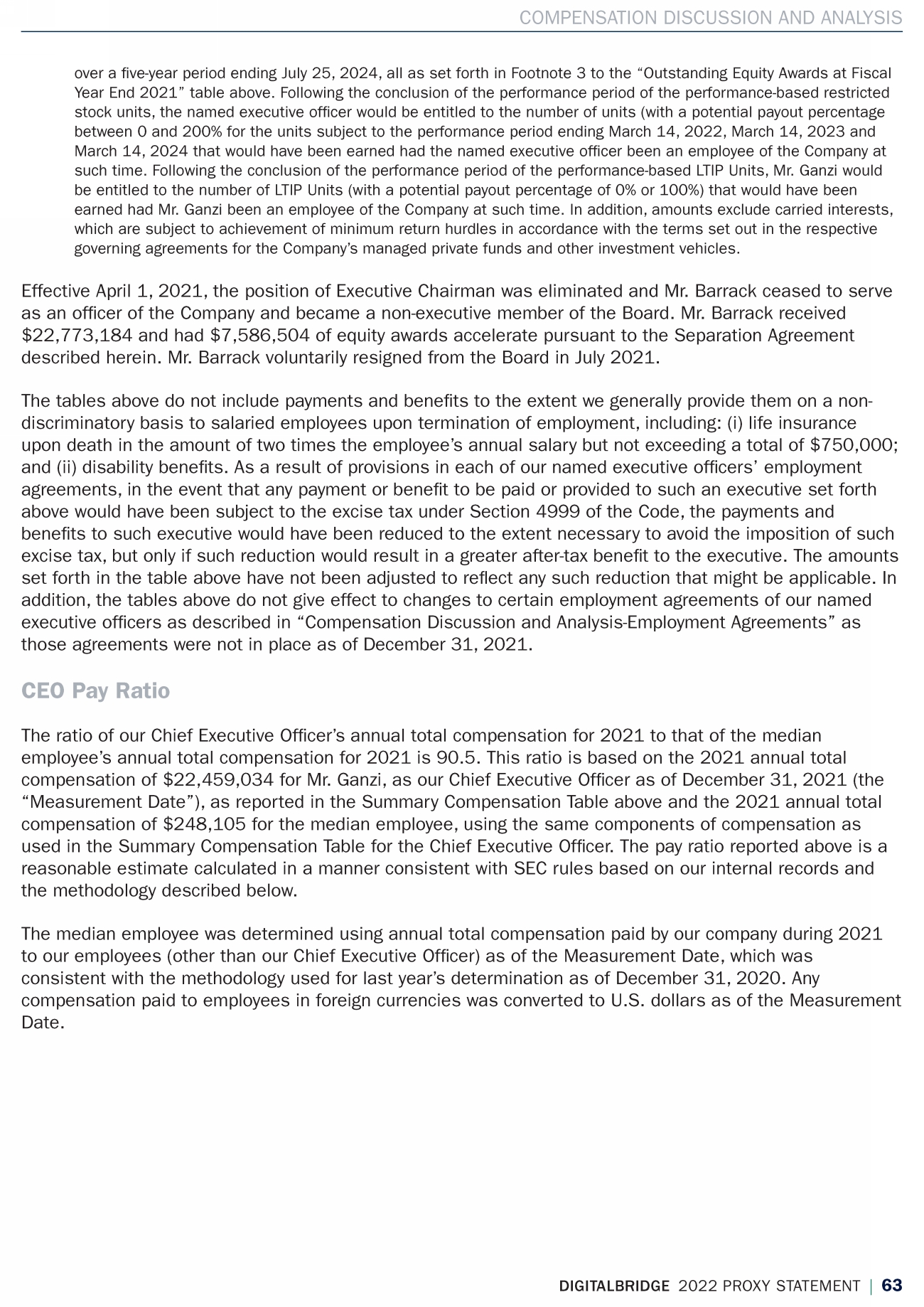

| COMPENSATION DISCUSSION AND ANALYSIS 52 | DIGITALBRIDGE 2023 PROXY STATEMENT or above $40.00 during regular trading on the New York Stock Exchange over any 90 consecutive trading days during the fve-year performance period ending on July 25, 2024. Option Exercises and Stock Vested in 2022 The following table sets forth certain information with respect to stock awards vesting during the year ended December 31, 2022 with respect to our NEOs. Restricted Stock Awards Performance-Based Equity Awards Number of Number of Shares Acquired Value Realized Shares Acquired Value Realized on Vesting on Vesting on Vesting on Vesting Name (#) ($)(1) (#) ($)(1) Marc C. Ganzi 68,216 1,866,390 — — Benjamin J. Jenkins 3,079 84,241 — — Jacky Wu 98,223 2,522,943 — — Ronald M. Sanders 38,492 1,053,141 15,165 429,473 Liam Stewart 1,651 45,171 — — (1) Based on the closing price of our Class A common stock on the NYSE on the date of vesting. Potential Payments on Termination or Change of Control TERMINATION/CHANGE OF CONTROL COMPENSATION TABLE The following table shows the potential payments to our NEOs upon a termination of employment without cause or for good reason, upon a change of control of DigitalBridge and upon the death or disability of the executive offcer based on agreements and plans in effect as of December 31, 2022. The types of events constituting cause, good reason, disability and a change of control differed in some respects among the different arrangements providing for benefts to the NEOs; however, for consistency in presentation, our executive compensation arrangements have been grouped together based on these concepts without regard for any such differences. Our NEOs were not entitled to any payments if they were terminated for cause or resigned without good reason. In preparing the tables below, we assumed the applicable event (i.e., termination, change of control or death or disability) occurred on December 31, 2022. Market values of equity awards were determined by multiplying the applicable number of shares or units by $10.94, the per share closing price of our Class A common stock as of December 31, 2022. Termination Without Cause or Change of Control Change of Control Death or for Good Reason Without Termination With Termination Disability Name Payments/Benefts ($) ($) ($) ($) Marc C. Ganzi Severance Payment 9,443,454(1) — 9,443,454(1) 1,440,000(2) Equity Award Acceleration(3) 2,818,538 2,818,538 2,818,538 2,818,538 Benjamin J. Jenkins Severance Payment 3,244,821(1) — 3,244,821(1) 700,000(2) Equity Award Acceleration(3) 237,125 — 237,125 237,125 Jacky Wu Severance Payment 9,550,000(4) — 9,550,000(4) 3,540,217(5) Equity Award Acceleration(3) — — — 1,712,329 Ronald M. Sanders Severance Payment 8,403,273(6) — 8,403,273(6) 3,757,796(7) Equity Award Acceleration(3) 773,688 — 773,688 773,688 Liam Stewart Severance Payment 3,578,454(1) — 3,578,454(1) 765,000(2) Equity Award Acceleration(3) 847,730 — 847,730 847,730 Toppan Merrill - DigitalBridge [fka Colony Capital_ Inc.] PRE 14A [iXBRL Proxy] ED [AUX] | ltolend | 28-Mar-23 09:40 | 23-2053-3.ea | Sequence: 20 CHKSUM Content: 24044 Layout: 13711 Graphics: 0 CLEAN JOB: 23-2053-3 CYCLE#;BL#: 9; 0 TRIM: 8.25" x 10.75" AS: New York: 212-620-5600 COLORS: DB dark green, DB lgt green, ~note-color 2, DB med blue, DB dark blue, Black, DB med gray GRAPHICS: none V1.5 |

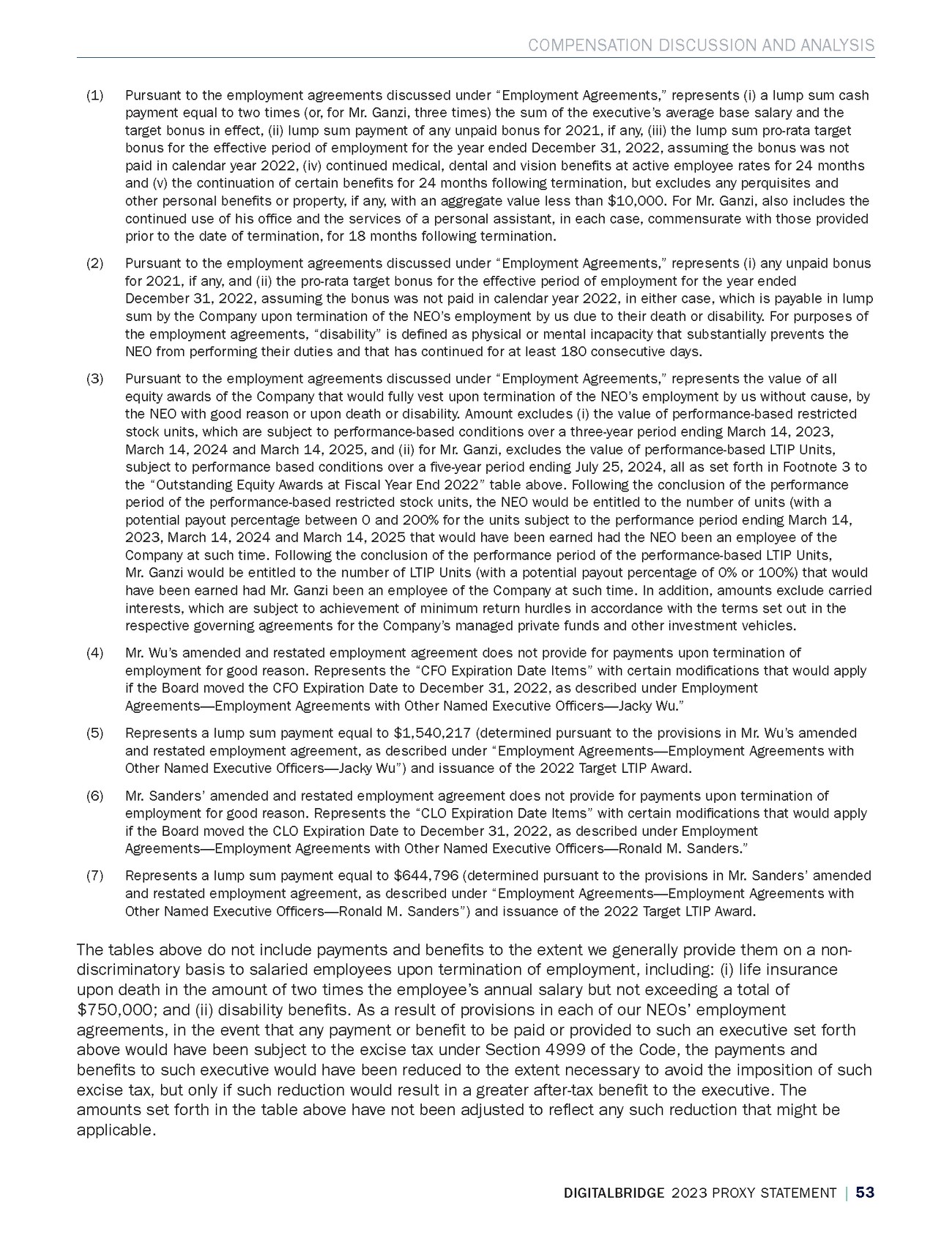

| COMPENSATION DISCUSSION AND ANALYSIS (1) Pursuant to the employment agreements discussed under “Employment Agreements,” represents (i) a lump sum cash payment equal to two times (or, for Mr. Ganzi, three times) the sum of the executive’s average base salary and the target bonus in effect, (ii) lump sum payment of any unpaid bonus for 2021, if any, (iii) the lump sum pro-rata target bonus for the effective period of employment for the year ended December 31, 2022, assuming the bonus was not paid in calendar year 2022, (iv) continued medical, dental and vision benefts at active employee rates for 24 months and (v) the continuation of certain benefts for 24 months following termination, but excludes any perquisites and other personal benefts or property, if any, with an aggregate value less than $10,000. For Mr. Ganzi, also includes the continued use of his offce and the services of a personal assistant, in each case, commensurate with those provided prior to the date of termination, for 18 months following termination. (2) Pursuant to the employment agreements discussed under “Employment Agreements,” represents (i) any unpaid bonus for 2021, if any, and (ii) the pro-rata target bonus for the effective period of employment for the year ended December 31, 2022, assuming the bonus was not paid in calendar year 2022, in either case, which is payable in lump sum by the Company upon termination of the NEO’s employment by us due to their death or disability. For purposes of the employment agreements, “disability” is defned as physical or mental incapacity that substantially prevents the NEO from performing their duties and that has continued for at least 180 consecutive days. (3) Pursuant to the employment agreements discussed under “Employment Agreements,” represents the value of all equity awards of the Company that would fully vest upon termination of the NEO’s employment by us without cause, by the NEO with good reason or upon death or disability. Amount excludes (i) the value of performance-based restricted stock units, which are subject to performance-based conditions over a three-year period ending March 14, 2023, March 14, 2024 and March 14, 2025, and (ii) for Mr. Ganzi, excludes the value of performance-based LTIP Units, subject to performance based conditions over a fve-year period ending July 25, 2024, all as set forth in Footnote 3 to the “Outstanding Equity Awards at Fiscal Year End 2022” table above. Following the conclusion of the performance period of the performance-based restricted stock units, the NEO would be entitled to the number of units (with a potential payout percentage between 0 and 200% for the units subject to the performance period ending March 14, 2023, March 14, 2024 and March 14, 2025 that would have been earned had the NEO been an employee of the Company at such time. Following the conclusion of the performance period of the performance-based LTIP Units, Mr. Ganzi would be entitled to the number of LTIP Units (with a potential payout percentage of 0% or 100%) that would have been earned had Mr. Ganzi been an employee of the Company at such time. In addition, amounts exclude carried interests, which are subject to achievement of minimum return hurdles in accordance with the terms set out in the respective governing agreements for the Company’s managed private funds and other investment vehicles. (4) Mr. Wu’s amended and restated employment agreement does not provide for payments upon termination of employment for good reason. Represents the “CFO Expiration Date Items” with certain modifcations that would apply if the Board moved the CFO Expiration Date to December 31, 2022, as described under Employment Agreements—Employment Agreements with Other Named Executive Offcers—Jacky Wu.” (5) Represents a lump sum payment equal to $1,540,217 (determined pursuant to the provisions in Mr. Wu’s amended and restated employment agreement, as described under “Employment Agreements—Employment Agreements with Other Named Executive Offcers—Jacky Wu”) and issuance of the 2022 Target LTIP Award. (6) Mr. Sanders’ amended and restated employment agreement does not provide for payments upon termination of employment for good reason. Represents the “CLO Expiration Date Items” with certain modifcations that would apply if the Board moved the CLO Expiration Date to December 31, 2022, as described under Employment Agreements—Employment Agreements with Other Named Executive Offcers—Ronald M. Sanders.” (7) Represents a lump sum payment equal to $644,796 (determined pursuant to the provisions in Mr. Sanders’ amended and restated employment agreement, as described under “Employment Agreements—Employment Agreements with Other Named Executive Offcers—Ronald M. Sanders”) and issuance of the 2022 Target LTIP Award. The tables above do not include payments and benefts to the extent we generally provide them on a non-discriminatory basis to salaried employees upon termination of employment, including: (i) life insurance upon death in the amount of two times the employee’s annual salary but not exceeding a total of $750,000; and (ii) disability benefts. As a result of provisions in each of our NEOs’ employment agreements, in the event that any payment or beneft to be paid or provided to such an executive set forth above would have been subject to the excise tax under Section 4999 of the Code, the payments and benefts to such executive would have been reduced to the extent necessary to avoid the imposition of such excise tax, but only if such reduction would result in a greater after-tax beneft to the executive. The amounts set forth in the table above have not been adjusted to refect any such reduction that might be applicable. DIGITALBRIDGE 2023 PROXY STATEMENT | 53 Toppan Merrill - DigitalBridge [fka Colony Capital_ Inc.] PRE 14A [iXBRL Proxy] ED [AUX] | ltolend | 28-Mar-23 09:40 | 23-2053-3.ea | Sequence: 21 CHKSUM Content: 17296 Layout: 29481 Graphics: 0 CLEAN JOB: 23-2053-3 CYCLE#;BL#: 9; 0 TRIM: 8.25" x 10.75" AS: New York: 212-620-5600 COLORS: DB dark green, ~note-color 2, DB med blue, DB dark blue, Black, DB med gray GRAPHICS: none V1.5 |

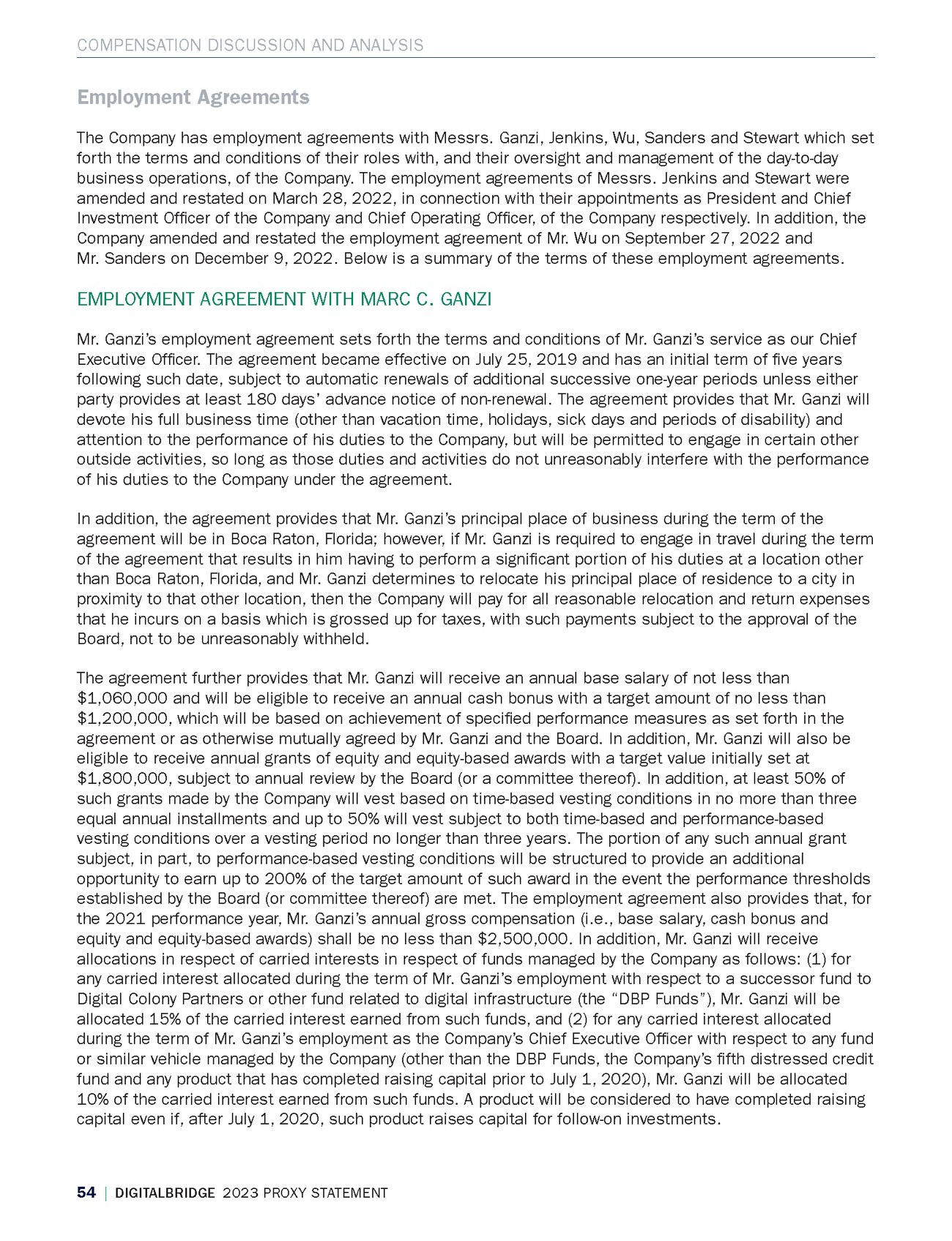

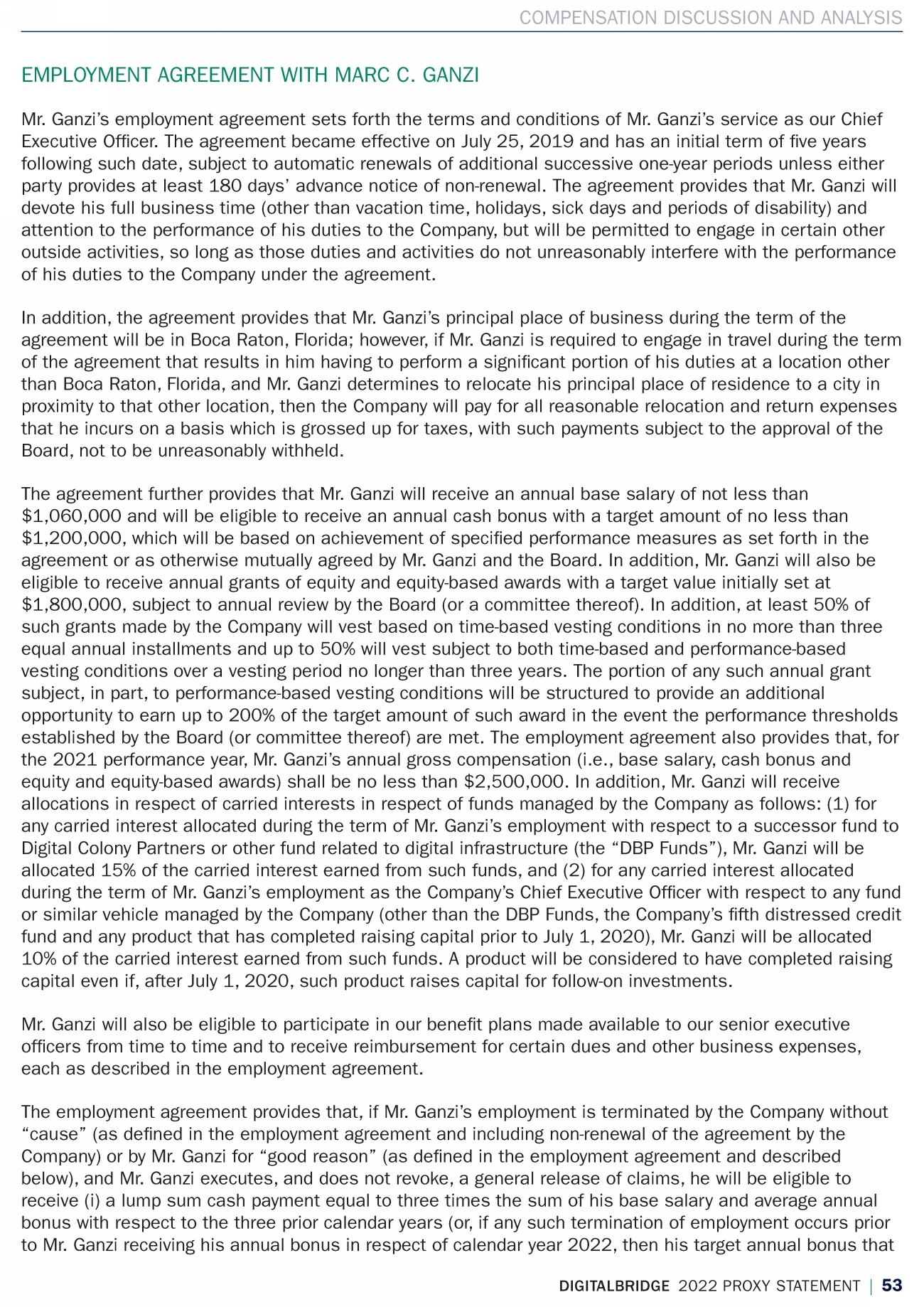

| COMPENSATION DISCUSSION AND ANALYSIS 54 | DIGITALBRIDGE 2023 PROXY STATEMENT Employment Agreements The Company has employment agreements with Messrs. Ganzi, Jenkins, Wu, Sanders and Stewart |

|

| COMPENSATION DISCUSSION AND ANALYSIS Mr. Ganzi will also be eligible to participate in our |

|

| COMPENSATION DISCUSSION AND ANALYSIS 56 | DIGITALBRIDGE 2023 PROXY STATEMENT payments after such reduction would result in Mr. Ganzi receiving a greater net after-tax |

|

| COMPENSATION DISCUSSION AND ANALYSIS and non-solicitation obligations will continue for one year after the CFO Expiration Date. If Mr. Wu departs prior to the CFO Expiration Date or is terminated for Cause (as defned in the agreement), Mr. Wu will not receive the CFO Expiration Date Items. In the event of termination due to death or disability prior to the CFO Expiration Date, Mr. Wu will receive (i) a cash payment equal to a pro rata portion of the $3,100,000, (ii) the target annual bonus for 2022 if such termination occurs on or after January 1, 2023 and prior to the payment of the annual bonus for 2022, (iii) a pro-rated target bonus for the year of termination, (iv) the CFO Target LTIP Award for 2022 if such termination occurs on or after January 1, 2023 and prior to issuance of the LTIP Award for 2022, (v) a pro-rated LTIP Award for the year of termination, and (vi) full vesting of all equity-based awards of the company, carried interests and other like compensation that such executive holds, to the extent unvested upon such termination. The agreement also provides that the Board may change the CFO Expiration Date to a date that is earlier than December 31, 2023. At such time, the employment term will end, and after Mr. Wu executes a release of claims, he will be eligible to receive the CFO Expiration Date Items with the following modifcations: (i) to the extent unpaid, payment of the target bonus amount in respect of the 2022 calendar year, (ii) to the extent not issued, issuance of the CFO Target LTIP Award in respect of the 2022 calendar year, (iii) certain fund incentives will vest as if Mr. Wu had remained employed through December 31, 2023, and (iv) Mr. Wu will receive an amount equal to the base salary that would have been paid to executive from the CFO Expiration Date through December 31, 2023. The agreement also includes a provision providing that if any payments to be made to Mr. Wu, whether under the agreement or otherwise, would subject the executive to the excise tax on so-called “golden parachute payments” in accordance with Sections 280G or 4999 of the Code, then the payments will be reduced to the extent necessary to avoid the excise tax, but only if the amount of the payments after such reduction would result in Mr. Wu receiving a greater net after-tax beneft than if all of the payments were provided and the excise tax were imposed. In addition, the agreement, through a restrictive covenant agreement that is included as an exhibit to the agreement, provides that Mr. Wu will not, subject to certain exceptions, compete with us, or solicit our investors or customers or employees or those of our subsidiaries during his employment with us and for the one-year period following the termination of his employment with us. The agreement also contains covenants relating to the treatment of confdential information and intellectual property matters and restrictions on disparagement. Ronald M. Sanders Mr. Sanders’ employment agreement sets forth the terms and conditions of Mr. Sanders’ service as our Chief Legal Offcer. The agreement became effective on December 9, 2022, and provides for Mr. Sanders’ term of employment to conclude on December 31, 2023. The agreement provides that if a successor chief legal offcer of the Company is not satisfactorily established by April 27, 2023, the Board may request that Mr. Sanders’ last day of employment be extended, with any such extension being subject to the consent of Mr. Sanders (such end date, as may be extended as described above, or accelerated by the Board, as described below, the “CLO Expiration Date”). The agreement provides that Mr. Sanders will devote his full business time and attention to the performance of his duties to us, but will be permitted to engage in certain other outside activities so long as such activities do not unreasonably interfere with the performance of his duties to us. The agreement provides for the payment of a specifed base salary of $475,000, an annual cash bonus target of $1,425,000 and an annual grant of equity-based awards with a target value of $1,688,000, consistent with terms previously approved by the Compensation Committee. DIGITALBRIDGE 2023 PROXY STATEMENT | 57 Toppan Merrill - DigitalBridge [fka Colony Capital_ Inc.] PRE 14A [iXBRL Proxy] ED [AUX] | ltolend | 28-Mar-23 09:40 | 23-2053-3.ea | Sequence: 25 CHKSUM Content: 44420 Layout: 61888 Graphics: 0 CLEAN JOB: 23-2053-3 CYCLE#;BL#: 9; 0 TRIM: 8.25" x 10.75" AS: New York: 212-620-5600 COLORS: DB dark green, ~note-color 2, DB med blue, DB dark blue, Black, DB med gray GRAPHICS: none V1.5 |

| COMPENSATION DISCUSSION AND ANALYSIS 58 | DIGITALBRIDGE 2023 PROXY STATEMENT The agreement provides that if Mr. Sanders’ employment is terminated by reason of expiration of the employment term on the CLO Expiration Date and Mr. Sanders executes a release of claims, he will be eligible to receive: (i) a cash payment equal to the product of (A) two and (B) the sum of (1) Mr. Sanders’ base salary in effect immediately prior to the CLO Expiration Date and (2) the average annual bonus paid in respect of each of the three calendar years prior to the CLO Expiration Date (provided that for these purposes Mr. Sanders’ annual bonus for 2022 shall not be less than target), (ii) to the extent unpaid, the annual bonus in respect of the 2022 calendar year, (iii) to the extent not issued, the issuance of the target value of annual equity-based awards (the “CLO Target LTIP Award”) in respect of the 2022 calendar year (the “2022 LTIP Award”), (iv) a cash payment equal to the product of (A) the target bonus in effect for the 2023 calendar year, and (B) 32% (the “Pro-Rated Percentage”), unless the CLO Expiration Date is extended past April 27, 2023, in which case the payment will be pro-rated based on the period of service in 2023, (v) issuance of LTIP Awards, subject to time-based vesting, equal to the product of (A) the CLO Target LTIP Award in effect for the 2023 and (B) the Pro-Rated Percentage, unless the CLO Expiration Date is extended past April 27, 2023, in which case the payment will be pro-rated based on the period of service in 2023, (vi) full vesting of all fund incentives that are outstanding and unvested, (vii) full vesting of all equity or equity-based awards relating to the securities of the Company issued to Mr. Sanders that are outstanding and unvested, provided that any equity awards subject to performance-based vesting, will remain outstanding and, notwithstanding the expiration of the employment term, will continue to vest based on the level of actual achievement of such performance goals or metrics and (viii) continuation of the Company’s contributions necessary to maintain the Executive’s coverage for the 24 calendar months immediately following the end of the calendar month in which the Expiration Date occurs under the medical, dental and vision programs in which the Executive participated immediately prior to his termination of employment (and such coverage shall include the Executive’s eligible dependents) (collectively, the “CLO Expiration Date Items”). If Mr. Sanders departs prior to the CLO Expiration Date or is terminated for Cause (as defned in the agreement), Mr. Sanders will not receive the CLO Expiration Date Items. In the event of termination due to death or disability prior to the CLO Expiration Date, Mr. Sanders will receive (i) a cash payment equal to the payment described in clause (i) of the preceding paragraph, adjusted pro rata for the period served from December 9, 2022 through the CLO Expiration Date, (ii) the 2022 annual bonus (or target annual bonus for 2022 if the 2022 annual bonus has not been established) if such termination occurs on or after January 1, 2023 and prior to the payment of the annual bonus for 2022, (iii) a cash payment equal to the target bonus amount in effect for the calendar year in which the termination occurs, pro-rated for the period of service in such year, (iv) the 2022 LTIP Award if such termination occurs on or after January 1, 2023 and prior to issuance of the LTIP Award for 2022, (v) an LTIP Award equal to the CLO Target LTIP Award in effect for the calendar year in which the termination occurs, pro-rated for the period of service in such year, and (vi) full vesting of all equity-based awards of the company, carried interests and other like compensation that such executive holds, to the extent unvested upon such termination. The agreement also provides that the Board may change the CLO Expiration Date to a date that is earlier than April 27, 2023. At such time, the employment term will end, and after Mr. Sanders executes a release of claims, he will be eligible to receive the CLO Expiration Date Items with certain modifcations. The agreement also includes a provision providing that if any payments to be made to Mr. Sanders, whether under the agreement or otherwise, would subject the executive to the excise tax on so-called “golden parachute payments” in accordance with Sections 280G or 4999 of the Code, then the payments will be reduced to the extent necessary to avoid the excise tax, but only if the amount of the payments after such reduction would result in Mr. Sanders receiving a greater net after-tax beneft than if all of the payments were provided and the excise tax were imposed. In addition, the agreement, through a restrictive covenant agreement that is included as an exhibit to the agreement, provides that Mr. Sanders will not, subject to certain exceptions, compete with us, or solicit our investors or customers or employees or those of our subsidiaries during his employment with us and for the Toppan Merrill - DigitalBridge [fka Colony Capital_ Inc.] PRE 14A [iXBRL Proxy] ED [AUX] | ltolend | 28-Mar-23 09:40 | 23-2053-3.ea | Sequence: 26 CHKSUM Content: 58050 Layout: 28061 Graphics: 0 CLEAN JOB: 23-2053-3 CYCLE#;BL#: 9; 0 TRIM: 8.25" x 10.75" AS: New York: 212-620-5600 COLORS: DB dark green, ~note-color 2, DB med blue, DB dark blue, Black, DB med gray GRAPHICS: none V1.5 |

| COMPENSATION DISCUSSION AND ANALYSIS one-year period following the termination of his employment with us. If Mr. Sanders’ employment with us terminates by reason of the expiration of the employment term on the CLO Expiration Date, Mr. Sanders will not thereafter be subject to such non-compete or non-solicitation covenants. The agreement also contains covenants relating to the treatment of confdential information and intellectual property matters and restrictions on disparagement. Other NEOs These employment agreements provided for an initial term of three years for Mr. Jenkins and |

|

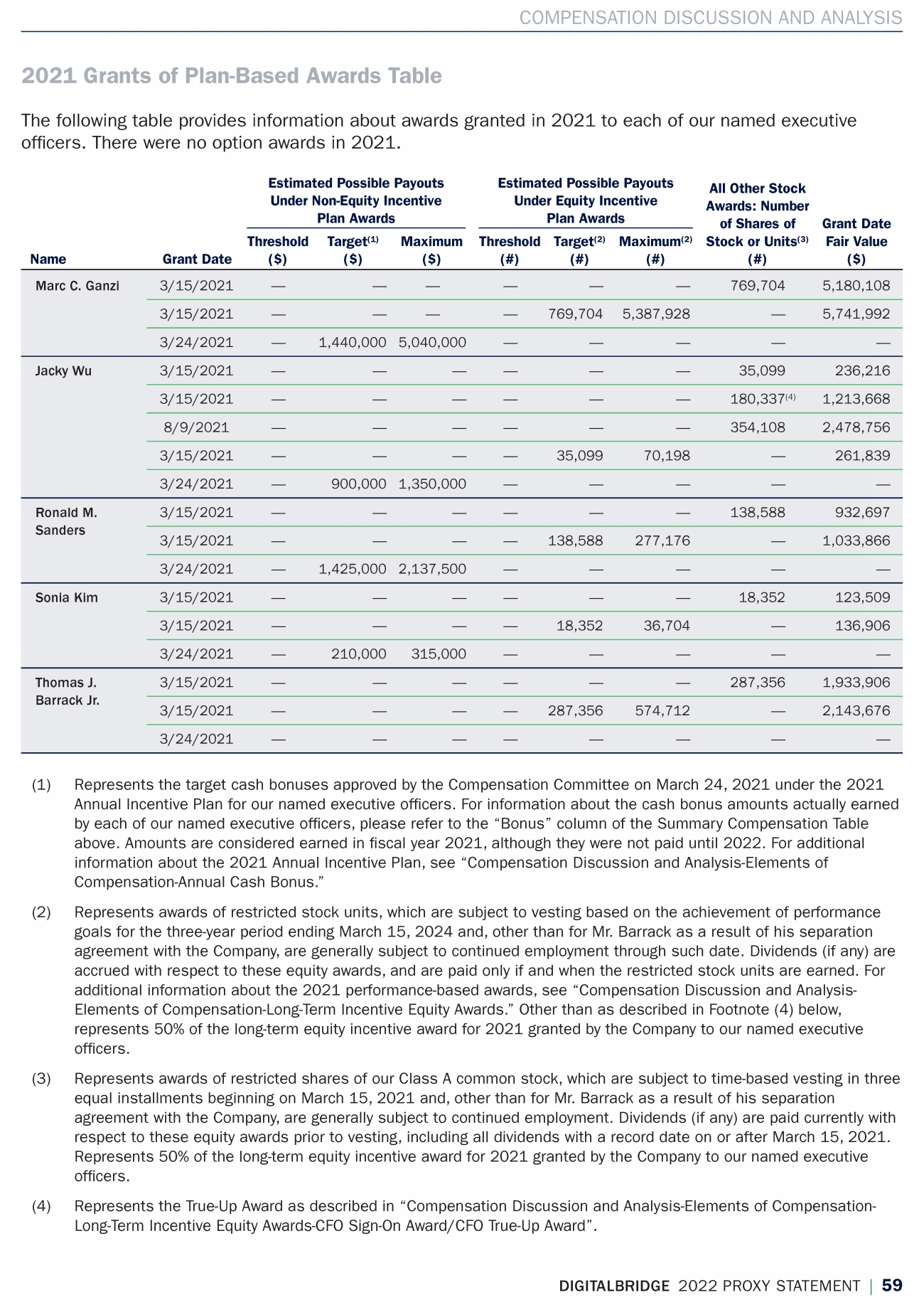

| COMPENSATION DISCUSSION AND ANALYSIS 60 | DIGITALBRIDGE 2023 PROXY STATEMENT and equity-based awards of the Company, carried interests and other like compensation that he holds, to the extent unvested. For purposes of the agreements, “good reason” includes, in summary, (i) a material diminution in the executive’s duties, authority or responsibilities or a diminution in the executive’s title or position, (ii) a requirement that the executive report to any person other than the Company’s Chief Executive |

|

|

|

|

|

|

|

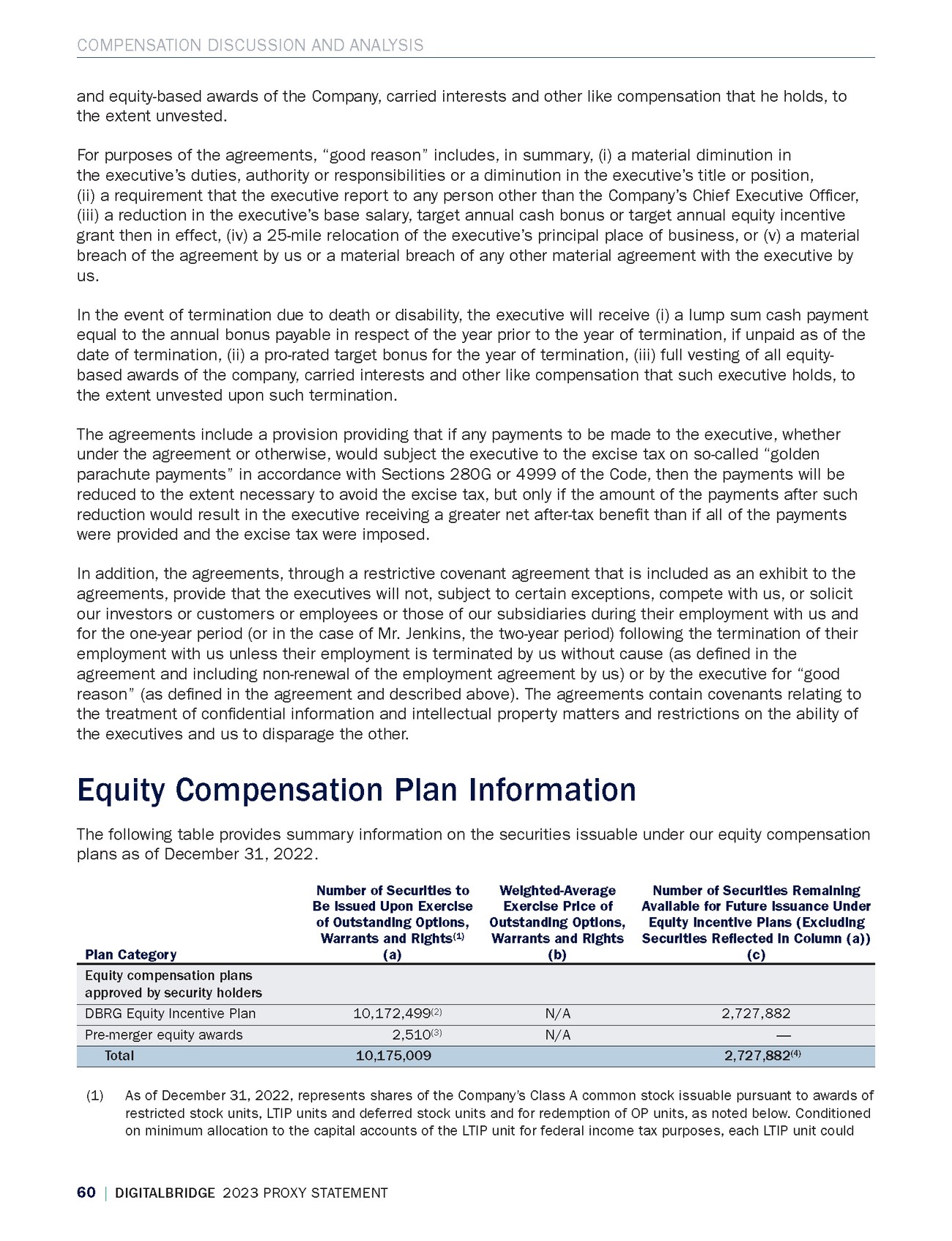

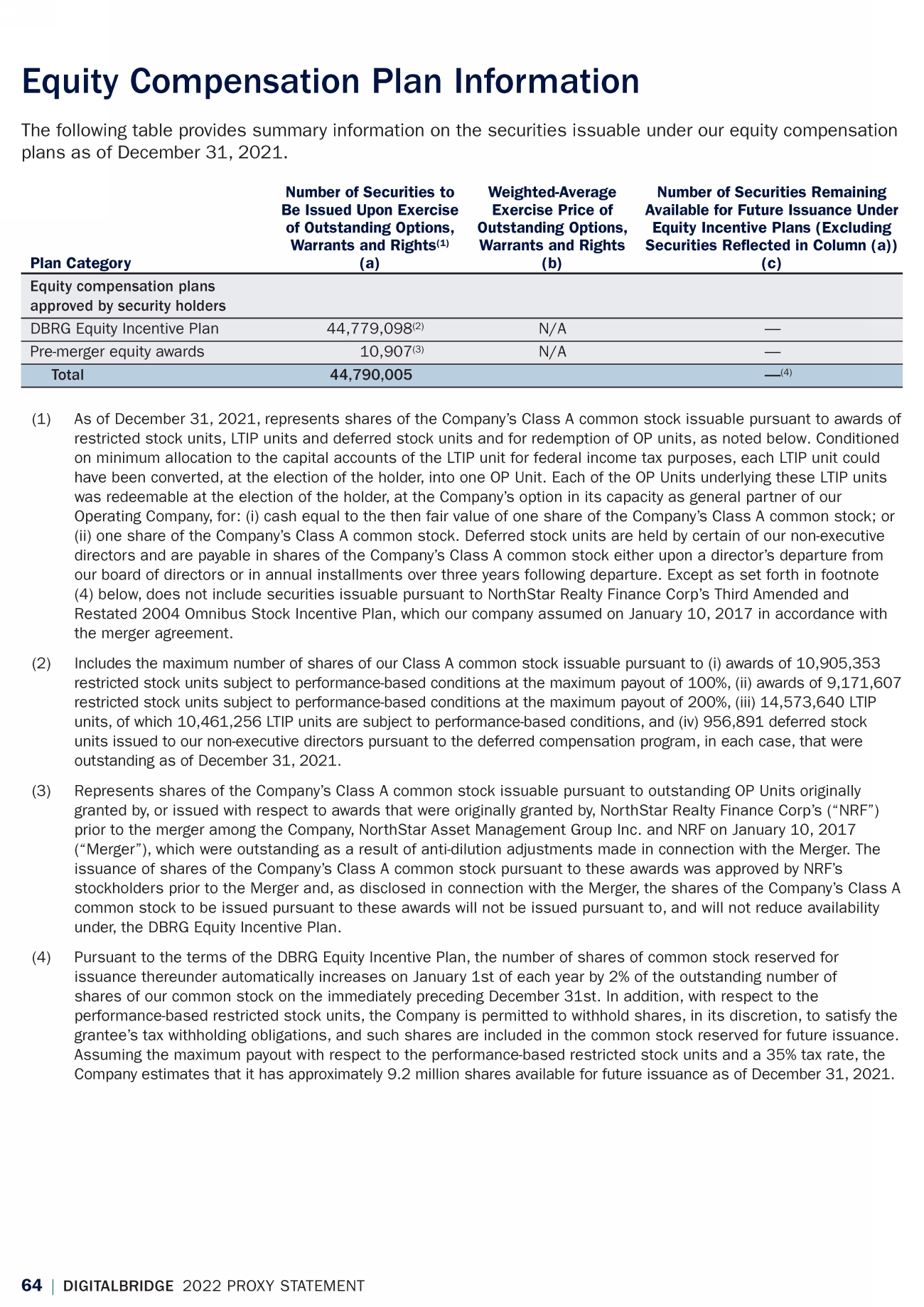

| Equity Compensation Plan Information The following table provides summary information on the securities issuable under our equity compensation plans as of December 31, |

| have been converted, at the election of the holder, into one OP Unit. Each of the OP Units underlying these LTIP units was redeemable at the election of the holder, at the Company’s option in its capacity as general partner of our Operating Company, for: (i) cash equal to the then fair value of one share of the Company’s Class A common stock; or (ii) one share of the Company’s Class A common stock. Deferred stock units are held by certain of our non-executive directors and are payable in shares of the Company’s Class A common stock either upon a director’s departure from our board of directors or in annual installments over three years following departure. Except as set forth in footnote (4) below, does not include securities issuable pursuant to NorthStar Realty Finance Corp’s Third Amended and Restated 2004 Omnibus Stock Incentive Plan, which our company assumed on January 10, 2017 in accordance with the merger agreement. (2) Includes the maximum number of shares of our Class A common stock issuable pursuant to (i) awards of |

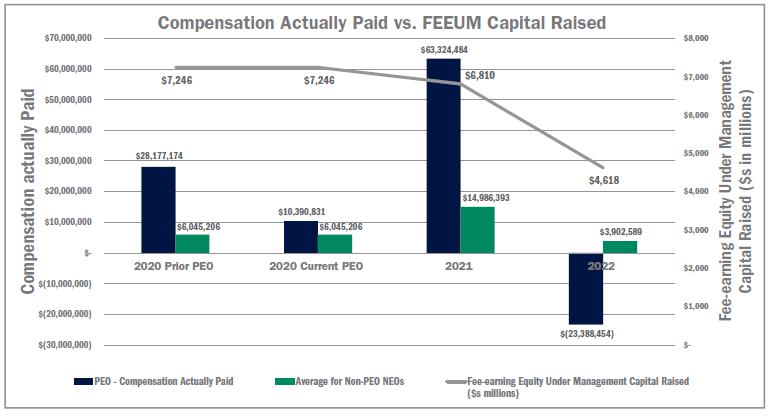

COMPENSATION DISCUSSION AND ANALYSIS

Pay Versus Performance

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and Item 402(v) of Regulation S-K, we are providing the following information about the relationship between executive compensation actually paid and certain financial performance of the Company. The disclosure included in this section is prescribed by SEC rules and does not necessarily align with how the Company or the Compensation Committee views the link between the Company’s performance and its NEO’s pay. For a discussion of how the Company views its executive compensation structure, including alignment with Company performance, see “Compensation Discussion and Analysis” beginning on page 35. The Compensation Committee did not consider the pay versus performance disclosure below in making its pay decisions for any of the years shown.

| Value of Initial Fixed | ||||||||||||||

| Average | $100 Investment | |||||||||||||

| Summary | Average | Based On: | ||||||||||||

| Compensation | Compensation | Peer | ||||||||||||

| Summary Compensation | Compensation Actually | Table | Actually | Group | ||||||||||

| Table Total for PEO1 | Paid to PEO2 | Total for | Paid to | Total | Total | FEEUM | ||||||||

| ($) | ($) | Non-PEO | Non-PEO | Shareholder | Shareholder | Net | Capital | |||||||

| Marc C. | Thomas | Marc C. | Thomas J. | NEOs3 | NEOs4 | Return5 | Return6 | Income | Raise | |||||

| Year | Ganzi | Barrack, Jr. | Ganzi | Barrack, Jr. | ($) | ($) | ($) | ($) | ($ millions)7 | ($ millions)8 | ||||

| (a) | (b)(i) | (b)(ii) | (c)(i) | (c)(ii) | (d) | (e) | (f) | (g) | (h) | (i) | ||||

| 2022 | 38,321,508 | — | (23,388,454) | — | 7,646,528 | 3,902,589 | 60.68 | 111.72 | (570) | 4,618 | ||||

| 2021 | 22,459,034 | — | 63,324,484 | — | 9,614,818 | 14,986,393 | 184.51 | 153.75 | (817) | 6,810 | ||||

| 2020 | 4,815,779 | 10,200,262 | 10,390,831 | 28,177,174 | 4,573,017 | 6,045,206 | 106.54 | 117.15 | (3,790) | 7,246 | ||||

| (1) | The dollar amounts in columns (b)(i) and (b)(ii) are the amounts of total compensation reported for each principal executive officer (“PEO”) as reported in the “Total” column of the Summary Compensation Table for each year in which they served as PEO, and we refer to Mr. Barrack as our “Prior PEO.” Refer to “Executive Compensation—Executive Compensation Tables—Summary Compensation Table.” |

| (2) | The dollar amounts in columns (c)(i) and (c)(ii) represent the amount of “compensation actually paid” to each PEO as computed in accordance with Item 402(v) of Regulation S-K for each corresponding year in which they served as PEO. The dollar amounts do not reflect the actual amount of compensation earned by or paid to Mr. Ganzi or our Prior PEO during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to Mr. Ganzi’s total compensation for each year to determine the compensation actually paid: |

| Reported | |||||

| Summary | Reported | ||||

| Compensation | Value of | Equity | Compensation | ||

| Table Total | Equity | Award | Actually | ||

| for PEO | Awards(a) | Adjustments(b) | Paid to PEO | ||

| Year | ($) | ($) | ($) | ($) | |

| 2022 | 38,321,508 | (7,246,051) | (54,463,911) | (23,388,454) | |

| 2021 | 22,459,034 | (10,922,100) | 51,787,549 | 63,324,484 | |

| 2020 | 4,815,779 | (176,489) | 5,751,542 | 10,390,831 |

In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to our Prior PEOs total compensation to determine the compensation actually paid in 2020:

| Reported | ||||

| Summary | Reported | |||

| Compensation | Value of | Equity | Compensation | |

| Table Total | Equity | Award | Actually | |

| for PEO | Awards(a) | Adjustments(b) | Paid to PEO | |

| Year | ($) | ($) | ($) | ($) |

| 2020 | 10,200,262 | (3,565,431) | 21,542,342 | 28,177,174 |

62 | DIGITALBRIDGE 2023 PROXY STATEMENT

COMPENSATION DISCUSSION AND ANALYSIS

| (a) | The grant date fair value of equity awards represents the total of the amounts reported in the “Stock Awards” column in the Summary Compensation Table for the applicable year. |

| (b) | The equity award adjustments for each applicable year include the addition (or subtraction, as applicable) of the following: (i) the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; (ii) the amount of change as of the end of the applicable year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year; (iii) for awards that are granted and vest in the same applicable year, the fair value as of the vesting date; (iv) for awards granted in prior years that vest in the applicable year, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value; (v) for awards granted in prior years that are determined to fail to meet the applicable vesting conditions during the applicable year, a deduction for the amount equal to the fair value at the end of the prior fiscal year; and (vi) the dollar value of any dividends or other earnings paid on stock awards in the applicable year prior to the vesting date that are not otherwise reflected in the fair value of such award or included in any other component of total compensation for the applicable year. The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. |

The amounts deducted or added in calculating the equity award adjustments for Mr. Ganzi are as follows:

| Fair | Value | |||||||

| Year | Value at the | of Dividends | ||||||

| over Year | End of the | or other | ||||||

| Fair | Change in | Prior | Earnings | |||||

| Year | Value as of | Fair Value | Year of Equity | Paid on | ||||

| over Year | Vesting Date | of Equity | Awards that | Stock not | ||||

| Change in | of Equity | Awards | Failed | Otherwise | ||||

| Year End | Fair Value of | Awards | Granted | to Meet | Reflected in | Total | ||

| Fair Value | Outstanding | Granted | in Prior Years | Vesting | Fair Value or | Equity | ||

| of Equity | and Unvested | and Vested | that Vested | Conditions | Total | Award | ||

| Awards | Equity Awards | in the Year | in the Year | in the Year | Compensation | Adjustments | ||

| Year | ($) | ($) | ($) | ($) | ($) | ($) | ($) | |

| 2022 | 1,671,856 | (55,660,831) | — | (477,512) | — | 2,576 | (54,463,911) | |

| 2021 | 12,141,070 | 39,611,280 | — | 35,199 | — | — | 51,787,549 | |

| 2020 | 648,535 | 5,097,629 | — | — | — | 5,378 | 5,751,542 |

The amounts deducted or added in calculating the equity award adjustments for our Prior PEO in 2020 are as follows:

| Fair | Value | |||||||

| Year | Value at the | of Dividends | ||||||

| over Year | End of the | or other | ||||||

| Fair | Change in | Prior | Earnings | |||||

| Year | Value as of | Fair Value | Year of Equity | Paid on | ||||

| over Year | Vesting Date | of Equity | Awards that | Stock not | ||||

| Change in | of Equity | Awards | Failed | Otherwise | ||||

| Year End | Fair Value of | Awards | Granted | to Meet | Reflected in | Total | ||

| Fair Value | Outstanding | Granted | in Prior Years | Vesting | Fair Value or | Equity | ||

| of Equity | and Unvested | and Vested | that Vested | Conditions | Total | Award | ||

| Awards | Equity Awards | in the Year | in the Year | in the Year | Compensation | Adjustments | ||

| Year | ($) | ($) | ($) | ($) | ($) | ($) | ($) | |

| 2020 | 13,101,786 | 1,239,403 | 5,448,922 | (744,577) | — | 2,496,808 | 21,542,342 |

| (3) | The dollar amounts reported in column (d) represent the average of the amounts reported for the Company’s NEOs as a group excluding the PEO (the “Non-PEO NEOs”) in the “Total” column of the Summary Compensation Table in each applicable year. The names of each of the Non-PEO NEOs included for purposes of calculating the average amounts in each applicable year are as follows: (i) for 2022, Benjamin J. Jenkins, Jacky Wu, Ronald M. Sanders and Liam Stewart; (ii) for 2021, Jacky Wu, Ronald M. Sanders, Sonia Kim and Thomas J. Barrack, Jr.; and (iii) for 2020, Jacky Wu, Ronald M. Sanders, Neale W. Redington, Mark M. Hedstrom, Darren J. Tangen and Kevin P. Traenkle. |

| (4) | The dollar amounts reported in column (e) represent the average amount of “compensation actually paid” to the Non-PEO NEOs, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the |

DIGITALBRIDGE 2023 PROXY STATEMENT |63

COMPENSATION DISCUSSION AND ANALYSIS

| actual average amount of compensation earned by or paid to the Non-PEO NEOs during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to average total compensation for the Non-PEO NEOs for each year to determine the compensation actually paid, using the same methodology described above in Note 2: |

| Average | |||||

| Reported Summary | Average | Average | |||

| Compensation | Reported | Average Equity | Compensation | ||

| Table Total for | Value of Equity | Award | Actually Paid | ||

| Non-PEO NEOs | Awards | Adjustments(a) | to Non-PEO NEOs | ||

| Year | ($) | ($) | ($) | ($) | |

| 2022 | 7,646,528 | (1,212,185) | (2,531,754) | 3,902,589 | |

| 2021 | 9,614,818 | (2,623,760) | 7,995,335 | 14,986,393 | |

| 2020 | 4,573,017 | (722,530) | 2,194,719 | 6,045,206 |

| (a) | The amounts deducted or added in calculating the total average equity award adjustments are as follows: |

| Average Fair | Average Value | ||||||

| Year over Year | Value at the | of Dividends | |||||

| Average | Average | End of the | or other | ||||

| Fair | Change in | Prior | Earnings | ||||

| Year over | Value as of | Fair Value | Year of Equity | Paid on | |||

| Year Average | Vesting Date | of Equity | Awards that | Stock not | |||

| Average | Change in | of Equity | Awards | Failed | Otherwise | Total | |

| Year End | Fair Value of | Awards | Granted | to Meet | Reflected in | Average | |

| Fair Value | Outstanding | Granted | in Prior Years | Vesting | Fair Value or | Equity | |

| of Equity | and Unvested | and Vested | that Vested | Conditions | Total | Award | |

| Awards | Equity Awards | in the Year | in the Year | in the Year | Compensation | Adjustments | |

| Year | ($) | ($) | ($) | ($) | ($) | ($) | ($) |

| 2022 | 338,993 | (2,375,753) | — | (495,810) | — | 816 | (2,531,754) |

| 2021 | 2,296,938 | 3,969,682 | 602,441 | 1,126,274 | — | — | 7,995,335 |

| 2020 | 2,110,144 | 89,316 | 352,189 | (404,145) | — | 47,215 | 2,194,719 |

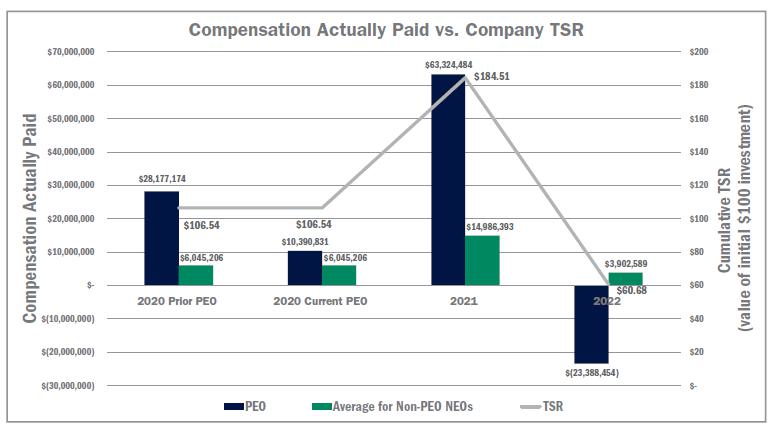

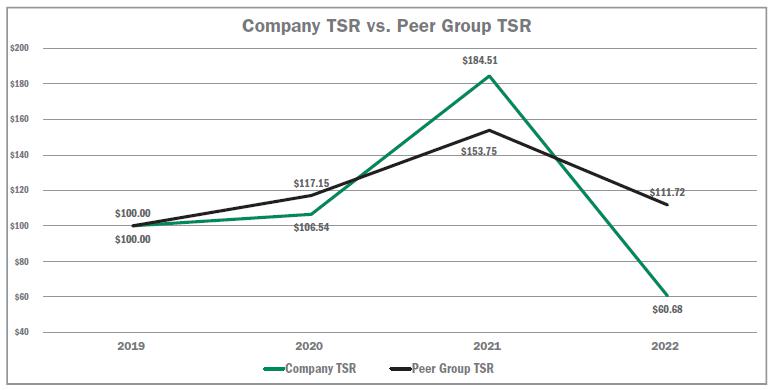

| (5) | Cumulative TSR is calculated by dividing the sum of the cumulative amount of dividends for the applicable fiscal year, assuming dividend reinvestment, and the difference between the Company’s share price at the end and the beginning of such fiscal year by the Company’s share price at the beginning of such fiscal year. |

| (6) | Represents the Dow Jones U.S. Asset Managers Index peer group TSR, weighted according to the respective companies’ stock market capitalization at the beginning of each period for which a return is indicated. |

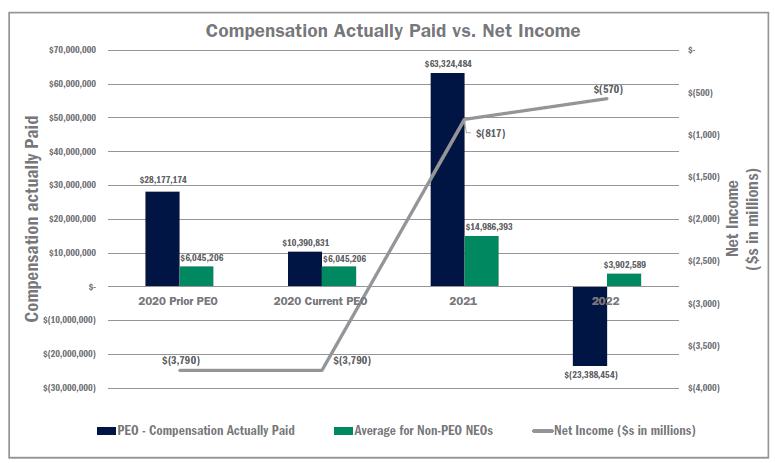

| (7) | The dollar amounts reported represent the amount of net income reflected in the Company’s audited financial statements for the applicable year. |

| (8) | FEEUM Capital Raise is defined as the gross increase in FEEUM resulting from capital commitments closed during the applicable fiscal year. While the Company uses numerous financial and non-financial performance measures for the purpose of evaluating performance for the Company’s compensation programs, the Company has determined that FEEUM Capital Raise is the financial performance measure that, in the Company’s assessment, represents the most important performance measure (that is not otherwise required to be disclosed in the table) used by the company to link compensation actually paid to the company’s NEOs, for the most recently completed fiscal year, to company performance. |

Financial Performance Measures

As described in greater detail in “Executive Compensation—Compensation Discussion and Analysis,” the Company’s executive compensation program reflects a variable pay-for-performance philosophy. The metrics that the Company uses for both our long-term and short-term incentive awards are selected based on an objective of incentivizing our NEOs to increase the value of our enterprise for our shareholders. The most important financial performance measures used by the Company to link executive compensation actually

64| DIGITALBRIDGE 2023 PROXY STATEMENT

COMPENSATION DISCUSSION AND ANALYSIS

paid to the Company’s NEOs, for the most recently completed fiscal year, to the Company’s performance are as follows:

| ■ | Digital FEEUM Capital Raise |

| ■ | Digital IM Revenues |

| ■ | Digital Operating Revenues |

| ■ | Digital IM FRE |

| ■ | Digital Operating adjusted EBITDA |

| ■ | Relative TSR (the Company’s TSR as compared to a peer group established by the Compensation Committee) |

Analysis of the Information Presented in the Pay versus Performance Table

As described in more detail in the section “Executive Compensation—Compensation Discussion and Analysis,” the Company’s executive compensation program reflects a variable pay-for-performance philosophy. While the Company utilizes several performance measures to align executive compensation with Company performance, all of those Company measures are not presented in the Pay versus Performance table. Moreover, the Company generally seeks to incentivize long-term performance, and therefore does not specifically align the Company’s performance measures with compensation that is actually paid (as computed in accordance with Item 402(v) of Regulation S-K) for a particular year. In accordance with Item 402(v) of Regulation S-K, the Company is providing the following descriptions of the relationships between information presented in the Pay versus Performance table.

Compensation Actually Paid and Cumulative TSR

DIGITALBRIDGE 2023 PROXY STATEMENT |65

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Actually Paid and Net Income (Loss)

Compensation Actually Paid and FEEUM Capital Raise

66 | DIGITALBRIDGE 2023 PROXY STATEMENT

COMPENSATION DISCUSSION AND ANALYSIS

Cumulative TSR of the Company and Cumulative TSR of the Peer Group

DIGITALBRIDGE 2023 PROXY STATEMENT |67

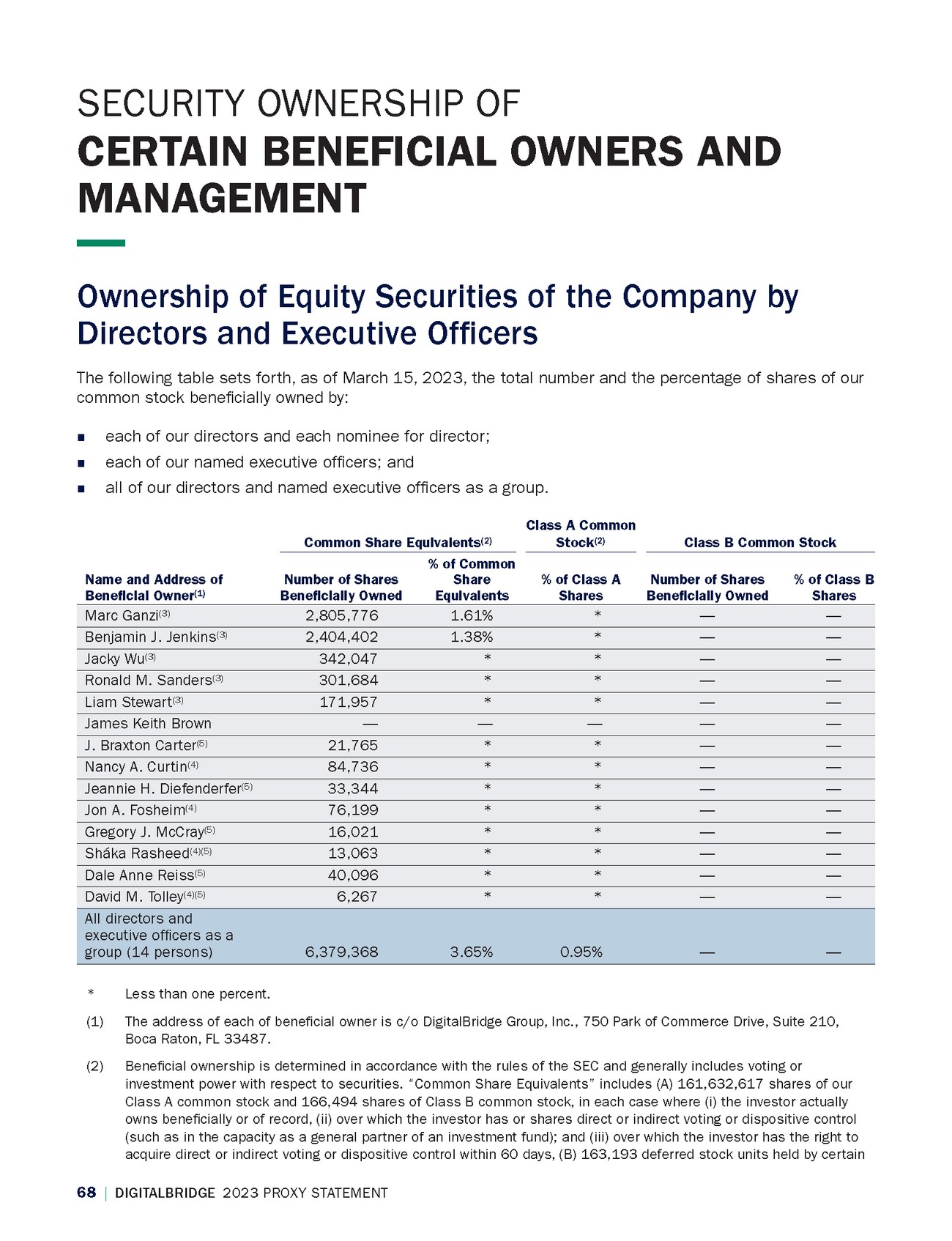

| 68 | DIGITALBRIDGE |

|

|

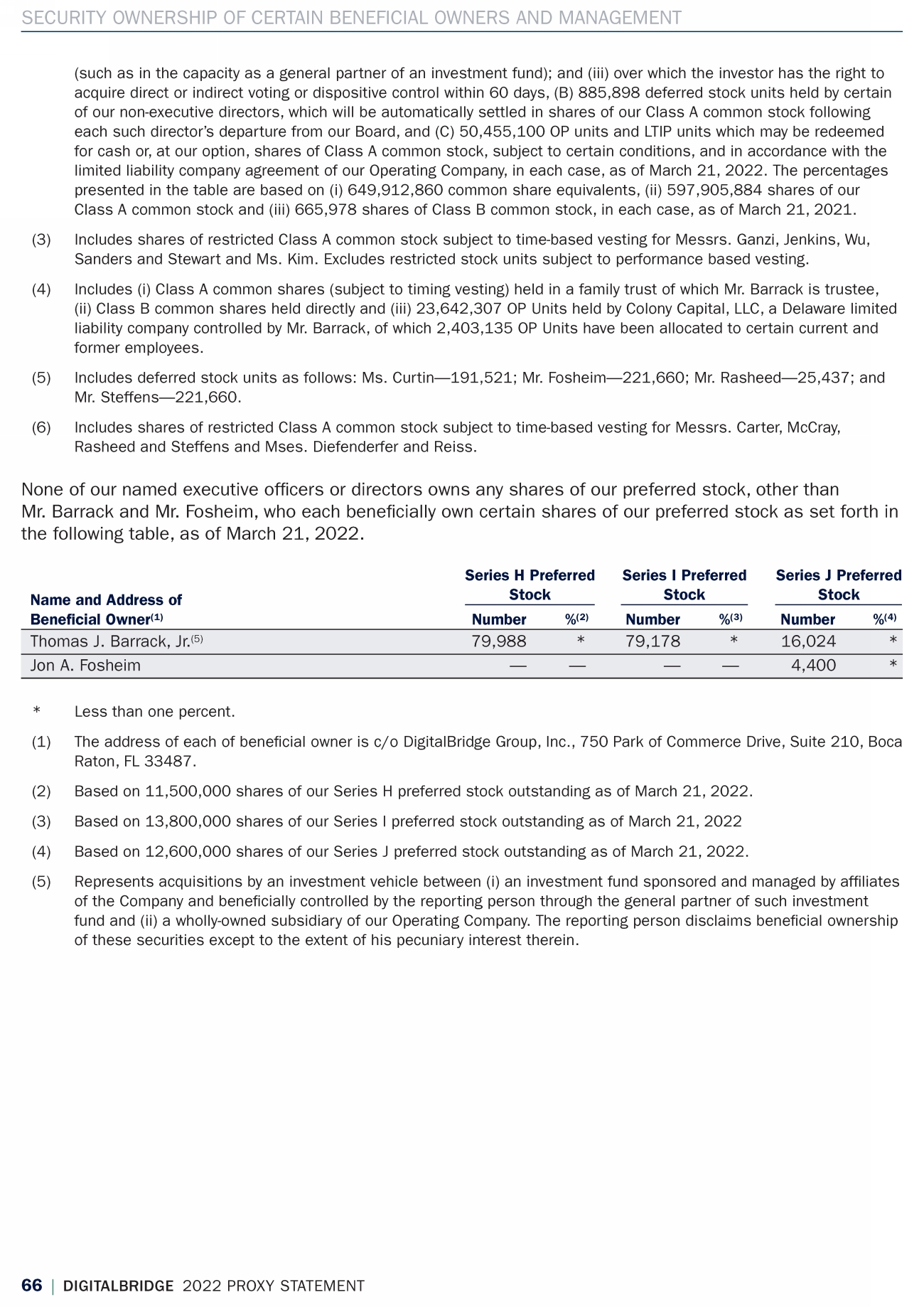

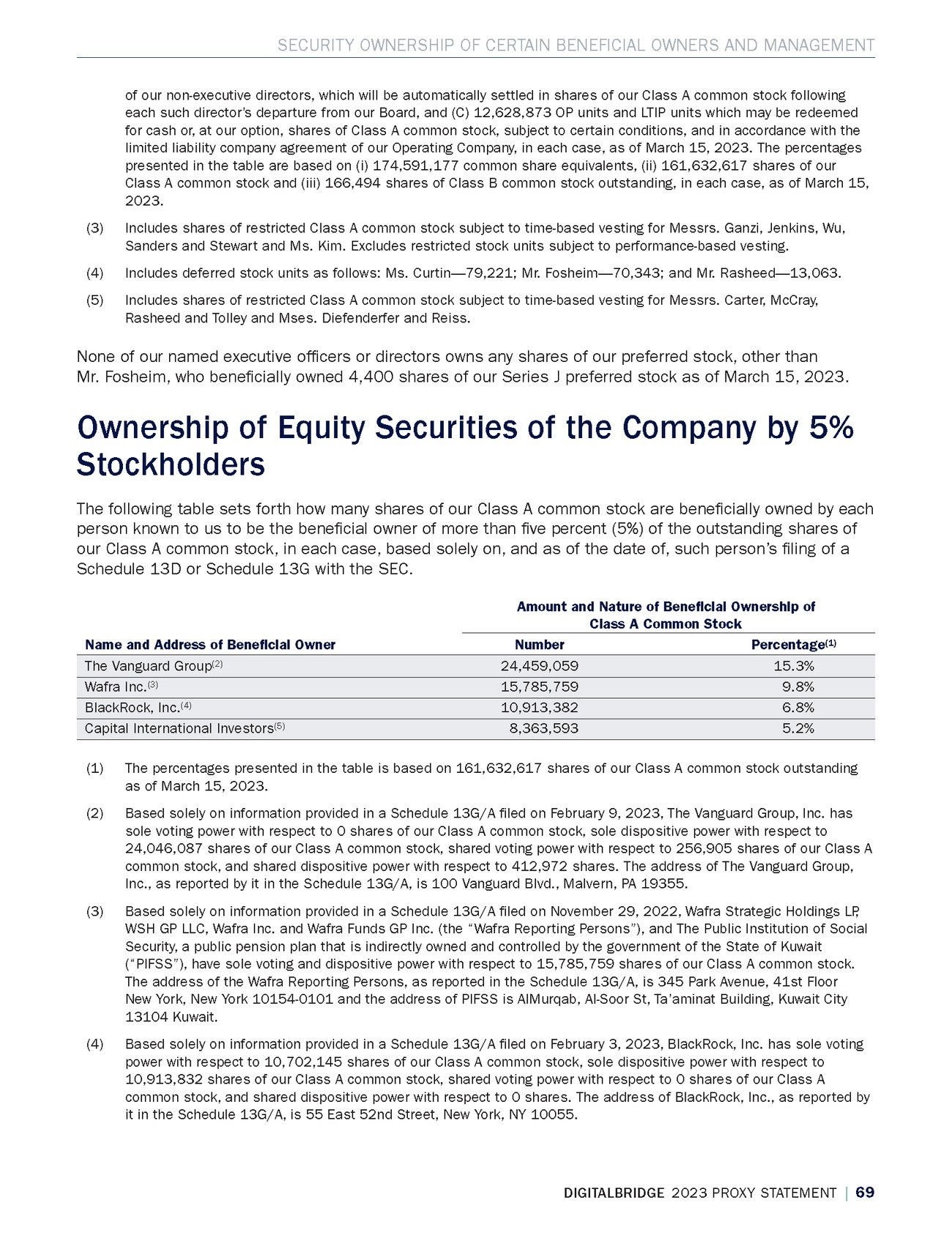

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT of our non-executive directors, which will be automatically settled in shares of our Class A common stock following each such director’s departure from our Board, and (C) |

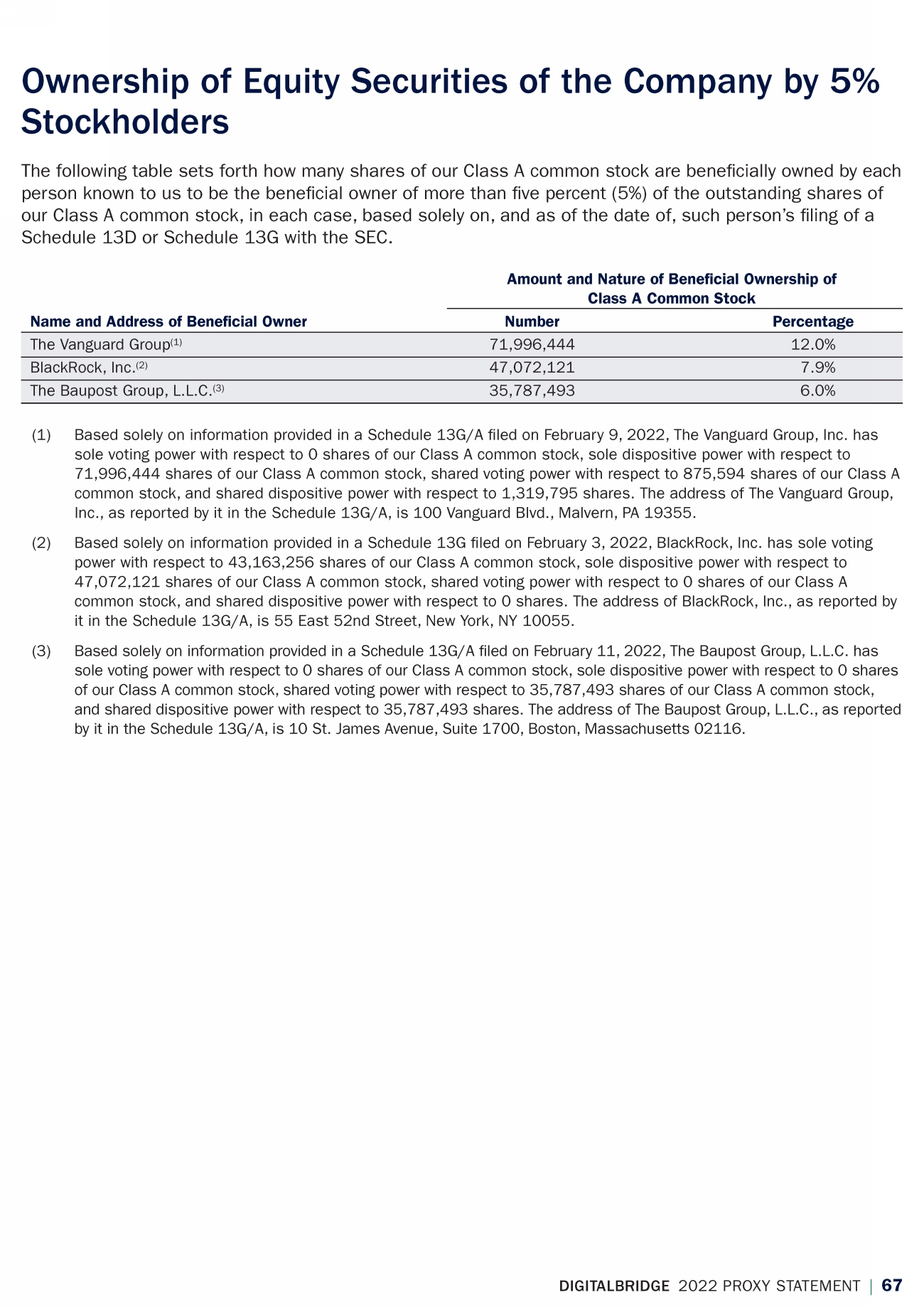

| 15, 2023. Ownership of Equity Securities of the Company by 5% Stockholders The following table sets forth how many shares of our Class A common stock are |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT 70 | DIGITALBRIDGE 2023 PROXY STATEMENT (5) Based solely on information provided in a Schedule 13G/A |

| PROPOSAL NO. 3: ADVISORY VOTE ON THE FREQUENCY OF THE ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION We are seeking an advisory vote on the frequency with which say-on-pay votes should be held in the future. This advisory vote is commonly referred to as “say-on-frequency.” Stockholders may vote to indicate their preference for conducting a say-on-pay vote as follows: ! One year; ! Two years; ! Three years; or ! Abstain from voting on this proposal. The Board of Directors has determined that holding a say-on-pay vote every year is the most appropriate alternative for the Company. In recommending an annual advisory vote on executive compensation, the Board considered that an annual vote will allow our stockholders to provide us with timely feedback on our compensation policies and practices as disclosed in the proxy statement every year, which will allow us to take action, if appropriate, on a real-time basis. Additionally, an annual say-on-pay vote is consistent with our general policy of seeking regular input from, and engaging in discussions with, our stockholders on corporate governance matters and our executive compensation policies and practices. Because this proposal is advisory, it will not be binding on the Company, and the Board of Directors may determine to hold an advisory vote on executive compensation more or less frequently than the option selected by our stockholders. However, the Board of Directors values our stockholders’ opinions, and the Board will consider the outcome of the vote when determining the frequency of future advisory votes on executive compensation. Our Board of Directors Recommends a Vote, on a Non-binding, Advisory Basis, for “ONE YEAR” for the Frequency of the of the Advisory Vote On Named Executive Offcer Compensation. DIGITALBRIDGE 2022 PROXY STATEMENT | |

|

| 72 | DIGITALBRIDGE 2022 PROXY STATEMENT PROPOSAL NO. |

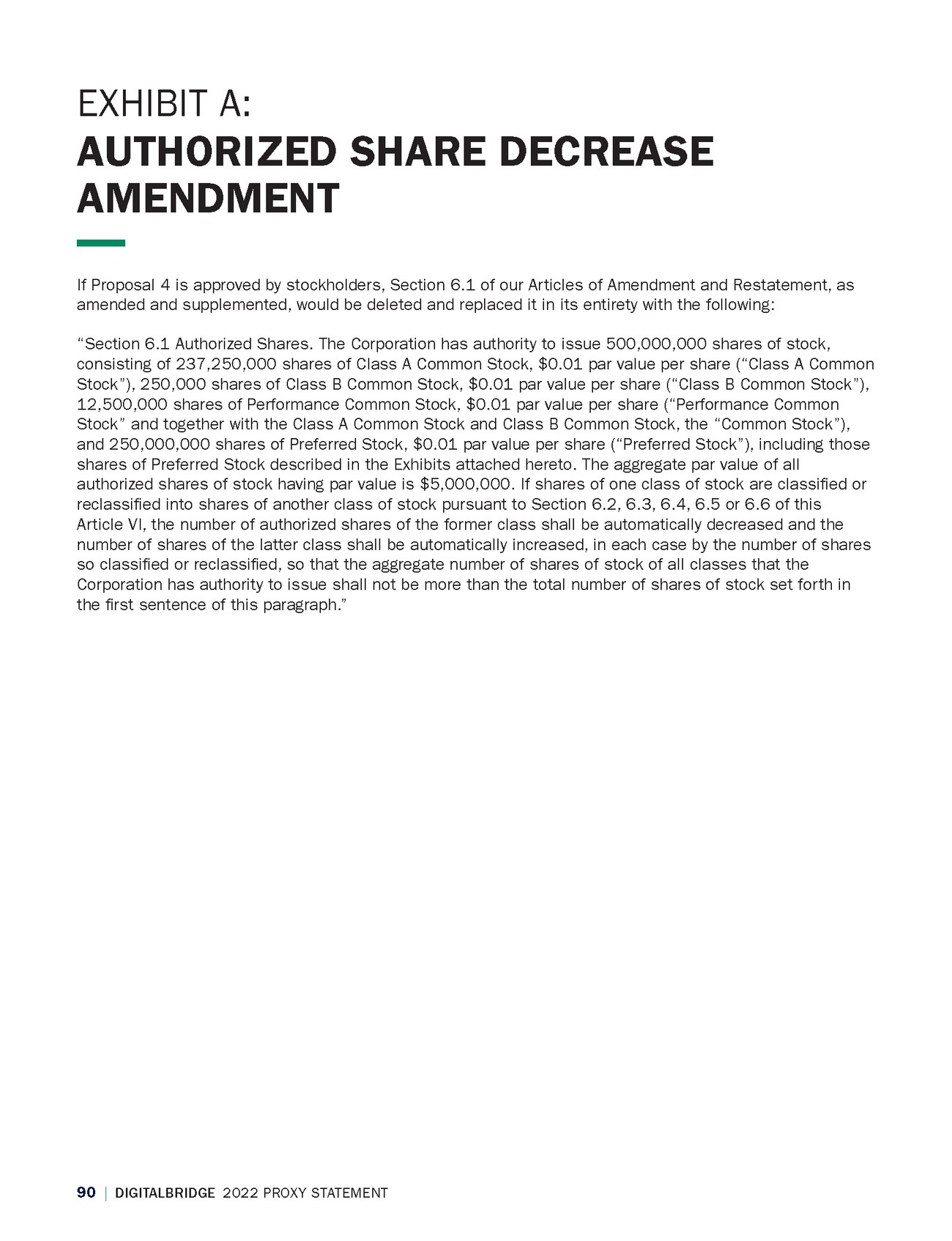

| DIGITALBRIDGE 2022 PROXY STATEMENT | 73 Effects of the Amendment The Authorized Share Decrease Amendment will not change any rights of any holder of our common or preferred stock. The proposed amendment would decrease (i) the number of authorized shares of Class A common stock from 949,000,000 to 237,250,000, (ii) the number of authorized shares of Class B common stock from 1,000,000 to 250,000 and (iii) the number of authorized shares of Performance common stock from 50,000,000 to 12,500,000. Consistent with the foregoing, the number of overall shares of capital stock would be reduced from 1,250,000,000 to 500,000,000, inclusive of 250,000,000 authorized shares of preferred stock. If the Authorized Share Decrease Amendment is approved by our stockholders, the Authorized Share Decrease Amendment would become effective when the Authorized Share Decrease Amendment is accepted and recorded by the State Department of Assessments and Taxation of Maryland. If the amendment is not approved, our current authorized stock will remain unchanged. Vote Required The affrmative vote of a majority of all the votes entitled to be cast on the matter is required to approve the Authorized Share Decrease Amendment. Each holder of our common shares is entitled to cast a vote on the Authorized Share Decrease Amendment. Pursuant to our Charter, including the applicable articles supplementary, no holders of our preferred stock are entitled to vote on this Authorized Share Decrease Amendment. Amendment to Change Par Value Prior to or concurrently with the fling of the Authorized Share Decrease Amendment, the Company intends to fle an amendment to reduce the par value of our common stock from $0.04 per share to $0.01 per share. Pursuant to Section 2-605 of the Maryland General Corporation Law and our Charter, the majority of the entire board of directors, without action by the stockholders, may amend the charter of a corporation to change the par value of any class or series of stock of the corporation and the aggregate par value of the stock of the corporation. The Authorized Share Decrease Amendment refects this intended change in par value. Our Board of Directors Recommends a Vote “FOR” Approval of the Amendment to our Charter to Decrease the Number of Authorized Shares of Common Stock. Toppan Merrill - DigitalBridge [fka Colony Capital_ Inc.] PRE 14A [iXBRL Proxy] ED [AUX] | 105969 | 27-Mar-23 23:29 | 23-2053-3.fa | Sequence: 3 CHKSUM Content: 15754 Layout: 11348 Graphics: 56666 CLEAN JOB: 23-2053-3 CYCLE#;BL#: 8; 0 TRIM: 8.25" x 10.75" AS: New York: 212-620-5600 COLORS: DB dark green, DB med gray, Magenta, Yellow, Cyan, ~note-color 2, DB dark blue, Black, DB lgt gray GRAPHICS: tickmark_4c_icon.eps V1.5 |

| 74 | DIGITALBRIDGE 2022 PROXY STATEMENT PROPOSAL NO. 5: RATIFICATION OF APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Audit Committee of our Board of Directors has appointed Ernst & Young LLP as our independent registered public accounting |

|

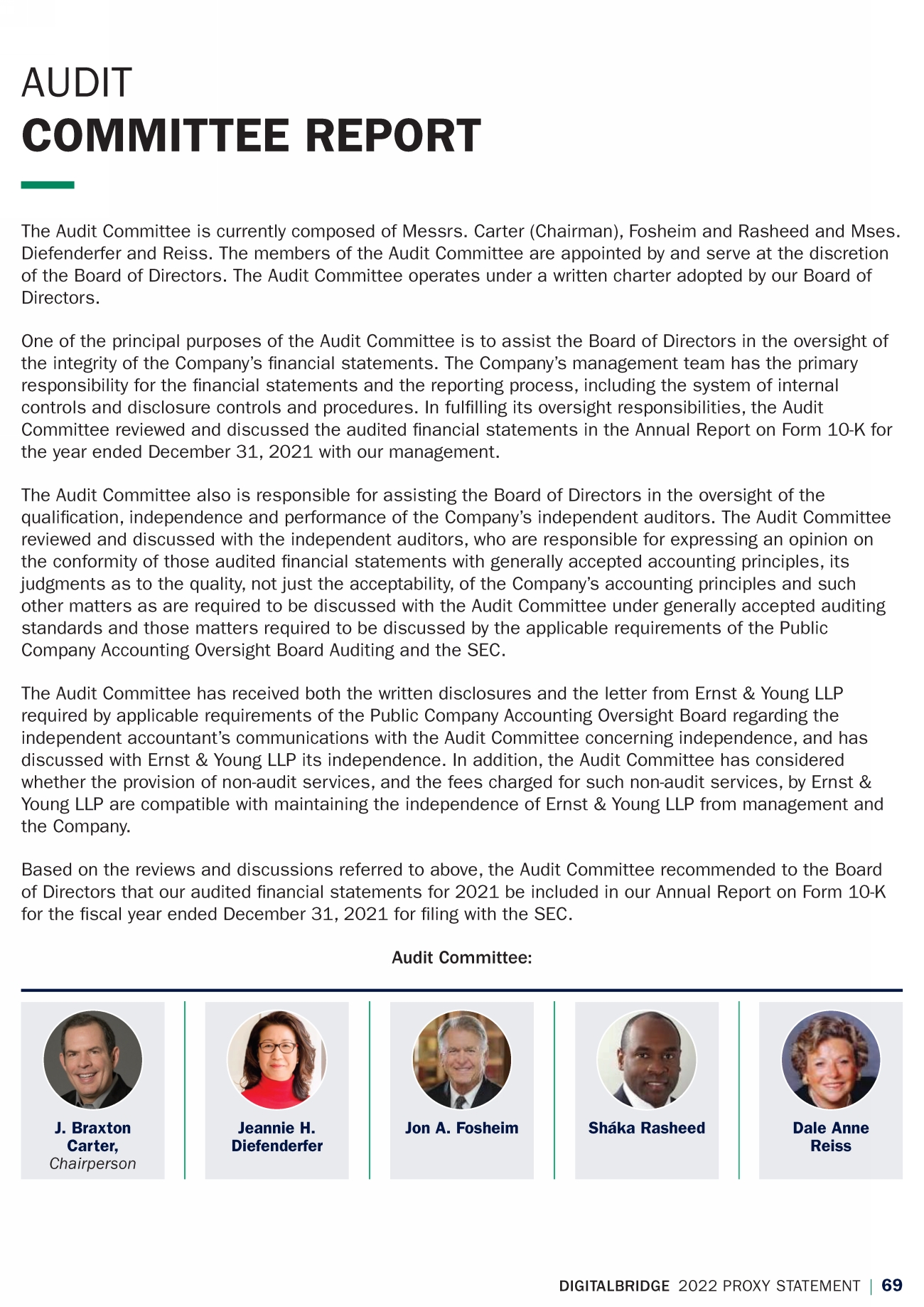

| AUDIT COMMITTEE REPORT The Audit Committee is currently composed of Messrs. Carter (Chairman), Fosheim, |

|

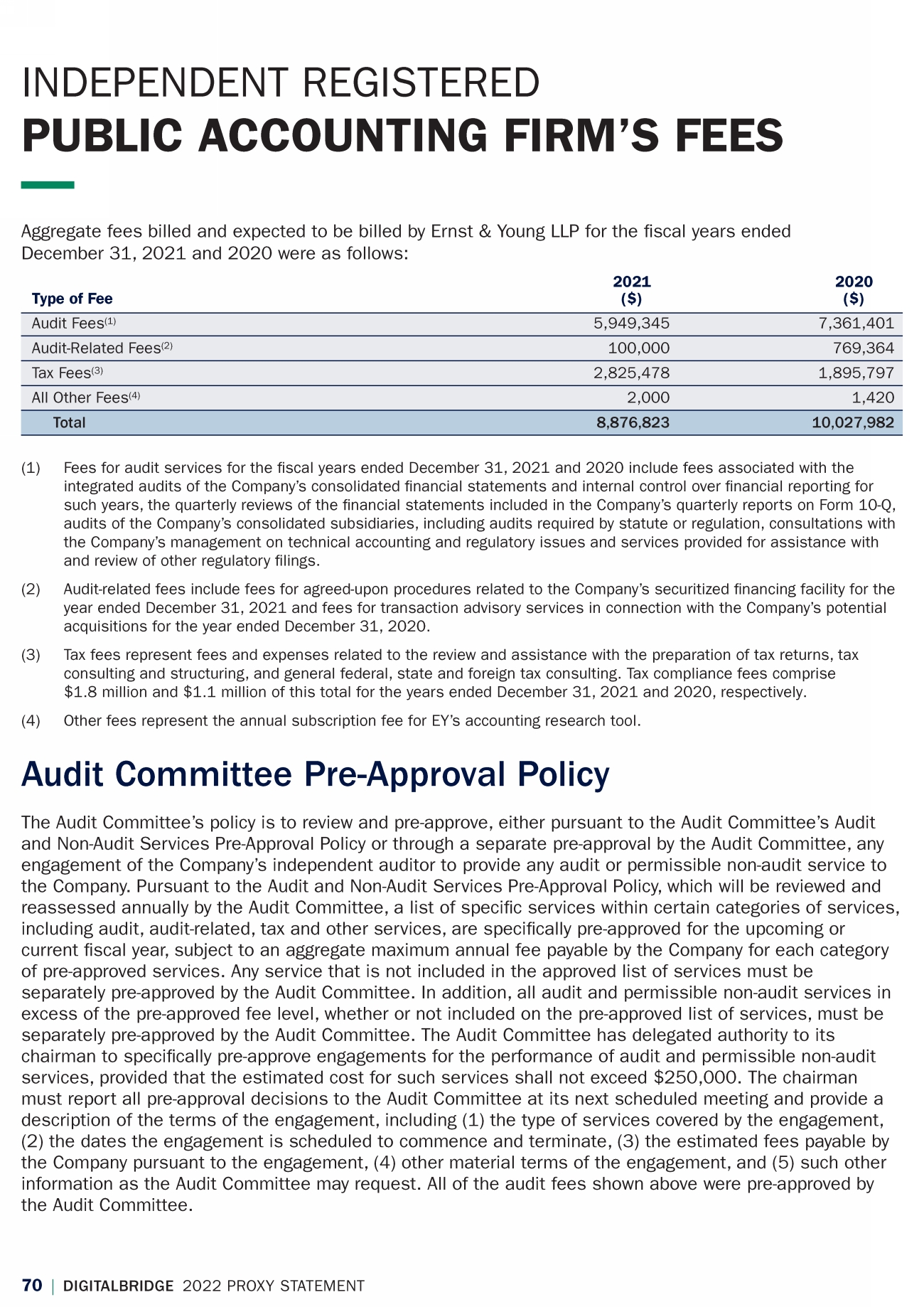

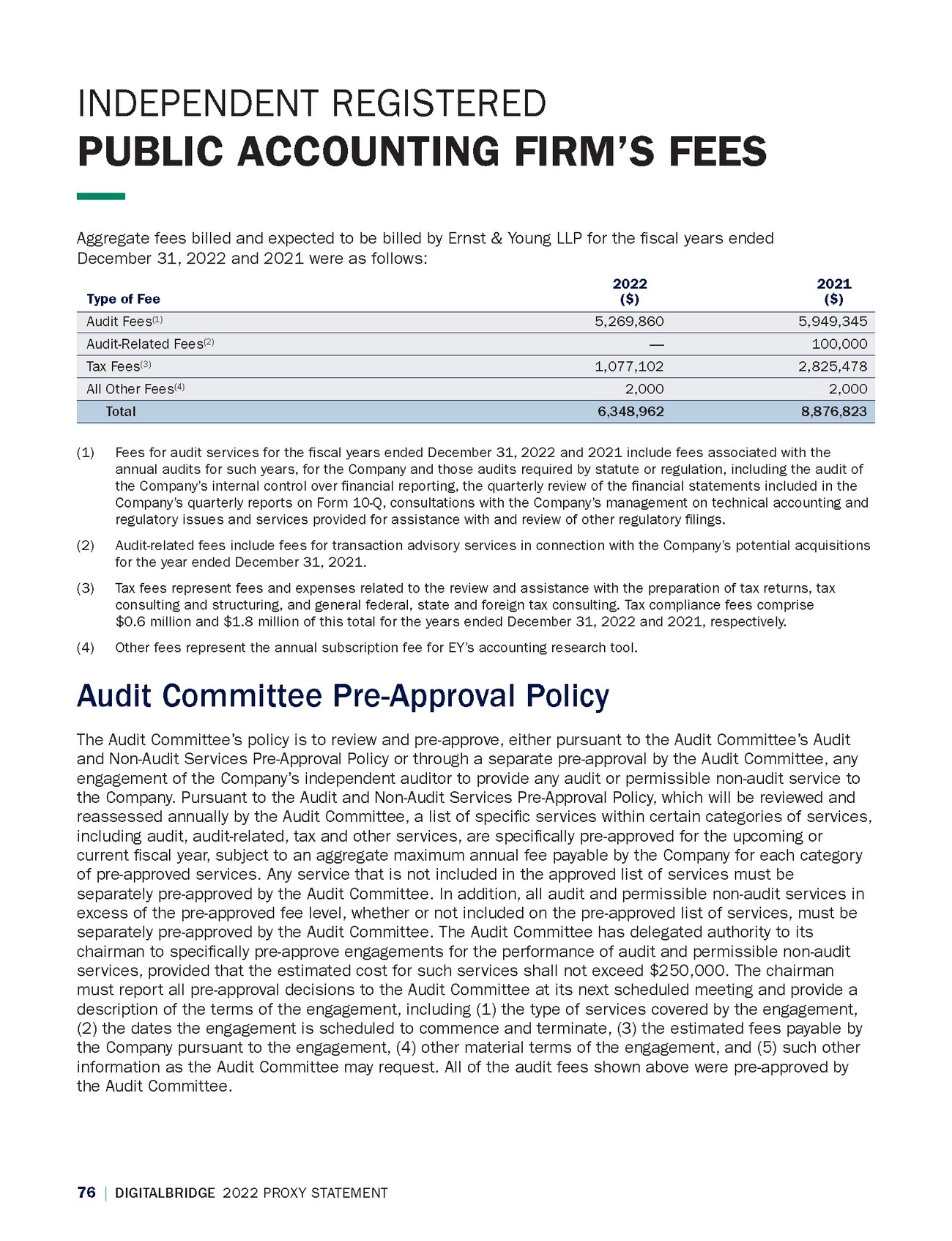

| 76 | DIGITALBRIDGE 2022 PROXY STATEMENT INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM’S FEES Aggregate fees billed and expected to be billed by Ernst & Young LLP for the |

|

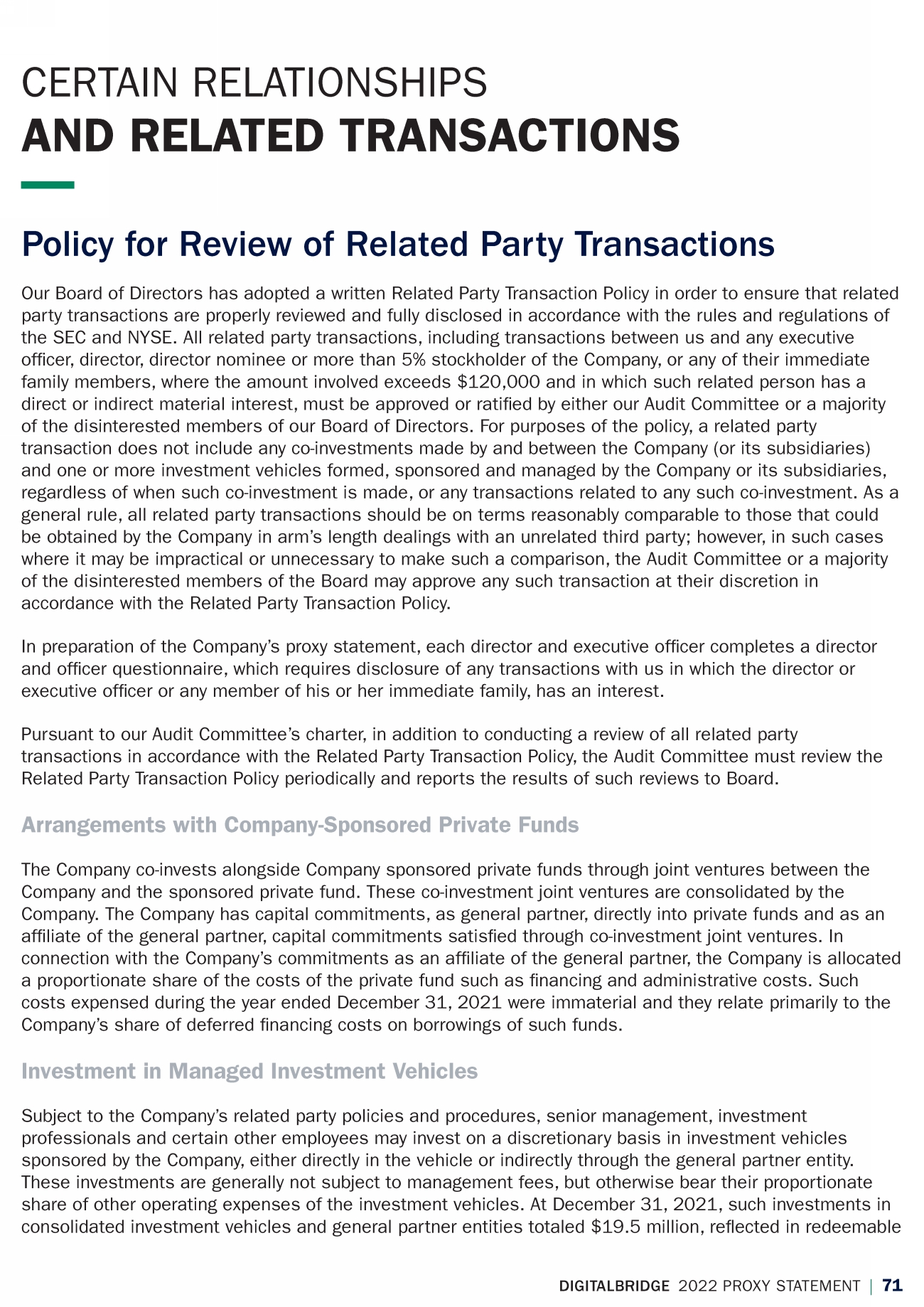

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS Policy for Review of Related Party Transactions Our Board of Directors has adopted a written Related Party Transaction Policy in order to ensure that related party transactions are properly reviewed and fully disclosed in accordance with the rules and regulations of the SEC and NYSE. All related party transactions, including transactions between us and any executive |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS 78 | DIGITALBRIDGE 2022 PROXY STATEMENT noncontrolling interests and noncontrolling interests on the balance sheet, and their share of net income was |

|

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS Messrs. Ganzi and Jenkins upon the occurrence of future realization events. Such investments made by the Company include ongoing payments for the build-out of expansion capacity, including lease-up of the expanded capacity and existing inventory, in Vantage SDC and the acquisition of additional |

|

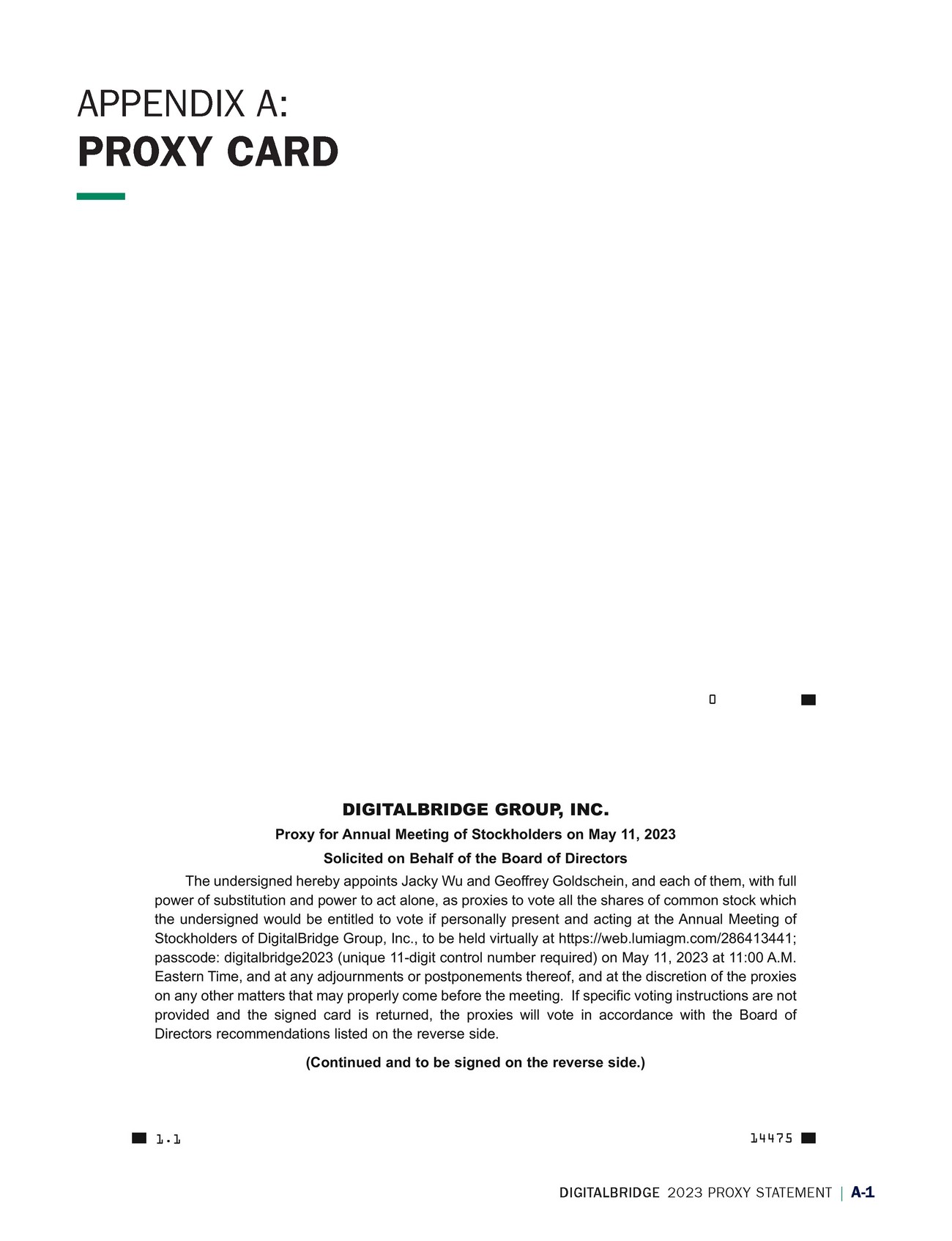

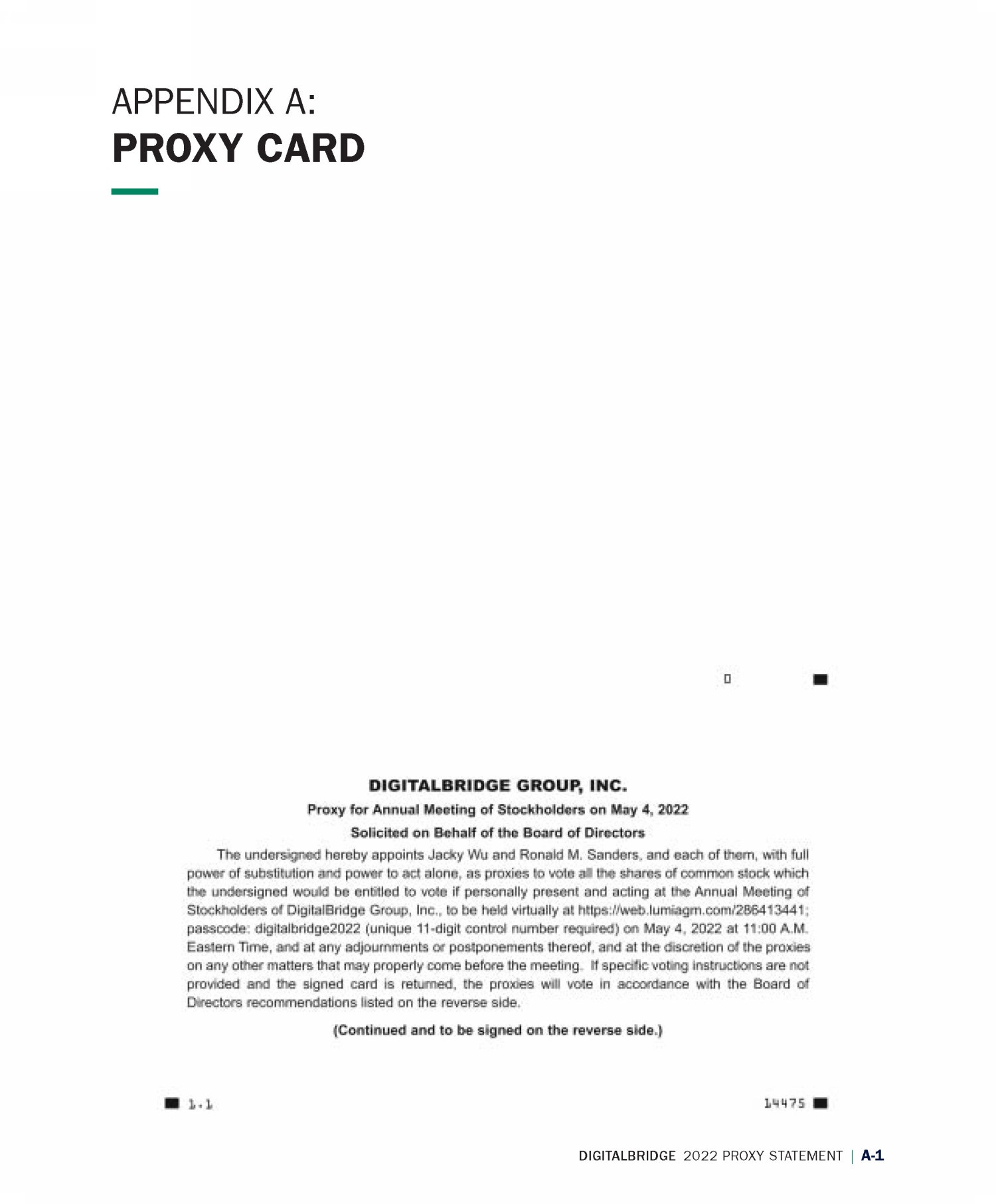

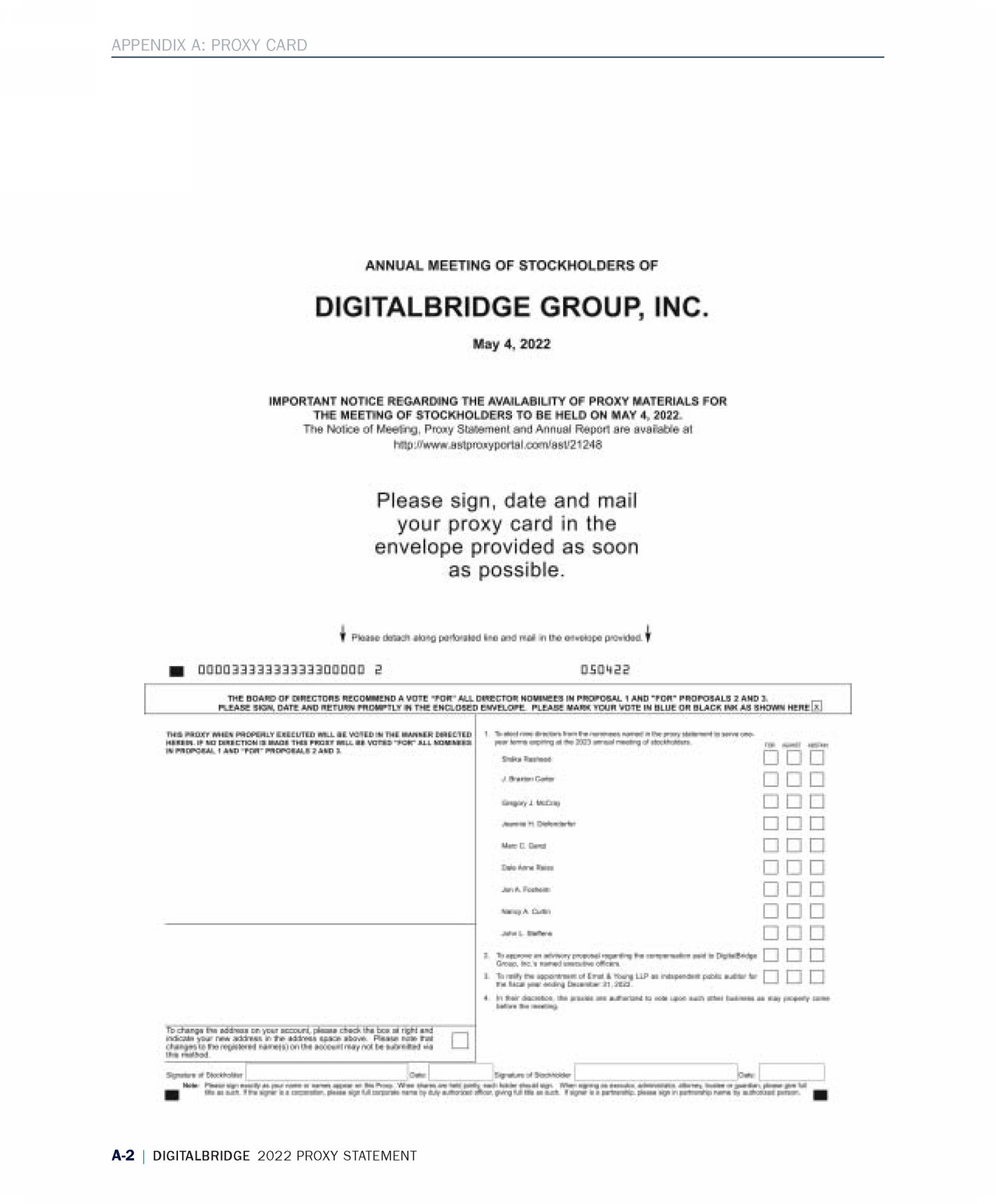

| FREQUENTLY ASKED QUESTIONS AND ANSWERS Questions and Answers about the |

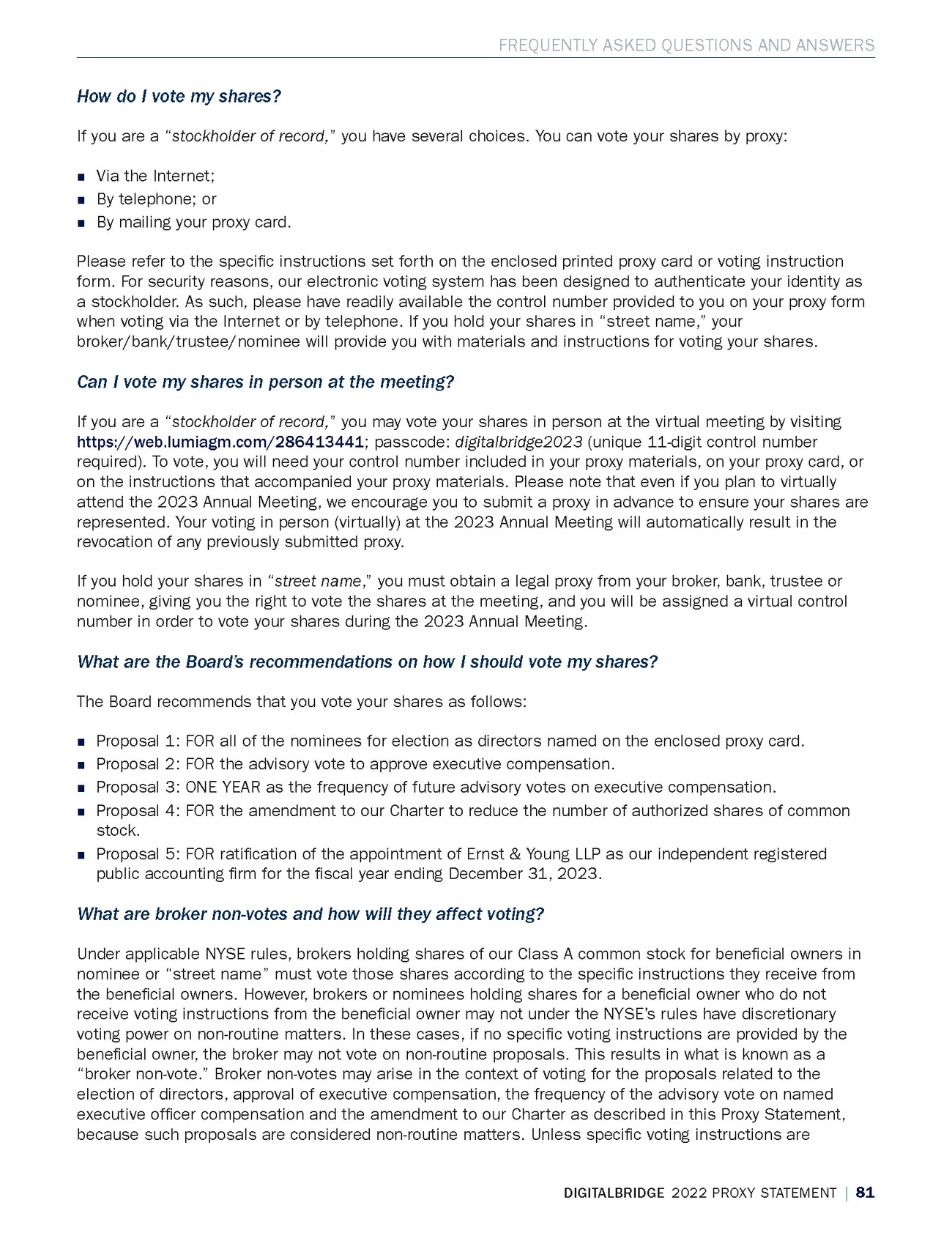

| FREQUENTLY ASKED QUESTIONS AND ANSWERS How do I vote my shares? If you are a “stockholder of record,” you have several choices. You can vote your shares by proxy: |

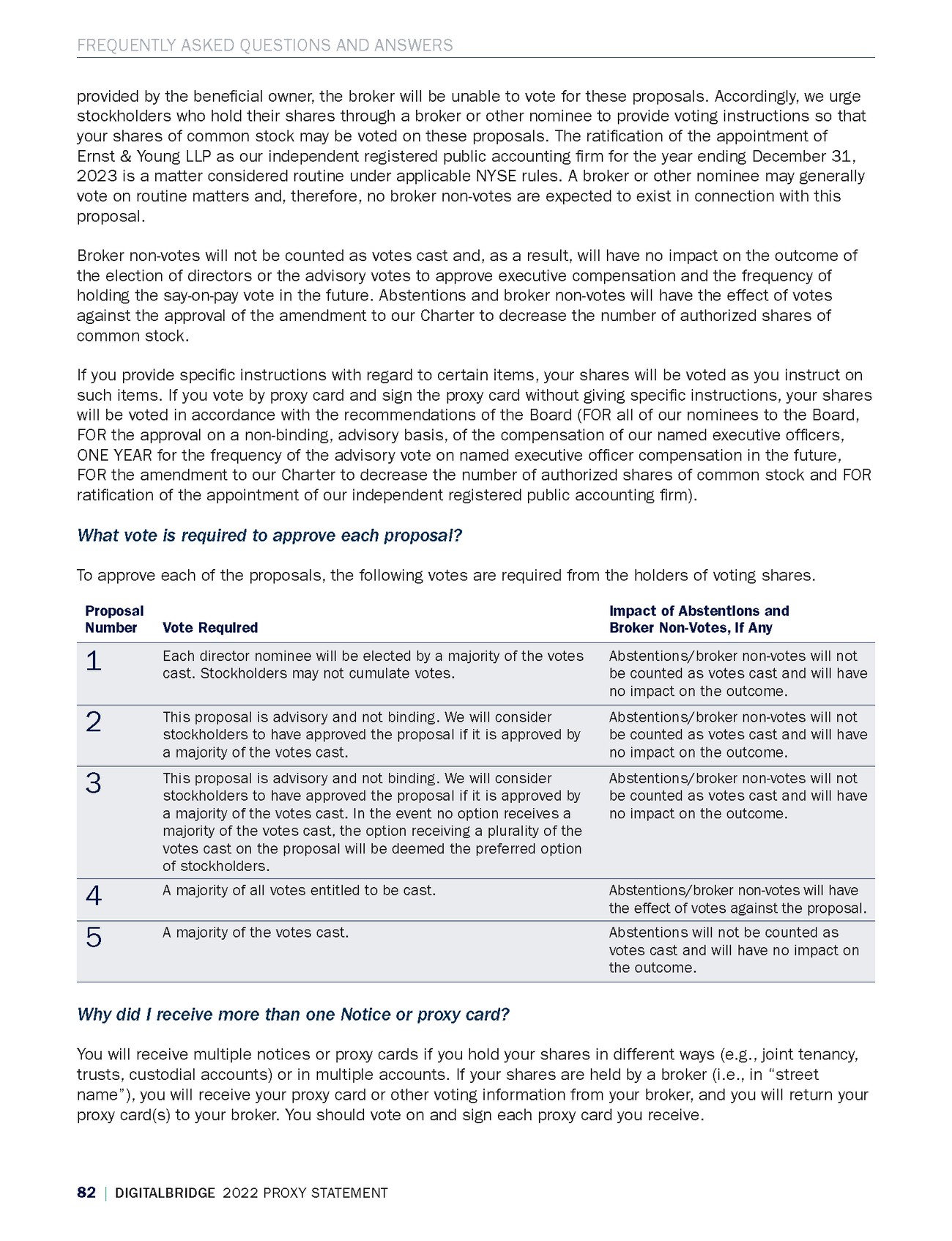

| FREQUENTLY ASKED QUESTIONS AND ANSWERS 82 | DIGITALBRIDGE 2022 PROXY STATEMENT provided by the |

|

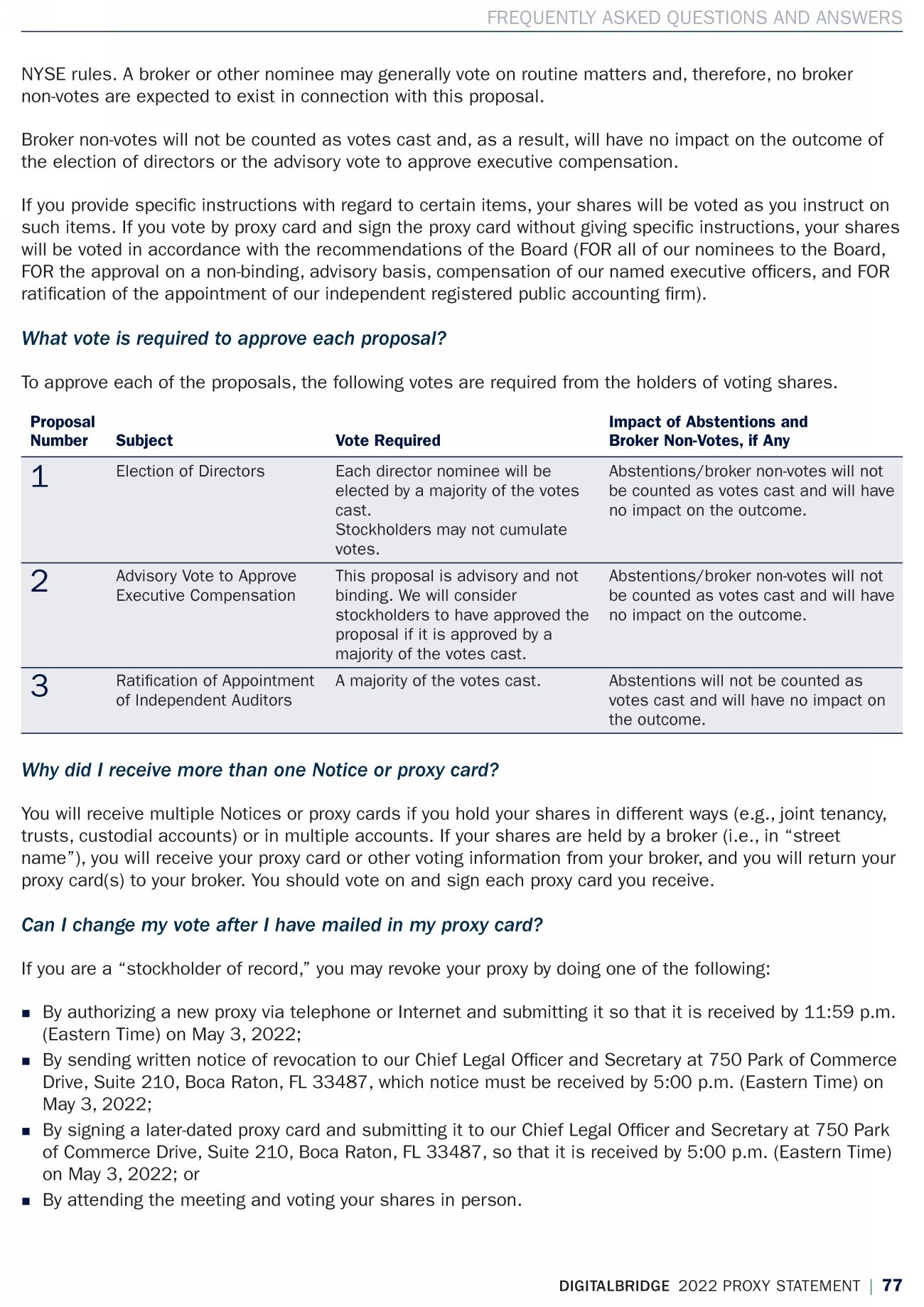

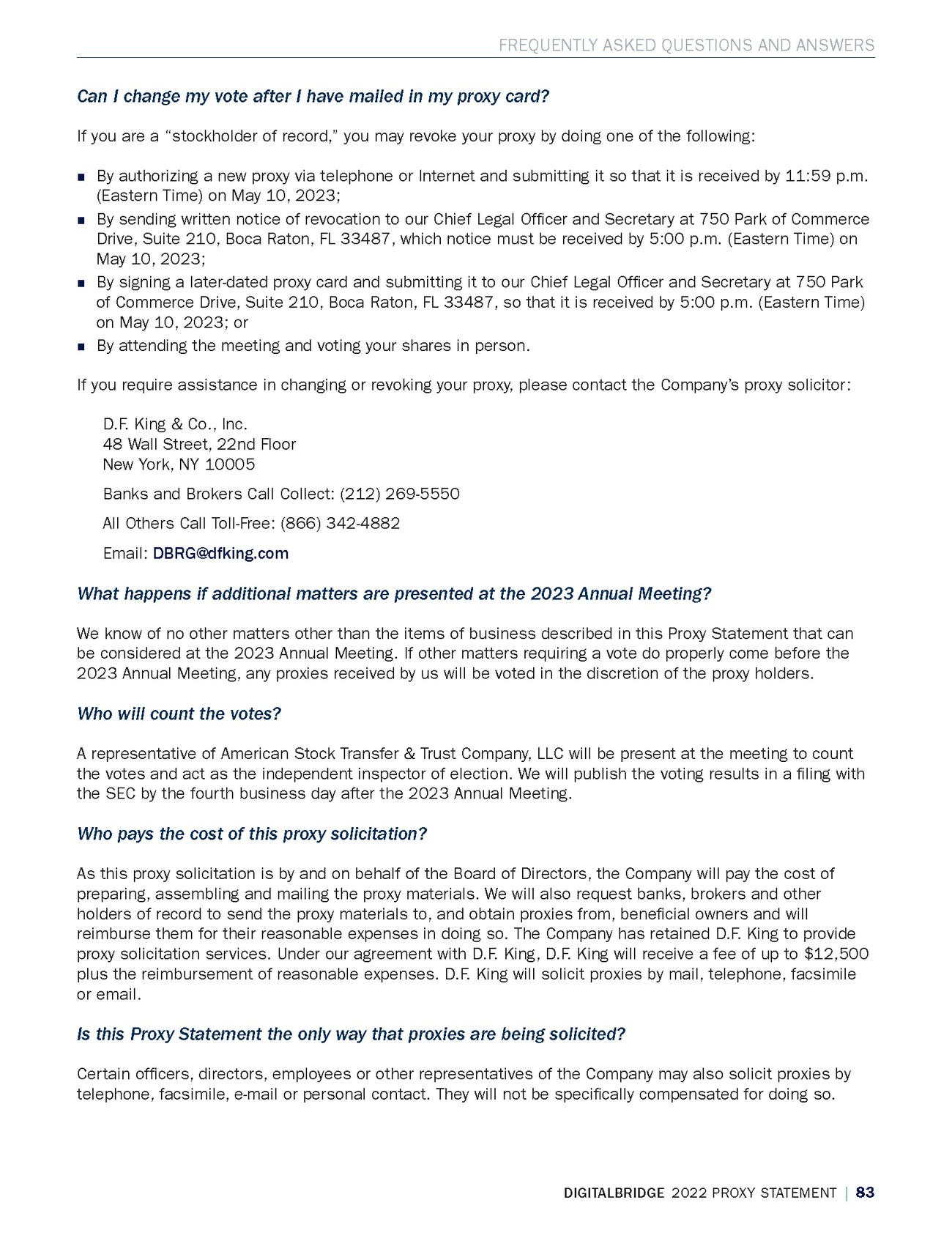

| FREQUENTLY ASKED QUESTIONS AND ANSWERS Can I change my vote after I have mailed in my proxy card? If you are a “stockholder of record,” you may revoke your proxy by doing one of the following: |

|

| FREQUENTLY ASKED QUESTIONS AND ANSWERS 84 | DIGITALBRIDGE 2022 PROXY STATEMENT Attend Our |

|

| DIGITALBRIDGE 2022 PROXY STATEMENT | |

| 85 OTHER INFORMATION Stockholder Proposals and Director Nominations for |

| OTHER INFORMATION 86 | DIGITALBRIDGE 2022 PROXY STATEMENT |

|

|

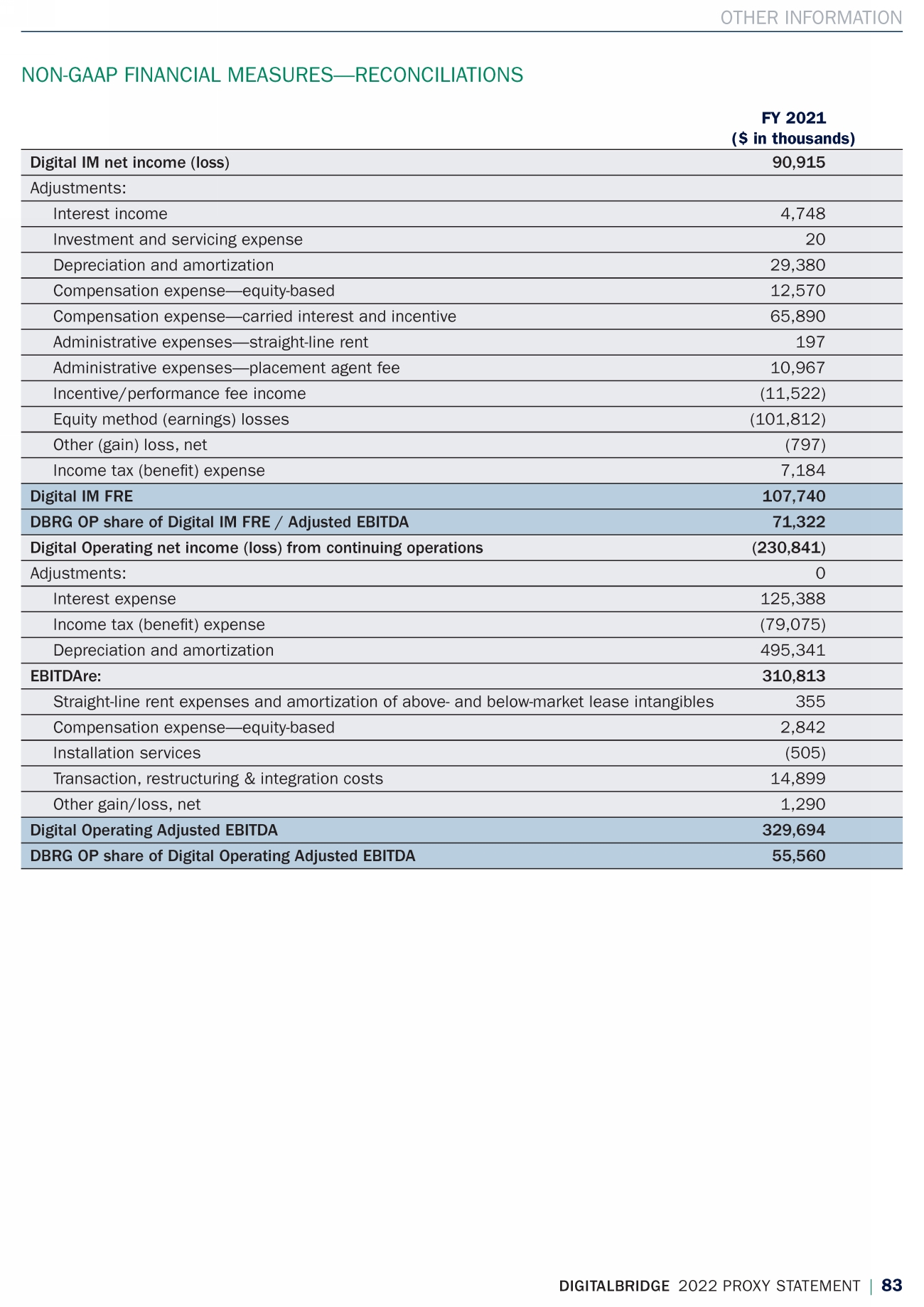

| OTHER INFORMATION Fee Earning Equity Under Management (FEEUM) FEEUM is equity for which the Company and its affliates provide investment management services and |

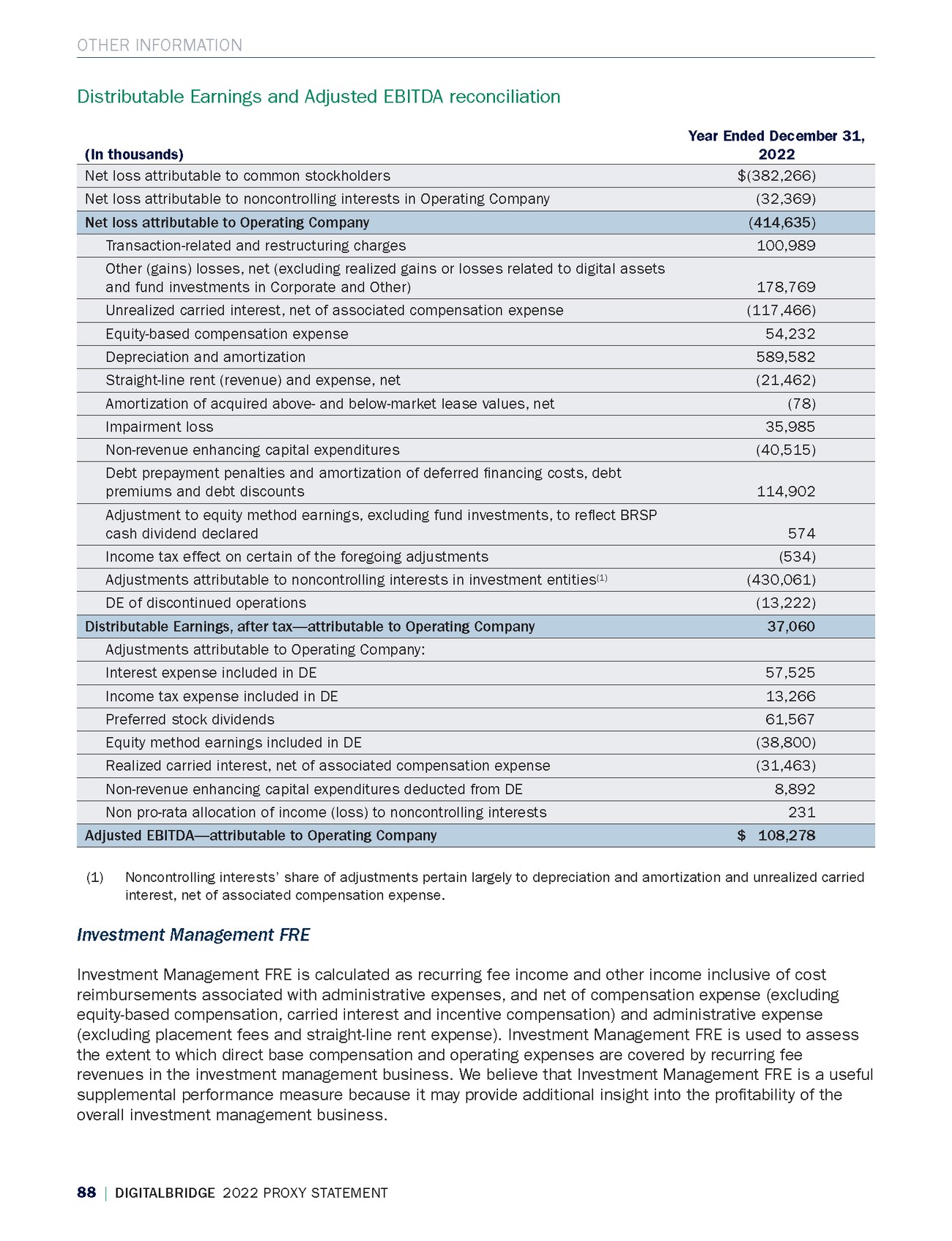

| OTHER INFORMATION 88 | DIGITALBRIDGE 2022 PROXY STATEMENT Distributable Earnings and Adjusted EBITDA reconciliation Year Ended December 31, (In thousands) 2022 Net loss attributable to common stockholders $(382,266) Net loss attributable to noncontrolling interests in Operating Company (32,369) Net loss attributable to Operating Company (414,635) Transaction-related and restructuring charges 100,989 Other (gains) losses, net (excluding realized gains or losses related to digital assets and fund investments in Corporate and Other) 178,769 Unrealized carried interest, net of associated compensation expense (117,466) Equity-based compensation expense 54,232 Depreciation and amortization 589,582 Straight-line rent (revenue) and expense, net (21,462) Amortization of acquired above- and below-market lease values, net (78) Impairment loss 35,985 Non-revenue enhancing capital expenditures (40,515) Debt prepayment penalties and amortization of deferred fnancing costs, debt premiums and debt discounts 114,902 Adjustment to equity method earnings, excluding fund investments, to refect BRSP cash |

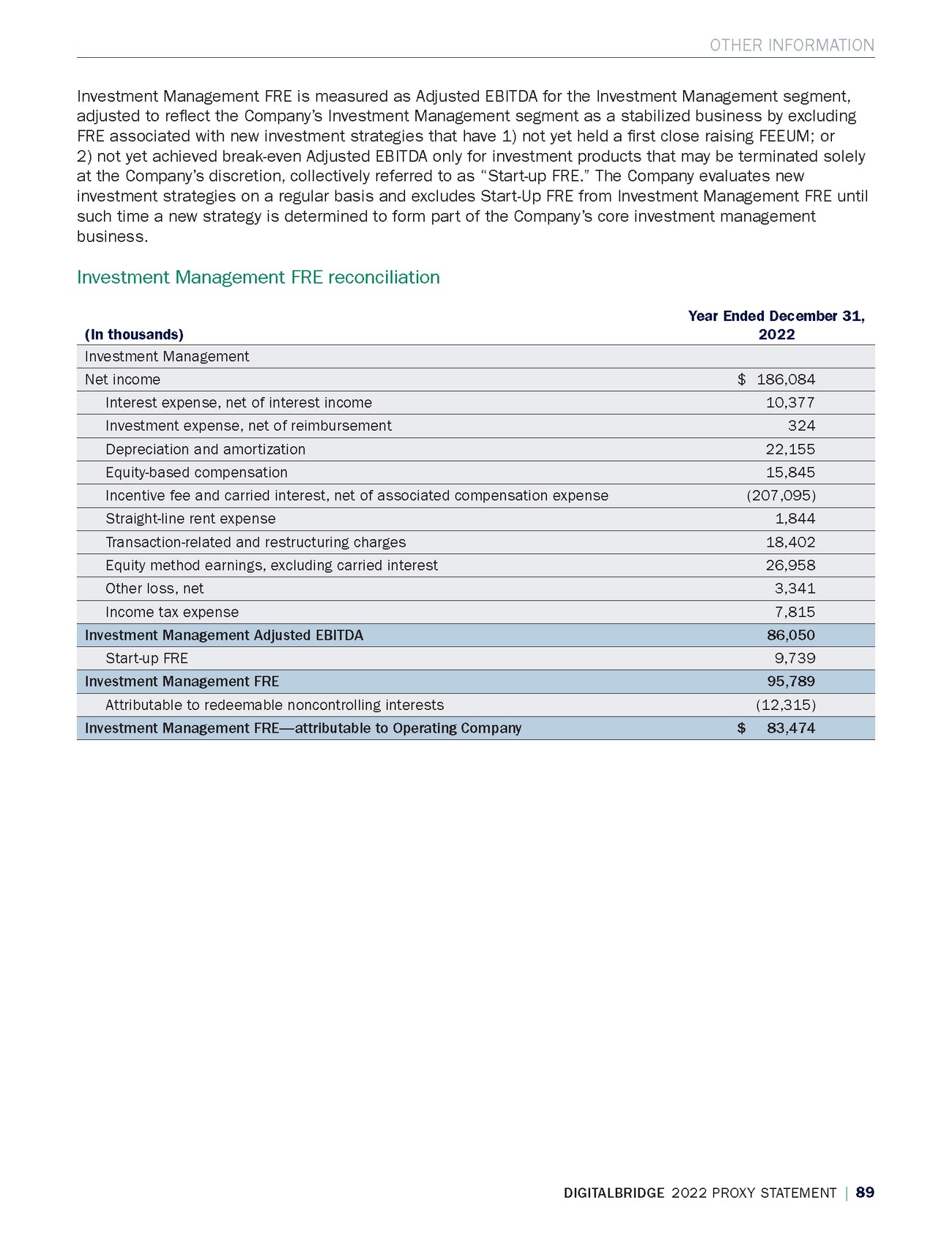

| OTHER INFORMATION Investment Management FRE is measured as Adjusted EBITDA for the Investment Management segment, adjusted to refect the Company’s Investment Management segment as a stabilized business by excluding FRE associated with new investment strategies that have 1) not yet held a frst close raising FEEUM; or 2) not yet achieved break-even Adjusted EBITDA only for investment products that may be terminated solely at the Company’s discretion, collectively referred to as “Start-up FRE.” The Company evaluates new investment strategies on a regular basis and excludes Start-Up FRE from Investment Management FRE until such time a new strategy is determined to form part of the Company’s core investment management business. Investment Management FRE reconciliation Year Ended December 31, (In thousands) 2022 Investment Management Net income $ 186,084 Interest expense, net of interest income 10,377 Investment expense, net of reimbursement 324 Depreciation and amortization 22,155 Equity-based compensation 15,845 Incentive fee and carried interest, net of associated compensation expense (207,095) Straight-line rent expense 1,844 Transaction-related and restructuring charges 18,402 Equity method earnings, excluding carried interest 26,958 Other loss, net 3,341 Income tax expense 7,815 Investment Management Adjusted EBITDA 86,050 Start-up FRE 9,739 Investment Management FRE 95,789 Attributable to redeemable noncontrolling interests (12,315) Investment Management FRE—attributable to Operating Company $ 83,474 DIGITALBRIDGE 2022 PROXY STATEMENT | 89 Toppan Merrill - DigitalBridge [fka Colony Capital_ Inc.] PRE 14A [iXBRL Proxy] ED [AUX] | 105969 | 27-Mar-23 23:29 | 23-2053-3.fa | Sequence: 19 CHKSUM Content: 36741 Layout: 56527 Graphics: 0 CLEAN JOB: 23-2053-3 CYCLE#;BL#: 8; 0 TRIM: 8.25" x 10.75" AS: New York: 212-620-5600 COLORS: DB dark green, ~note-color 2, DB med blue, DB dark blue, Black, DB med gray GRAPHICS: none V1.5 |

| 90 | DIGITALBRIDGE 2022 PROXY STATEMENT EXHIBIT A: AUTHORIZED SHARE DECREASE AMENDMENT If Proposal 4 is approved by stockholders, Section 6.1 of our Articles of Amendment and Restatement, as amended and supplemented, would be deleted and replaced it in its entirety with the following: “Section 6.1 Authorized Shares. The Corporation has authority to issue 500,000,000 shares of stock, consisting of 237,250,000 shares of Class A Common Stock, $0.01 par value per share (“Class A Common Stock”), 250,000 shares of Class B Common Stock, $0.01 par value per share (“Class B Common Stock”), 12,500,000 shares of Performance Common Stock, $0.01 par value per share (“Performance Common Stock” and together with the Class A Common Stock and Class B Common Stock, the “Common Stock”), and 250,000,000 shares of Preferred Stock, $0.01 par value per share (“Preferred Stock”), including those shares of Preferred Stock described in the Exhibits attached hereto. The aggregate par value of all authorized shares of stock having par value is $5,000,000. If shares of one class of stock are classifed or reclassifed into shares of another class of stock pursuant to Section 6.2, 6.3, 6.4, 6.5 or 6.6 of this Article VI, the number of authorized shares of the former class shall be automatically decreased and the number of shares of the latter class shall be automatically increased, in each case by the number of shares so classifed or reclassifed, so that the aggregate number of shares of stock of all classes that the Corporation has authority to issue shall not be more than the total number of shares of stock set forth in the frst sentence of this paragraph.” Toppan Merrill - DigitalBridge [fka Colony Capital_ Inc.] PRE 14A [iXBRL Proxy] ED [AUX] | 105969 | 27-Mar-23 23:29 | 23-2053-3.fa | Sequence: 20 CHKSUM Content: 23895 Layout: 9110 Graphics: 0 CLEAN JOB: 23-2053-3 CYCLE#;BL#: 8; 0 TRIM: 8.25" x 10.75" AS: New York: 212-620-5600 COLORS: DB dark blue, ~note-color 2, DB dark green, Black GRAPHICS: none V1.5 |

|

|

|

|